HFM Broker Review – Is This Broker A Scam?

USP: Regulated by FCA, CySEC & FSCA | Raw spreads from 0.0 pips | MT4, MT5 & HFM proprietary platform

HFM Overview & Company Background

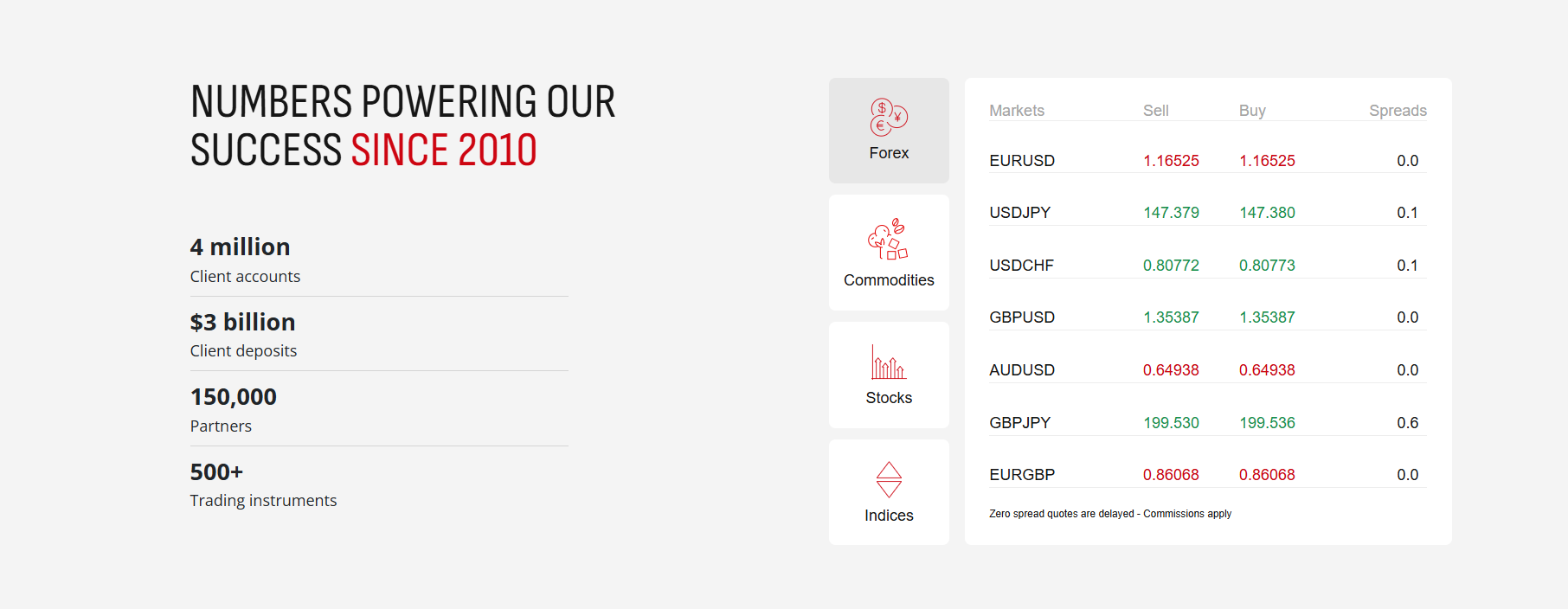

Founded in 2010, HFM (formerly HotForex) is an international multi-asset broker headquartered in Saint Vincent & the Grenadines. It has grown rapidly into a global online trading leader, now serving over 4 million client accounts. HFM is overseen by multiple regulators (CySEC, FCA UK, FSCA SA, etc.) and emphasizes cutting-edge tech and education. The group’s mission is to deliver the best trading experience through innovative platforms and tight trading conditions. Over the years HFM has earned 80+ industry awards and handled multi-billion-dollar trading volume, cementing its position in the global market.

