Lirunex Review 2025: Does it have Multi-Jurisdiction Regulation?

USP: Regulated by CySEC & Labuan FSA | Spreads from 0.0 pips | Leverage up to 1:2000 | MT4 & MT5 platforms

Lirunex Overview & Company Background

Lirunex is a multi-licensed forex and CFD broker that has quickly grown its global presence since its launch in the late 2010s. Headquartered in Cyprus, the company has expanded across Southeast Asia, Africa, and Europe, establishing itself as a competitive brokerage with a focus on transparency and client trust. Lirunex offers a range of account types with very low entry barriers (no strict minimum deposit for standard accounts) and provides access to popular trading platforms MetaTrader 4 and 5. In just a few years of operation, it has earned a reputation for tight spreads and fast execution, positioning itself among emerging brokers in the industry.

- Headquarters: Cyprus (global offices serving Asia, Africa, Europe)

- Founded: 2017 (est.)

- Regulation: CySEC (Cyprus), Labuan FSA (Malaysia), FSC (Mauritius)

- Supported Countries: Global clientele (service available in Asia, Africa, Europe; excludes US, etc.)

- Platforms: MetaTrader 4, MetaTrader 5, and proprietary WebTrader/Mobile App

- Minimum Deposit: $0 for Standard/Prime accounts (no fixed minimum); $10,000 for Pro account

Company Overview

Lirunex was established with a mission to provide transparent and trustworthy trading services to its clients. The company’s goal has been to deliver superior brokerage services in forex, indices, metals, and commodities while ensuring clients remain satisfied with their trading experience. In practice, this means Lirunex emphasizes tight spreads and best-execution practices, adapting to client needs without compromising on trade execution quality.

Over the past few years, Lirunex has experienced rapid growth, particularly in the Asia-Pacific region. It has expanded its operations with new offices (such as a recent branch in Thailand) to support its Southeast Asia and Africa client base. This expansion, coupled with a growing number of clients, has helped Lirunex establish itself as a leading broker in those regions. Lirunex’s commitment to education is notable – the broker provides webinars, tutorials, and market insights to empower traders with knowledge and confidence in trading decisions. Overall, backed by a philosophy of client-centric service and regulatory compliance, Lirunex has built a globally trusted brand in a relatively short time.

Pros & Cons Analysis

- Licensed by CySEC and Labuan FSA, ensuring strong regulation and client protection.

- Spreads start from 0.0 pips with low commissions and no strategy restrictions.

- Offers various account types with leverage up to 1:2000 for flexible trading.

- Supports MT4, MT5, and a proprietary app with TradingView charts and trading tools.

- Not available in regions like the US and parts of Asia/Africa due to regulatory restrictions.

- Lacks licenses from top-tier regulators like the FCA or ASIC, which may concern some traders.

- Research tools are basic, with limited in-house analysis and no third-party research integrations.

Lirunex vs. Competitors:

- Lirunex vs. XM: Both offer MT4/MT5 and high leverage, but Lirunex stands out with raw spread accounts (0.0 pip spreads) whereas XM’s spreads on standard accounts are higher. XM, however, is under more top-tier regulators (FCA, ASIC) which some risk-averse traders prefer.

- Lirunex vs. Exness: Exness and Lirunex both cater to high-leverage traders (Exness up to 1:2000 as well). Lirunex offers a cent account for newcomers, similar to Exness’s cent account, but Lirunex’s multi-license regulatory status (including an EU license) can be seen as an advantage in client fund safety over some of Exness’s offshore entities.

- Lirunex vs. IC Markets: IC Markets is known for raw spreads and low commissions (around $7 round-turn per lot) which is comparable to Lirunex’s Pro account offering. However, IC Markets has long-established trust with ASIC and CYSEC regulation. Lirunex competes by offering similar trading conditions with a newer platform interface (TradingView integration) and potentially higher leverage for non-EU clients.

What's the word from fellow traders?

Overall Sentiment Score

Performance Breakdown

Based on verified trader reviews

Is Lirunex Regulated and Safe?