- 🏦 Headquarters: Saint Vincent & the Grenadines

- 📅 Founded: 2010

- 📜 Regulation: FCA (UK), CySEC (EU), FSCA (South Africa), FSA (Seychelles), CMA (Kenya)

- 🏦 Supported Countries: Global (150+ countries)

- 💻 Platforms: MetaTrader 4, MetaTrader 5, WebTrader, Mobile apps, HFM Proprietary Platform

- 💵 Min Deposit: $0 (Cent, Zero, Premium); $100 (Pro)

Over the past decade, HFM expanded its regulation and product offerings. It obtained a CySEC (Cyprus) license in 2012, a South African FSCA license in 2016, and UK FCA oversight in 2018. By 2024 HFM had grown to 4M+ accounts and $3B in deposits. It now offers 500+ trading instruments (Forex, indices, commodities, stocks, ETFs, crypto, etc.) across its platforms. This broad suite and regulatory coverage make HFM a major player in retail and institutional trading worldwide.

Pros & Cons Analysis

- Licensed under FCA (UK), CySEC (EU), FSCA (South Africa), etc.: strong regulatory oversight.

- Tight pricing: raw spreads from 0.0 pips on major FX with competitive commissions.

- Multiple platforms: supports MetaTrader 4, 5, WebTrader, and HFM’s own mobile app.

- High leverage: up to 1:2000 (region-dependent) provides flexibility.

- Wide asset range: Forex, commodities, metals, indices, stocks, ETFs, and cryptos.

- Offshore entity: main brokerage is in SVG (Tier-3), which may concern some traders.

- No U.S. access: residents of the USA and a few other countries are restricted.

- Variable spreads: no fixed-spread account; spread volatility can increase in fast markets.

- Complex platform options: may overwhelm beginners with many account and platform choices.

HFM vs Competitors: Key Differences

- HFM’s FCA/CySEC regulation is stronger than many offshore brokers but lacks ASIC or CFTC (US) licenses, unlike some peers.

- HFM offers raw spreads (like many ECN brokers) with small commissions, comparable to top ECN platforms (e.g. IC Markets).

- Few competitors match HFM’s multi-platform support (including its own HFM app) alongside MT4/5.

- HFM’s in-house analysis and copy-trading services add to its edge, whereas some competitors focus narrowly on spread/commission.

Is HFM Regulated and Safe?

HFM has a multi-jurisdictional regulatory framework. Its main entities are licensed by Tier-1 authorities (FCA UK, CySEC EU) and Tier-2 bodies (FSCA South Africa, Kenya CMA). This means customer funds are held with segregated accounts at top banks, and clients benefit from standard protections like compensation funds. HFM also maintains industry-leading safeguards (see below) and claims enhanced security measures on its platforms. Overall, FCA/CySEC oversight implies robust oversight and partial compensation cover, while other licenses extend regional protection.

Regulatory Licenses

- FCA (UK) – License No. 801701

- CySEC (Cyprus) – License No. 183/12

- FSCA (South Africa) – License No. 46632

- FSA (Seychelles) – License No. SD015

- CMA (Kenya) – License No. 155

Safety Measures

- Client Fund Protection: HFM keeps client deposits in fully segregated accounts at major global banks. Even in case of broker insolvency, client money cannot be used to meet company debts. HFM further backs funds with an industry-leading $5M insurance policy against fraud and operational risks.

- Compensation Schemes: As a CySEC-regulated firm, HFM Europe is a member of the Cyprus Investor Compensation Fund, offering pay-out up to €20,000 if necessary. UK clients also qualify for FCA’s compensation scheme (up to £85,000) for covered investment defaults. These schemes add layers of client protection beyond normal segregation.

- Negative Balance Protection: Traders can never lose more than their account balance. HFM enforces automatic negative-balance reset: any negative equity is brought back to zero to shield clients from owing money. This rule applies across all accounts, giving traders confidence in worst-case scenarios.

- Data Security & Encryption: HFM employs high-grade SSL encryption on its website and platforms, with secure login verification processes. The broker continuously monitors its systems and performs audits (e.g. by Deloitte). Two-factor authentication (2FA) is available, and client data is stored with strict confidentiality, following global privacy standards.

Trading Conditions & Costs

✅ Instruments: Forex (major/minor), Commodities, Indices, Stocks, ETFs, Metals, Energies, Cryptocurrencies. HFM offers over 500 tradable CFDs in total, so traders can diversify across global markets in one place.

✅ Spreads: Variable and ultra-low. The Zero and Pro accounts feature “raw” spreads starting from 0.0 pips on major FX pairs. Even on the Premium account spreads start from about 1.2 pips, which is quite tight for a non-raw account. All spreads widen slightly during volatile events, but normal conditions see very competitive spreads.

✅ Commission: Low commissions apply on raw accounts. For example, the Zero Account charges roughly $3 (per lot per side) on majors. The Pro account actually has no additional commission (its cost is built into spreads). Premium and Cent accounts are commission-free, meaning only the spread costs apply. Overall, HFM’s combined spread+commission on Zero/Pro is on par with top ECN-style brokers.

✅ Leverage: Up to 1:2000 on most symbols for qualifying accounts. This very high leverage (in line with many global ECN brokers) can amplify gains but also losses. Note that regulators may impose lower limits (e.g. ESMA 1:30). By default HFM offers 1:2000 on FX. Traders should use leverage judiciously and are recommended to understand margin requirements before trading.

- Instruments: A wide basket from Forex and precious metals to stock indices, individual equities and crypto coins. Every account provides access to the full range of instruments, allowing portfolio diversification. Crypto trading (BTC, ETH, etc.) is available via CFDs on the MT5 platform.

- Spreads: The Zero and Pro accounts provide raw interbank spreads, which means HFM’s USD/EUR can be at or near zero. On these accounts, spreads may even go to 0.0 pips on EUR/USD on liquid markets. The Premium account has slightly wider typical spreads (around 1.2 pips) but charges no commission. Spreads on other FX majors usually remain very competitive (e.g. 0.6 pip on Pro EUR/USD). Importantly, HFM is transparent about its rollover/swap policy so there are no hidden markups.

- Commission: The Pro account integrates the cost into its spreads, so traders pay no separate commission. The Zero account charges a small per-lot commission (about $3 per side on FX), which is typical for an ECN. Non-raw accounts (Cent, Premium) charge zero commission in exchange for slightly higher spreads. In practice, traders can choose the structure they prefer: raw spreads + commission or wider spreads with no commission, depending on their style and volume.

- Leverage: HFM’s leverage is very high (up to 1:2000) which suits experienced traders and those using micro accounts. Such leverage means a $100 margin can control $200,000 in forex, for instance. Beginners should be cautious: the high leverage can boost profits or losses. Regulatory authorities in some regions enforce lower caps (e.g. 1:30 in Europe), but HFM’s non-EU entities allow up to 1:2000. Stop-out occurs at 20%, and Negative Balance Protection prevents accounts dropping below zero.

HFM Trading Platforms & Tools

HFM caters to diverse trader preferences by supporting multiple platforms:

-

✔ MetaTrader 4 (MT4): A globally popular desktop and mobile platform. MT4 offers advanced charting, 30+ built-in technical indicators, Expert Advisors (EAs for automated trading) and one-click execution. Traders on HFM can run MT4 on Windows, Mac, WebTrader and iOS/Android. All HFM account types work on MT4.

-

✔ MetaTrader 5 (MT5): An upgraded successor to MT4, MT5 adds more chart timeframes, additional order types, an economic calendar and expanded asset support (stocks, commodities, etc.). HFM’s MT5 (desktop/mobile) gives access to all instruments, including stocks and cryptocurrencies. Like MT4, MT5 supports EAs and one-click trading.