Regulatory Assessment

Lirunex is regulated under multiple jurisdictions, which adds layers of safety for traders. Its flagship regulation comes from CySEC in Cyprus, a well-regarded European regulator that enforces stringent compliance, including segregation of client funds and participation in investor compensation schemes. This CySEC oversight places Lirunex in the Tier-2 regulatory category, meaning it adheres to EU regulations (e.g. MiFID II) that enhance transparency and client protection. In addition, Lirunex operates under Labuan FSA in Malaysia and other international licenses, allowing it to offer very high leverage and flexible terms to global clients under those entities. While it does not hold Tier-1 licenses like the FCA (UK) or ASIC (Australia), Lirunex’s existing licenses in reputable jurisdictions indicate that it is a legitimate and compliant broker. Clients can take comfort in the fact that Lirunex’s operations are audited and reviewed by official authorities across three different regions, reducing the risk of fraud or malpractice.

Licenses

- CySEC (Cyprus) – License No. 338/17. Lirunex Limited is authorized and regulated by the Cyprus Securities and Exchange Commission, with a cross-border EU license allowing international investment services. Being CySEC-regulated means EU-standard protections apply, such as coverage by the Investor Compensation Fund (up to €20,000 per client) and mandatory negative balance protection for retail traders.

- Labuan FSA (Malaysia) – Lirunex holds a license under the Labuan Financial Services Authority, which enables it to serve clients in Asia with generous leverage (up to 1:1000 or more) and a broad range of products. Labuan FSA is an offshore but government-supervised jurisdiction; this license indicates Lirunex meets capital adequacy and compliance standards in Malaysia’s Labuan IBFC. (License number not publicly listed on the site.)

- FSC (Mauritius) – Global Business License. Lirunex Limited is incorporated in Mauritius and regulated by the Mauritius Financial Services Commission under License No. GB24203882. The FSC license affirms Lirunex’s commitment to international compliance and offers a framework for enhanced fund safety and AML (anti–money laundering) oversight.

(Lirunex is also registered with the Ministry of Economic Development (MED) in the Maldives, as noted in company announcements, further extending its regulatory footprint.)

Safety Measures

- Client Fund Protection: Lirunex keeps client monies in segregated accounts with trusted banks, separating client funds from the company’s operational funds. This ensures that even if Lirunex encounters financial issues, client funds remain safeguarded and cannot be used to pay company debts.

- Compensation Scheme: As a CySEC-regulated firm, Lirunex is a member of the Investor Compensation Fund (ICF) in Cyprus. This means eligible clients have insurance on their trading account funds (up to €20,000) if the broker becomes insolvent. Such schemes add an extra layer of safety for clients of Lirunex’s EU entity.

- Negative Balance Protection: Retail traders with Lirunex are protected from losing more than their account balance. In volatile market events, if a client’s account were to go negative due to leverage, Lirunex’s policy (aligned with EU requirements) is to reset the balance to zero, so traders are not liable for any resulting deficit. This prevents customers from debt to the broker.

- Data Security & Encryption: Lirunex uses secure socket layer (SSL) encryption on its platforms and client portal to protect personal data and transaction information. All client areas and payment processing pages are encrypted to industry standards, ensuring that sensitive information (like IDs or banking details) is transmitted securely. Additionally, Lirunex adheres to strict data protection regulations (such as GDPR in Europe) to keep client information confidential and secure.

Overall, Lirunex’s multi-jurisdiction regulation and robust safety measures indicate that it is a secure broker to trade with. The combination of segregated funds, regulatory oversight, and protective policies (like compensation fund membership and negative balance protection) provides clients with assurance that their funds and interests are well protected when trading with Lirunex.

Trading Conditions & Costs

Trading Conditions & Costs

- Instruments: Lirunex offers a broad range of trading instruments, encompassing Forex (currency pairs), global Stock CFDs, Equity Indices, Precious Metals (like gold and silver), Energy Commodities (such as oil), and even Cryptocurrencies as CFDs. In total, clients can access dozens of major, minor, and exotic FX pairs, plus popular indices, commodity futures, and crypto markets from a single account. This multi-asset selection allows traders to diversify their portfolios and explore various markets easily.

- Spreads: Spreads at Lirunex are highly competitive. On its raw spread accounts (Prime and Pro), spreads start from 0.0 pips on major forex pairs during liquid market hours. Even the standard accounts feature tight floating spreads, typically starting around 1.5 pips for major pairs under normal conditions. The spread may vary by instrument and liquidity, but overall Lirunex’s pricing is on par with industry-leading ECN brokers – ideal for cost-sensitive traders like scalpers and day traders.

- Commission: Zero commissions are charged on Lirunex’s standard and cent account types, as costs are built into the spread. For the raw spread accounts, Lirunex charges a small commission in exchange for the near-zero spreads. The Prime account has a commission of $8 per lot, and the higher-tier Pro account charges only $4 per lot (per 100k traded). This equates to roughly $7–$8 per standard lot round-turn, which is very competitive. Effectively, traders on Pro accounts pay about $4 commission each side ($8 total) for a full lot trade, while enjoying interbank-level spreads of 0.0–0.1 pips on majors.

- Leverage: Lirunex offers leverage up to 1:500 as a default maximum on many instruments, and even higher on certain account types or under specific regulatory entities. Notably, the LX-Standard, Prime, and Pro accounts support leverage as high as 1:1000 or 1:2000 on major forex pairs for clients outside EU regulatory constraints. This ultra-high leverage caters to experienced traders who employ strategies requiring substantial margin-based buying power. (EU-based clients under CySEC will have leverage capped at 1:30 for retail traders due to ESMA regulations, but they can opt to open under other Lirunex entities if eligible for higher leverage.) Lirunex’s flexible leverage structure allows traders to optimize their risk/reward according to their strategy, but clients should always use high leverage responsibly given the increased risk.

Lirunex Trading Platforms & Tools

- Platforms: Lirunex supports a suite of industry-leading trading platforms. Clients can trade on MetaTrader 4 (MT4) and MetaTrader 5 (MT5), which are available for Windows, Mac, web, and mobile devices. Both MT4 and MT5 are well-known for their user-friendly interface and advanced charting capabilities, and they allow for one-click trading, custom indicators, and Expert Advisors (automated trading scripts). In addition, Lirunex offers its own Lirunex Trading App, a modern mobile and web-based platform that caters to traders who want access to markets on the go. (The Lirunex app also features a WebTrader interface – meaning you can trade through a web browser without any software installation.) All platforms are provided free of charge to Lirunex clients, and accounts can be accessed interchangeably on MT4, MT5, or the proprietary app, giving traders ultimate flexibility in how they trade.

- Platform Features: The trading platforms supported by Lirunex come packed with tools for analysis and execution. On MT4/MT5, traders have interactive charts with multiple timeframes (from 1-minute up to monthly) and over 50 built-in technical indicators (moving averages, RSI, MACD, etc.) for market analysis. Lirunex’s platforms fully support automated trading through Expert Advisors (EAs) – clients can deploy algorithmic strategies or use custom EAs for automated trade management. One-click trading, customizable chart layouts, and support for multiple order types (market, limit, stop orders, trailing stops) are standard. Notably, Lirunex’s proprietary platform integrates TradingView charting technology, offering a highly robust and familiar chart interface with extensive drawing tools and indicator options. The platforms also ensure mobile trading support, meaning traders can open, monitor, and close trades from their smartphones or tablets seamlessly, receiving real-time price alerts and push notifications.

- Research & Tools: Lirunex provides a decent array of research tools and market insights to assist traders. Within the Lirunex Trading App and WebTrader, users have access to TradingView-powered charts that display real-time prices and even allow viewing TradingView community ideas if desired. The platform also includes an economic calendar built-in, which is updated in real time to show key economic releases and events that could impact markets. Additionally, Lirunex offers “Experts Forex Signal” functionality – essentially a signal service integrated into the platform that lets traders copy or follow trading signals from expert providers directly, placing orders based on those signals with one click. For news, the platform provides a stream of the latest financial news and market updates, which, along with push notifications, ensures traders are informed of major market moves.Beyond the platform, Lirunex’s website features an Education section and periodic market analysis articles. Traders can find tutorials on how to use the platforms, articles on trading strategies, and weekly market outlooks in the Lirunex Education and Lirunex News sections. While Lirunex may not have a comprehensive proprietary research portal as some larger brokers do, the integration of TradingView charts and signals, plus the standard MT4/MT5 tools, means most traders will find all the analytical tools they need for chart analysis and strategy development. In summary, Lirunex’s platform offering is rich in features – from advanced charting and technical analysis to automated trading and embedded research aids – providing a well-rounded trading environment for both beginners and seasoned traders.