-

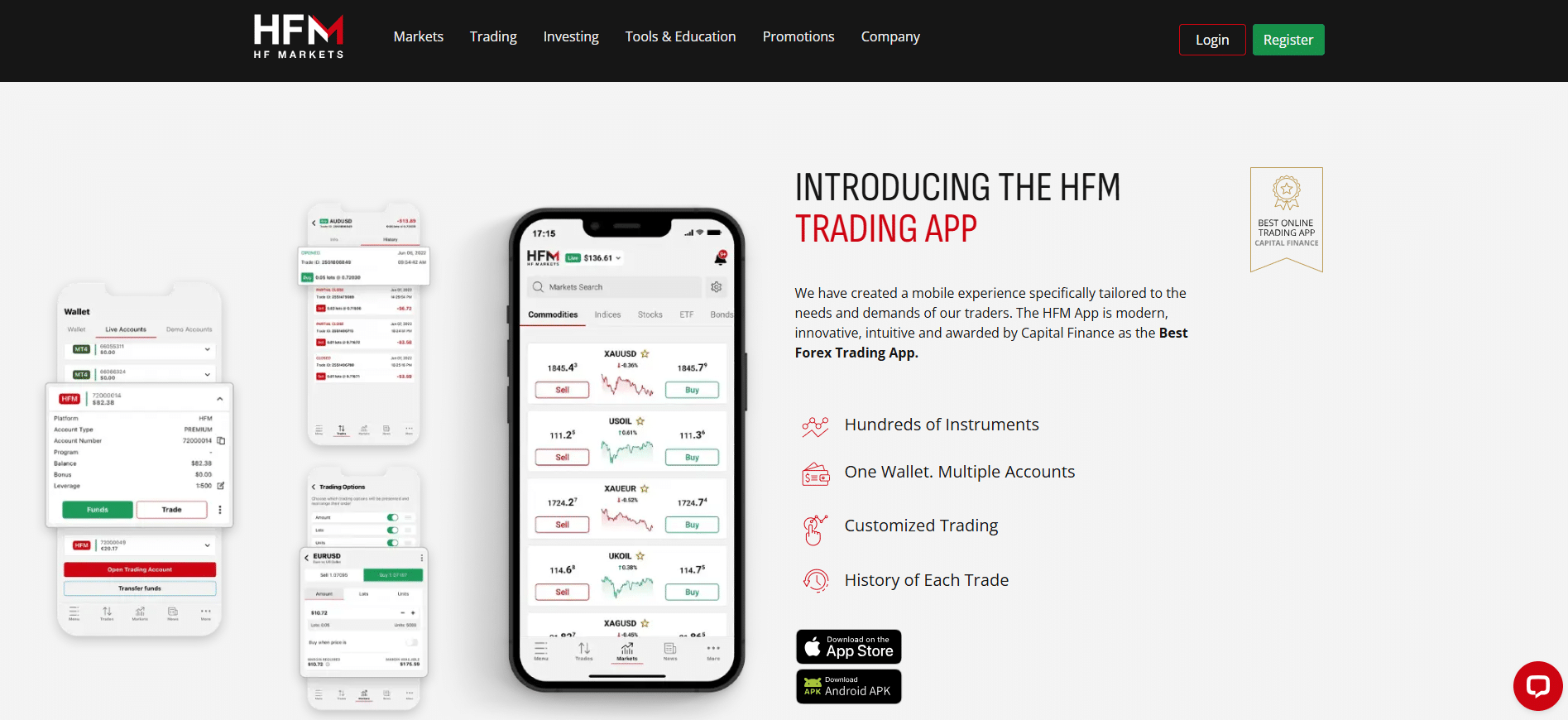

✔ HFM Proprietary Platform: HFM’s own web and mobile app (HFM App) provides an alternative for traders who prefer a simpler, modern interface. The HFM platform delivers live market news, analysis, customizable watchlists and push notifications. It allows trades directly from charts and syncs with the client’s accounts on MT4/MT5. This platform is available for iOS and Android.

-

✔ WebTrader: Both MT4 and MT5 are available in browser form (no download needed), enabling trading from any PC/Mac. The web terminals include the same order types and charts as the desktop versions. HFM also offers a “One-Click Trading” feature in its web/mobile platforms for fast order entry.

-

✔ API Access: For quantitative traders, HFM provides the RapidTrader API (an ECN trading API) to integrate custom algorithms and platforms directly. This is a more specialized option requiring technical skill.

Platform Features

-

Automated & One-Click Trading: Both MT4/5 support automated strategies via EAs and scripts, enabling backtesting and trading robots. HFM’s platforms also offer one-click trading (instant order execution with a single click) to speed up order placement. This is ideal for scalpers or high-frequency setups.