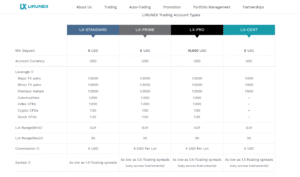

Lirunex Account Types & Minimum Deposit

Lirunex caters to different trader profiles by offering several account types with varying pricing structures and features. Below is a summary of the account types and their key conditions:

| Account Type | Minimum Deposit | Spread (From) | Commission | Platforms |

|---|---|---|---|---|

| LX-Standard | $0 (No fixed minimum) | 1.5 pips (floating) | None (zero commission) | MT4, MT5 |

| LX-Prime | $0 (No fixed minimum) | 0.0 pips (raw spreads) | $8 per lot traded (round-turn) | MT4, MT5 |

| LX-Pro | $10,000 | 0.0 pips (raw spreads) | $4 per lot traded (round-turn) | MT4, MT5 |

| LX-Cent | $0 (Denominated in cents)** | 1.5 pips (floating) | None | MT4, MT5 |

(Note: The Cent account uses “USC” (U.S. Cents) as the base currency – e.g., a deposit of $10 is reflected as 1,000 USC. It’s designed for micro trading.)

As shown above, Standard and Cent accounts have no required minimum deposit, meaning you can start with any amount you are comfortable with (Lirunex makes these accounts very accessible, even a deposit of $10–$50 is fine). These accounts charge no commissions; the trading costs are built into the spreads which average ~1.5 pips on majors. They are ideal for beginners or casual traders. The Prime account is a raw-spread account requiring no minimum deposit as well; it offers spreads as low as 0.0 pips by charging a small commission of $8 per lot. Finally, the Pro account is intended for high-volume or professional traders – it requires a higher minimum capital of $10,000 but rewards with ultra-tight 0.0 pip spreads and a reduced commission of $4 per lot (effectively one of the lowest commission rates in the industry). All account types support both MT4 and MT5 platforms and allow all trading strategies (scalping, hedging, and use of EAs are all permitted on every account type).

Special Features:

- Demo Account: Lirunex offers free demo accounts for all its platform options. New clients can practice trading on MT4, MT5, or the Lirunex app with virtual funds. The demo closely simulates real market conditions and is an excellent way for beginners to get comfortable or for experienced traders to test new strategies without risk.

- Islamic (Swap-Free) Accounts: Traders of Muslim faith can request an Islamic account option, which Lirunex provides in accordance with Shariah law. Swap-free versions of the Standard and Prime accounts are available, meaning no overnight interest (swap) is charged on positions. Instead, a small admin fee may apply on certain instruments in lieu of swaps. This allows clients to hold positions without accruing interest, aligning with Islamic finance principles.

- Cent Accounts for Beginners: The LX-Cent account is a notable feature designed for beginners or those who want to trade very small sizes. It operates in cent increments – for example, a trade of 1 lot on the Cent account is actually 1/100th the size of a standard lot (because the account balance is in cents). This lets new traders practice live trading with very low risk (e.g., depositing $20 yields 2,000 USC, and one can trade micro-lots with minimal monetary risk). It’s an excellent stepping stone before moving to Standard accounts.

- VIP / Premium Services: For higher-net-worth clients or very active traders (typically those on the Pro account tier or using large volumes), Lirunex offers premium services. This can include a dedicated account manager, priority support, and perhaps custom trading conditions (such as negotiable commission rates or spread markups for extremely high volume). While labeled as “VIP” informally, the Pro account essentially serves this segment with its higher deposit requirement and premium conditions.

- Managed Accounts (PAMM/MAM): Lirunex supports PAMM/MAM accounts for investors and money managers. Through the PAMM/MAM service, clients can allocate funds to a professional trader (Money Manager) to trade on their behalf, or an experienced trader can manage multiple clients under a master account. This setup is beneficial for those who prefer to invest with a skilled manager or for traders who want to attract investor capital. Lirunex provides the technology and legal framework (via Lirunex’s PAMM/MAM platform) to facilitate profit sharing and performance tracking in a transparent manner.

Overall, Lirunex’s account offerings are flexible and inclusive. Whether you are a beginner starting small, a trader needing swap-free conditions, or a high-volume professional, there is an account type tailored to you. The fact that Standard accounts have no minimum deposit and Cent accounts exist means entry barriers are extremely low – anyone can start trading live with just a few dollars. As traders grow, they can seamlessly upgrade to Prime or Pro for better pricing. This tiered structure, combined with features like demo accounts and PAMM, makes Lirunex quite accommodating in the industry.

Deposits & Withdrawals

Lirunex provides a variety of convenient methods for funding your trading account and withdrawing profits. The broker emphasizes fast and fee-free transactions for most payment options, making account funding relatively hassle-free.