-

Advanced Analytics: Through MT4/5 and HFM’s tools, traders have dozens of built-in indicators, customizable chart types, and proprietary add-ons. HFM integrates premium tools like Autochartist (an automated market scanner that finds patterns) and the “Premium Trader” suite, which provide trade signals and order-entry aids.

-

Real-Time News & Alerts: HFM offers a live Trader’s Board on its platform that displays news headlines, major market movers, and overall sentiment data. Combined with a comprehensive Economic Calendar and daily market analysis from the HFM research team, traders can stay updated without needing third-party sites. SMS and push notifications (e.g. margin alerts) are also available.

-

VPS & Mobile: HFM provides a free VPS hosting service for qualifying accounts, enabling 24/7 run of EAs with low latency. All platforms synchronize with the HFM mobile app, so trades and charts carry over between desktop and mobile seamlessly. The HFM app also includes live streaming quotes and account management features.

Research Tools

-

Autochartist: A third-party technical scanner integrated with HFM’s MT4/5. It monitors charts 24/7 and alerts traders to patterns (like triangles, Fibonacci levels) as soon as they form. This tool is platform-native (runs on MT4/5) and customizable by instrument and timeframe.

-

Economic Calendar: HFM’s website and MT5 include a built-in macro calendar showing upcoming high-impact events (CPI releases, central bank meetings, etc.). Traders can filter by country or importance, and set alerts for events affecting their positions.

-

Market News & Analysis: HFM’s own Exclusive Analysis section provides daily written market commentary and updates from expert analyst. Combined with the live newsfeed on Trader’s Board, this means fundamental news is directly accessible to clients.

-

Trader’s Board (Market Sentiment): This proprietary dashboard shows aggregated client positions, top movers, and volume data. It helps gauge overall market sentiment and spot emerging trends based on the broker’s own order flow.

-

Trading Calculators & Tools: HFM offers a suite of calculators (pip value, swap, margin) and the Premium Trader tools bundle. These are platform-native toolkits (downloadable for MT4/5) that assist with risk calculations, trade automation support and more.