Deposit Methods:

Clients can deposit funds through Credit/Debit Cards (Visa, MasterCard), Bank Wire Transfers, a range of E-wallets like Skrill and Neteller, as well as local payment solutions and cryptocurrencies. Specifically, Lirunex supports payment via Apple Pay and Google Pay for quick card-based deposits, international bank wire (for larger amounts), and popular online wallets. The addition of Neteller & Skrill is noteworthy – these e-wallets allow instant funding and were introduced to enhance convenience for clients worldwide. For clients in certain regions, local bank transfers are available (e.g., domestic transfers in Southeast Asian currencies) to avoid international transfer fees. Lirunex also now accepts cryptocurrency deposits, specifically USDT (Tether), as part of its payment options, which is great for those who prefer funding via crypto for speed and low cost (they even ran a promotion for USDT deposits). In summary, you can fund a Lirunex account using methods ranging from traditional bank wires and cards to modern e-wallets and crypto – covering just about every preference.

Withdrawal Methods:

Withdrawal options generally mirror the deposit methods. You can withdraw via bank transfer, which is typically used for larger amounts, back to credit/debit cards, and to e-wallets like Skrill/Neteller. Lirunex processes withdrawals to the same method used for deposit whenever possible (to comply with anti-money laundering policies). This means if you deposited via Skrill, you should withdraw to the same Skrill account; if you deposited by bank wire, the withdrawal will be sent to your bank account, etc. Notably, withdrawals to Skrill/Neteller are quite fast once processed, and those methods have no payout limits for fully verified accounts. Crypto withdrawals (USDT) are also supported, allowing you to receive your funds in Tether if you deposited in Tether, which can be convenient for crypto-oriented clients.

Processing Times:

Lirunex prides itself on prompt processing. Deposits by e-wallet or card are usually credited almost instantly or within a few minutes to hours (the official timeframe given is within 24 hours, but in practice many methods are instantaneous). Bank wire deposits may take longer (typically 1-3 business days for international wires to reflect). For withdrawals, Lirunex’s back office typically processes all withdrawal requests within one working day (24 hours). After Lirunex processes a withdrawal, the time to receive funds depends on the method: e-wallet withdrawals often arrive the same day; credit/debit card withdrawals can take 3–8 business days to appear on your card statement (due to card issuers’ processing times); bank withdrawals take about 2–5 business days to reach your bank account. In many cases, clients report withdrawals via Skrill/Neteller are completed within 24 hours.

Fees:

Deposit fees – Lirunex does not charge any fees on deposits for nearly all methods. If you deposit $500 by card or e-wallet, $500 is credited to your trading account (0% fee). They even explicitly state “No Deposit Fee Chargeable” as part of their policy. However, your payment provider might have its own fees (for example, your bank might charge you for a wire transfer or your card issuer might treat a deposit as a cash advance, etc., so clients should check with their providers). Withdrawal fees – Lirunex similarly does not charge fees on most withdrawal methods. Withdrawing to Skrill, Neteller, or card comes with 0% withdrawal fee on Lirunex’s side. The one exception is bank wire withdrawals: if you withdraw via international bank transfer, a fixed fee (around $35) may apply. This fee likely covers the banking charges for sending an international wire. Local bank withdrawals (if available in your region) might be free. Overall, the absence of deposit/withdrawal fees on common methods is a big plus for Lirunex, as it means clients can move money without worrying about extra charges, apart from any third-party costs.

Limits:

The minimum deposit amount can be as low as $10–$25 for most methods (for example, card deposits have a minimum of $25). Some local payment methods allow even lower minimums (one local option had $10 min). There isn’t a strict maximum deposit, although very large deposits (e.g. six figures) might be best done via bank transfer for practicality. For withdrawals, the minimum withdrawal for cards and e-wallets tends to be around $20–$25. Bank wire withdrawals usually have a higher minimum (Lirunex’s table indicates a $200 minimum for bank withdrawal). No maximum withdrawal per transaction is explicitly stated for e-wallets or bank transfers on the site; practically, large withdrawals may just be broken into multiple transactions or take a bit longer for compliance checks. It’s worth noting that Lirunex may require additional verification for very large withdrawals (as is standard) to ensure security.

In terms of speed and reliability, user feedback indicates Lirunex’s finance team works efficiently – most clients receive their withdrawals in a timely manner as promised. The combination of many payment options and zero fees makes funding with Lirunex quite user-friendly. Traders can thus focus on trading rather than worrying about the logistics of moving their money.

How to trade with Lirunex? Step-by-Step Guide

Getting started and trading with Lirunex is designed to be straightforward, even if you’re a beginner. Here’s a step-by-step guide:

- Visit the Lirunex official website: Go to lirunex.com, the broker’s official site. Here you can find the “Create Account” (Sign Up) button on the homepage or in the top menu. Click that to begin the registration process.

- Register for an account: Fill in the sign-up form with your personal details. You’ll need to provide information like your name, email address, phone number, and create a password. Select the account type you want (you can start with a demo or a live standard account). Make sure to agree to the terms and submit the form.

- Verify your email and phone: After registering, Lirunex will send a confirmation link to the email address you provided. Click that link to verify your email. You may also receive an SMS code to verify your phone number. Verifying contact info ensures you can recover passwords and receive important account notifications.

- Complete KYC by uploading documents: Log in to your new Lirunex client portal and complete the Know Your Customer (KYC) verification. You’ll need to upload a proof of identity (such as a passport or driver’s license) and a proof of address (like a utility bill or bank statement with your address). Lirunex’s compliance team will review and approve these, usually within 1 business day if documents are clear.

- Fund your trading account: Once your account is approved, go to the “Deposit Funds” or “Wallet” section of the client portal. Choose your preferred deposit method (e.g., credit card, Skrill, bank transfer, etc.) and follow the instructions to deposit funds. Remember, Lirunex charges no deposit fees, so the amount you send should arrive in full in your trading account.

- Download and log in to a trading platform: After funding, you’re ready to trade. Download the platform of your choice – Lirunex will provide download links for MT4 or MT5 (desktop or mobile), or you can use their WebTrader in a browser. Log in to the platform using the account credentials (login ID and password) that Lirunex gave you (these are usually emailed to you when you created the trading account). Select the server corresponding to your account (e.g., “Lirunex-Live” for real accounts).

- Choose your trading instrument: In the platform, browse the Market Watch list to see available instruments (forex pairs, indices, metals, etc.). For example, you might choose EUR/USD for currencies or XAU/USD for gold. Double-click or search to open the chart of your desired instrument.

- Analyze the chart and apply indicators: Before entering a trade, perform your analysis. Lirunex’s platforms come with charting tools – you can add technical indicators like moving averages or RSI to gauge market conditions. Use drawing tools to mark support/resistance or trend lines. If you’re using the Lirunex Trading App, you can also view TradingView charts and even check any provided trading signals or news relevant to your instrument.

- Place your trade (Buy/Sell) and set SL/TP: When ready, initiate a trade by clicking New Order. Choose Buy if you expect the price to rise or Sell if you expect it to fall. Enter the trade volume (lot size). It’s strongly recommended to set a Stop Loss (SL) to limit risk and a Take Profit (TP) to secure target gains. For instance, if buying EUR/USD at 1.1000, you might set an SL at 1.0950 (to risk 50 pips) and a TP at 1.1100 (to take profit at +100 pips). Confirm and execute the order – your trade is now live.

- Monitor your trade and close it when ready: Once the trade is open, keep an eye on it. You can monitor profit/loss in real-time on the platform. If you need to, you can modify the SL or TP levels. Lirunex’s platform will also allow you to set price alerts or use a trailing stop if you want to lock in profits as the market moves in your favor. You can close the trade manually anytime by clicking “Close” on the position, or let it run until it hits your preset TP or SL, or you decide to exit. When the trade closes, any profit will be added to your account balance (and losses deducted from it).

Customer Support

Lirunex provides multi-channel customer support to assist clients with their needs or issues. Support is client-focused and available throughout the trading week.

- Support Channels: You can reach Lirunex’s support team via Live Chat on their website, which is often the fastest way to get answers to simple queries in real-time. Additionally, support is accessible by Email – for general inquiries you can email [email protected] and expect a helpful response. Lirunex also offers Phone Support for certain regions; the phone numbers are provided in the Contact Us section (for example, they maintain regional office lines in Asia). For account-specific queries, you may use the support ticket system within the client portal, which logs your request directly to their helpdesk. Uniquely, Lirunex is active on Telegram – they have official Telegram channels/social media where clients can follow updates, and they may provide assistance via messaging apps like Telegram or WhatsApp for convenience (especially for account managers handling VIP clients). Overall, having multiple channels means you can always find a way to get in touch.

- Support Hours: Lirunex offers 24/5 customer support, meaning support is available 24 hours a day, Monday through Friday, corresponding to the global forex market hours. During the trading week, regardless of your time zone, you can reach someone – be it early Asian session or late US session. The support is typically closed or limited on weekends (when markets are closed), but they may still respond to urgent issues even on weekends via email. For VIP clients, some support may extend beyond normal hours on a case-by-case basis.