HFM Account Types & Minimum Deposit

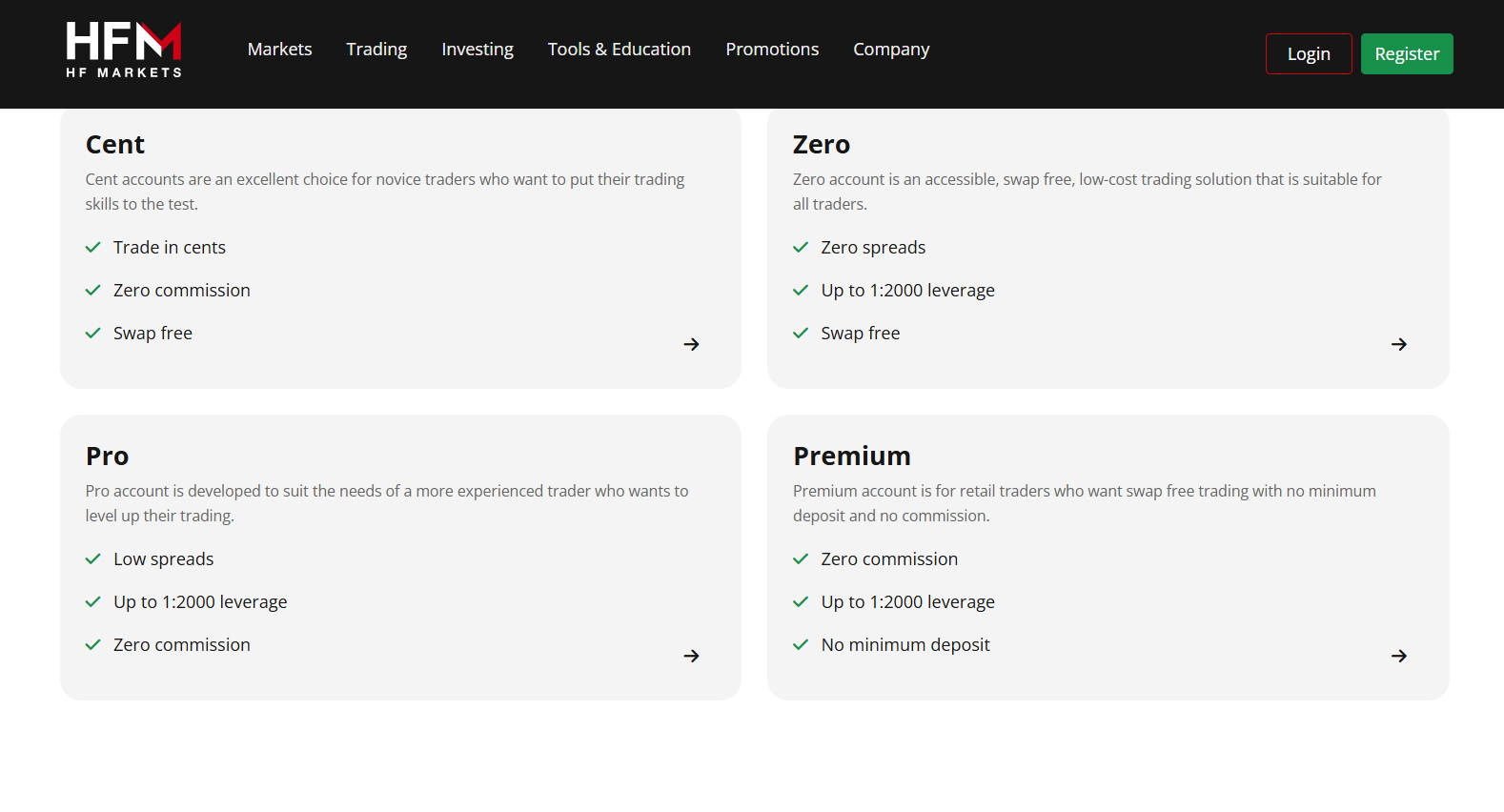

HFM provides four main live account types: Cent, Zero, Pro, and Premium. Each has different conditions for spreads and commissions:

| Account Type | Min Deposit | Spread | Commission | Platforms |

|---|---|---|---|---|

| Cent Account | $0 | From 1.2 pips | None (spread-based) | MT4, MT5, WebTrader, HFM Platform |

| Zero Account | $0 | From 0.0 pips | ~$3 per 1 lot | MT4, MT5, WebTrader, HFM Platform |

| Pro Account | $100 | From 0.6 pips | None | MT4, MT5, WebTrader, HFM Platform |

| Premium Account | $0 | From 1.2 pips | None | MT4, MT5, WebTrader, HFM Platform |

-

Cent Account: A micro-lot account for beginners, using “cent” lots (1,000 units). Spreads start around 1.2 pips on EUR/USD. No commissions; very low minimum deposit ($0).

-

Zero Account: For cost-conscious traders. Spreads are raw (from 0.0 on majors), with a fixed $3 per 1-lot commission. Min deposit is $0. Ideal for scalpers and high-frequency traders who want minimal spreads.

-

Pro Account: A versatile account with tight spreads (from ~0.6 pips on EUR/USD) and no commission. Requires a $100 minimum deposit. Swap-free available. Leverage up to 1:2000.

-

Premium Account: Geared toward casual traders needing no commissions. Spreads start around 1.2 pips (like Cent). Zero deposit requirement. Swap-free and high leverage. Ideal for those who prefer simplicity (no commissions, no minimum deposit).

Special Features

-

Demo Account: Unlimited free demo account to practice with virtual funds. It mirrors real market conditions with no risk.

-

Islamic (Swap-Free) Accounts: All live accounts can be converted to swap-free mode on request, complying with Sharia law. Swap-free applies to specific instruments.

-

VIP / Premium Accounts: HFM’s Premium account is effectively a VIP account with no minimum deposit or commission. High-volume traders may also negotiate custom terms.

-

Managed/PAMM Accounts: HFM supports copy-trading and PAMM programs. Clients can create PAMM (Percentage Allocation Management Module) portfolios or follow professional traders through the HFM copy-trade platform. This lets investors have their funds managed by experienced providers for performance-based returns.