- Additional Details: Lirunex prides itself on multilingual support. Given the broker’s strong presence in Asia, Africa, and Europe, their support team collectively speaks a variety of languages. You can get assistance in English, Chinese, Malay, Thai, Vietnamese, Arabic, Russian, and other languages that cater to their client regions. This is extremely helpful for clients who prefer communication in their native language. Furthermore, high-volume or VIP account holders are typically provided with a dedicated account manager – an assigned support representative who can personally handle queries, platform training, or any account-related assistance. For example, a Pro account client might have an account manager who periodically checks in and can be contacted directly for quicker service. Lirunex’s support also tends to have a fast response time; live chat responses are instantaneous, and email inquiries are often answered within a few hours. The support team can help with a range of issues: from technical platform guidance, account funding issues, to trading questions (though they won’t give financial advice, they can help with platform use or basic queries). According to client feedback, Lirunex’s customer service is professional and prompt, aiming for high user satisfaction. They understand that especially for new traders, having a reliable support system is crucial, and Lirunex appears committed to delivering on that front (their client-centric approach is part of their core values).

Lirunex Final Verdict

“Ideal for global traders seeking tight spreads, high leverage, and a modern trading experience under multi-regulation.”

Avoid If: you are in a region they do not service or if you require certain features outside Lirunex’s scope. For instance, U.S. residents cannot trade with Lirunex due to regulatory constraints, so they’ll need to find a U.S.-regulated alternative. Traders who prioritize brokers with decades of history or top-tier (Tier-1) licenses like FCA/ASIC might also lean toward other options, even though Lirunex’s CySEC regulation is robust. Moreover, if you rely heavily on extensive in-house research, you might find Lirunex’s research offerings adequate but not extraordinary – some larger brokers have daily video updates, trading central feeds, etc., which Lirunex replaces with a leaner, tech-driven approach (though the TradingView tools largely compensate for this for many). Also, extremely risk-averse investors who are not comfortable with the temptations of high leverage might prefer brokers that enforce lower leverage by default.

Bottom Line: Lirunex has proven to be a reliable and innovative broker that delivers a great blend of low-cost trading and user-friendly features. In just a few years, it has built a strong reputation, particularly in Asia, for its transparent service and client-first philosophy. The broker’s strengths lie in its competitive pricing (tight spreads, low commissions), its range of platforms and tools, and the reassurance of being regulated in multiple jurisdictions. The introduction of their own mobile trading app and integration of TradingView shows a commitment to giving traders cutting-edge tools. While no broker is perfect for everyone, Lirunex offers tremendous value for the majority of retail traders – whether you’re a newbie starting with $100 on a cent account or a seasoned trader deploying $50k on a Pro account, you’ll find the environment cost-effective and the execution reliable. With robust customer support and a growing community of traders, Lirunex stands out as a broker that is punching above its weight and is well worth considering as your trading partner in 2025.

Frequently Asked Questions

Is Lirunex a regulated forex broker?

Yes. Lirunex is regulated by multiple authorities. It holds a license from CySEC in Cyprus (License 338/17), operates under the Labuan FSA in Malaysia, and is registered with regulators like the FSC in Mauritius. These licenses mean Lirunex must follow strict financial standards and client protection rules, so it is a legitimate and regulated broker.

What is the minimum deposit to open an account with Lirunex?

Lirunex does not enforce a high minimum deposit for its standard accounts – in fact, the Standard, Prime, and Cent accounts have no fixed minimum (you can start with even $10). The Pro account, aimed at advanced traders, requires $10,000 minimum. Essentially, you can begin with any amount you’re comfortable with on the lower-tier accounts, which makes Lirunex very accessible to new traders.

Does Lirunex offer a demo account for practice?

Yes, Lirunex provides free unlimited demo accounts on all its platforms (MT4, MT5, and the Lirunex web trader/app). You can register for a demo account to practice trading with virtual money in real market conditions. It’s an excellent way for beginners to get comfortable and for experienced traders to test strategies risk-free. The demo setup and trading conditions closely mirror those of live accounts.

What trading platforms are available at Lirunex?

Lirunex supports the popular MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms for desktop, web, and mobile. In addition, Lirunex offers its own Lirunex Trading App/WebTrader, which integrates TradingView charts and other advanced tools. All platforms allow for one-click trading, advanced chart analysis, and use of Expert Advisors for algorithmic trading. You can choose whichever platform you prefer and even switch between them (your account login works on all).

What are the spreads and fees at Lirunex?

Lirunex offers very competitive spreads. On the Standard account, typical forex spreads start around 1.5 pips with no commission. On Prime and Pro accounts, spreads can go as low as 0.0 pips on major pairs. Prime charges a commission of $8 per lot, and Pro charges $4 per lot (round-turn) to offset the raw spreads. There are no fees to deposit or withdraw via most methods, and no account maintenance fees. Overall trading costs (spread+commission) at Lirunex are among the lowest in the industry.

Can I use scalping, hedging, or EAs on Lirunex?

Absolutely. Lirunex permits all trading strategies, including scalping, hedging, and the use of Expert Advisors (automated trading) on its platforms. There are no restrictions on EAs – you can run your algorithmic strategies on MT4/MT5 freely. Hedging (holding long and short positions on the same pair) is allowed. The broker’s infrastructure (with fast execution speeds) is well-suited for high-frequency scalping techniques as well. Lirunex promotes a no-dealing-desk environment with no requotes, making it friendly for all strategy types.

How can I withdraw money from Lirunex and how long does it take?

To withdraw funds, you submit a withdrawal request from your Lirunex client portal. You can withdraw using the same method you deposited with (for example, funds deposited by Skrill will be withdrawn to the same Skrill account). Lirunex’s finance team typically processes withdrawal requests within 24 hours on business days. After processing, the time to receive money depends on the method: e-wallets like Skrill/Neteller usually receive funds on the same day, credit/debit cards can take 3–8 business days to reflect, and bank wire transfers take about 2–5 business days to arrive. Lirunex does not charge withdrawal fees on most methods (bank wires may have a ~$35 fee).

Is Lirunex suitable for beginners?

Yes, Lirunex can be a good choice for beginners. It has no minimum deposit requirement for basic accounts, meaning new traders can start with very small amounts. They offer a Cent account, which is great for practicing with micro-lots. There is also a demo account for risk-free practice. The trading platforms provided (MT4/MT5) are industry-standard and there are plenty of tutorials available. Lirunex also provides educational content on their site (articles, webinars) to help beginners learn trading. Additionally, the customer support is responsive and can guide new users through any setup issues. All these factors, combined with a straightforward fee structure and strong client protection, make Lirunex quite beginner-friendly.

What leverage does Lirunex offer?

Lirunex offers leverage up to 1:500 on its major account categories by default, and even higher on certain accounts: up to 1:1000 or 1:2000 on major forex pairs for Standard/Prime/Pro accounts for non-EU clients. This high leverage is available under Lirunex’s Labuan/Mauritius entities. If you are trading under the CySEC (EU) regulation as a retail client, leverage is capped at 1:30 (per EU law). But qualified Professional clients or those who open accounts with the non-EU branch can utilize the higher leverage. Always use leverage cautiously, as while it can amplify profits, it also amplifies losses.

Does Lirunex offer any bonuses or promotions?

Lirunex does have promotions from time to time. As of 2025, they have offered bonuses like a 60% Trading Bonus or a 30% Deposit Bonus on deposits, as well as other reward programs. For example, a 60% bonus means if you deposit $500, you could get an extra $300 as bonus credit. They also run an IB Reward Programme and other seasonal contests. However, bonuses usually come with terms and conditions (like volume requirements for withdrawal). It’s important to read the bonus policy on their site before participating. Note that clients under certain regulators (like CySEC/EU) may not be offered bonuses due to regulatory restrictions on incentives. Always check Lirunex’s Promotions page for the latest offers and their terms.

About Author

Robert J. Williams

Robert J. Williams, an MBA graduate from the University of Southern California with a significant background in finance. Extensive professional experience with top investment firms such as Balt Investment and Globe Investments, enhancing venture capital portfolios and developing sophisticated investment strategies. Contributing expert at PipPenguin, where he simplifies complex financial topics and online brokers for a broad audience, empowering them with the knowledge to succeed in trading.User Reviews

Be the first to review “Lirunex Review 2025: Does it have Multi-Jurisdiction Regulation?” Cancel reply

- Lirunex Overview & Company Background

- Pros & Cons Analysis

- Is Lirunex Regulated and Safe?

- Trading Conditions & Costs

- Trading Conditions & Costs

- Lirunex Trading Platforms & Tools

- Lirunex Account Types & Minimum Deposit

- Deposits & Withdrawals

- How to trade with Lirunex? Step-by-Step Guide

- Customer Support

- Lirunex Final Verdict

- Frequently Asked Questions

- About Author

There are no reviews yet.