Deposits & Withdrawals

Deposit Methods

HFM accepts Bank Wire, Credit/Debit cards (Visa, Mastercard, Maestro), and various e-wallets (Neteller, Skrill, FasaPay, SticPay, crypto, etc.).

- Bank Transfer: Minimum $100; typical processing 2–7 business days. No fees from HFM for transfers above $100.

- Cards: Instant deposits (Visa/Mastercard/UnionPay); minimum $5; up to $10,000 per transaction. No deposit fees.

- E-Wallets & Crypto: Instant processing (or minutes); minimums typically $5–$30. Includes Skrill, Neteller, Bitcoin, Ethereum, etc. All HFM deposit methods are free of broker charges.

Withdrawal Methods

Clients can withdraw via Bank Wire, back to Credit/Debit card (same card used for deposit), and e-wallets/crypto.

- Bank Transfer: Minimum $100; 2–10 business days (depending on correspondent banks). HFM does not charge withdrawal fees, but intermediary banks may impose fees.

- Cards: Minimum $5; 2–10 business days by standard transfer. (Note: withdrawals are limited to the sum of your card deposits; any excess is paid by wire). No HFM fees.

- E-Wallets: Minimum $5–$10; typically instant to 24 hours. HFM supports the same e-wallets as deposits. No withdrawal fees from HFM.

Processing Details

- Processing Time: Deposits via cards/e-wallets are instant, bank wires take 2–7 days. Withdrawals to wallets are usually processed within hours, while bank/card withdrawals take 2–10 business days. Withdrawals submitted before 10am server time are often processed the same business day.

- Deposit Fees: None – HFM applies no fees on deposits.

- Withdrawal Fees: None charged by HFM. However, sending/correspondent banks may charge wire fees as noted on HFM’s site. E-wallet withdrawals are also free.

- Limits: Minimums are $5 for cards and e-wallets, and $100 for bank wires. Maximum transaction limits vary by method (up to $10,000 for cards, and higher for wires/e-wallets).

How to trade with HFM? Step-by-Step Guide

-

Visit the official HFM website or download the HFM app.

-

Click Register and complete the online form with your personal information.

-

Verify your email address and phone number via the confirmation links/code sent by HFM.

-

Upload required KYC documents (government ID and proof of address) for account verification.

-

Fund your trading account using your chosen deposit method (wire, card, or e-wallet).

-

Log in to your preferred trading platform (MetaTrader 4/5 or HFM Platform) with the credentials provided.

-

Choose a financial instrument (e.g. EUR/USD, Gold, an index or crypto) from the symbol list.

-

Analyze the market: apply technical indicators or review news/events on the platform’s charts.

-

Place a trade: enter a Buy or Sell order for your chosen lot size, and set your Stop Loss and Take Profit levels.

-

Monitor your open position and close it either manually or by automatic orders (stop levels) when desired.

The HFM trading process is straightforward and beginner-friendly. After opening and funding an account, clients can use the intuitive MT4/5 or HFM platforms to execute trades in minutes. The availability of extensive educational resources and 24/5 support means even new traders have guidance. Overall, HFM’s account setup and platform usage are designed for ease-of-use, making it accessible to beginners while still offering advanced features for pros.

Customer Support

Support Channels: HFM offers multiple support methods – 24/5 live chat, email, and phone. Clients can use the in-site Live Chat for instant assistance. Support email is [email protected], and phone support is available at +44-203 097 8571. HFM also maintains active social media channels and a comprehensive FAQ/help center on its website.

Support Hours: Customer support operates 24 hours a day, 5 days a week (Mon–Fri). Traders can get help around the clock during market hours via chat, and email inquiries are usually answered promptly by the next business day.

Additional Details:

- Multilingual Support: HFM provides service in 27+ languages, reflecting its global client base.

- Dedicated Account Managers: Premium and high-volume clients can request a personal account manager for one-on-one assistance (especially useful for corporate or large accounts).

- Fast Response Time: Live chat response is immediate during business hours, while emails and tickets are typically answered within 24 hours on business days. HFM’s support team is known for being responsive across channels.

HFM Final Verdict

“Ideal for global forex and CFD traders seeking ultra-low costs, professional-grade platforms, and strong regulatory oversight.”

Avoid If: HFM if you require access from the USA/Canada or need fixed spreads, as these are not available. Also, those needing local (bank) deposit methods in countries outside HFM’s supported list may find it limiting. Otherwise, HFM’s diverse accounts and multi-platform setup suit a wide range of traders.

Bottom Line: HFM is a versatile, multi-regulated broker that excels in offering tight raw spreads, high leverage, and a broad product range. Its strengths lie in cost-efficient pricing, robust trading tools, and top-tier regulatory licenses (FCA/CySEC) for trust. The broker’s awards and 4M+ client base underscore its market standing. We recommend HFM for traders (especially Forex scalpers and pros) who value low trading costs and a secure, technology-rich environment.

Frequently Asked Questions

Is HFM regulated and safe to use?

Yes. HFM operates under the HF Markets Group umbrella with multiple licenses. Its European arm (HF Markets Europe Ltd) is regulated by CySEC (License 183/12) and is a member of the Cyprus Investor Compensation Fund. HF Markets (UK) Ltd holds an FCA license (801701), and there are additional licenses in South Africa (FSCA 46632), Seychelles (FSA SD015) and Kenya (CMA 155). Clients benefit from segregated accounts and regulatory safeguards (including negative balance protection). This multi-tier regulation ensures strong oversight and fund security.

What account types does HFM offer and what are their minimum deposits?

HFM offers four live accounts: Cent, Zero, Pro, and Premium. The minimum deposits are $0 for the Cent, Zero and Premium accounts, and $100 for the Pro account. Spreads and commissions vary by account (Zero has raw spreads from 0.0 pips with ~$3 commission per lot, Pro has slightly wider spreads from ~0.6 pips with no commission). All accounts support MT4, MT5, WebTrader and HFM’s platform. You can start with a Cent or Premium account at just $5 if desired (they effectively have no required minimum).

Which trading platforms can I use with HFM?

HFM supports MetaTrader 4 and MetaTrader 5 on desktop, web, and mobile. Both platforms give access to all HFM assets and features like automated EAs and one-click trading. In addition, HFM offers its own proprietary trading app/platform for Android/iOS and web, which includes live streaming quotes, interactive charts, and the broker’s built-in analytics tools. This means you can trade HFM accounts from virtually any device.

How long do withdrawals take and are there any fees?

Withdrawals depend on the method: E-wallets (e.g. Skrill, Neteller, Crypto) are usually processed within 24 hours. Credit/debit card and bank wire withdrawals take about 2–10 business days (processing delays are due to banks and card networks). HFM charges no withdrawal fees itself (note: your bank or card issuer may charge its own transfer fee). The minimum withdrawal is $5 for cards/e-wallets and $100 for bank transfers. Generally, customers report payouts being handled promptly on request.

Does HFM offer Islamic (swap-free) trading accounts?

Yes. HFM provides Sharia-compliant accounts across all types. You can request swap-free trading on your live account, which removes overnight interest charges. Swap-free is available for all account types and is indicated by “Swap free: Yes” in the account details. (Note: swap-free status applies to specific products and requires adherence to HFM’s terms.)

About Author

Robert J. Williams

Robert J. Williams, a finance graduate from the London School of Economics, dove into finance clubs during her studies, honing her skills in portfolio management and risk analysis. With a career spanning prestigious firms like Barclays and HSBC, she's become an authority in asset allocation and investment strategy, known for her insightful reports.User Reviews

Be the first to review “HFM Broker Review – Is This Broker A Scam?” Cancel reply

- HFM Overview & Company Background

- Pros & Cons Analysis

- Is HFM Regulated and Safe?

- Trading Conditions & Costs

- HFM Trading Platforms & Tools

- HFM Account Types & Minimum Deposit

- Deposits & Withdrawals

- How to trade with HFM? Step-by-Step Guide

- Customer Support

- HFM Final Verdict

- Frequently Asked Questions

- About Author

There are no reviews yet.