XTB Broker Review: Comprehensive Insights into Services and Features

USP: Regulated by FCA (UK) & KNF (Poland) | Zero-commission stocks/ETFs up to €100k | Award-winning xStation 5 platform

XTB Broker Review Overview & Company Background

XTB is a well-regarded global broker founded in 2002, headquartered in Warsaw, Poland, and known for its powerful and user-friendly trading platform, xStation 5. XTB offers traders access to a wide range of over 2100 financial instruments across forex, CFDs, stocks, commodities, and cryptocurrencies. The broker is regulated by several top-tier authorities including the FCA and CySEC, ensuring a secure and transparent trading environment.

🏦 Headquarters: Warsaw, Poland.

📅 Founded: 2004.

📜 Regulation: FCA (UK), KNF (Poland), CySEC (Cyprus), DFSA (UAE), FSCA (South Africa), FSC (Belize)ir.

🏦 Supported Countries: Global presence (12+ offices worldwide)

💻 Platforms: xStation 5 (web), iOS & Android mobile app

💵 Min Deposit: No minimum (start trading from any amount)

Company Background

XTB began as X-Trade Brokers in Poland in 2004 and has grown into a publicly listed global broker. It was listed on the Warsaw Stock Exchange in 2016 and now serves over 1.6 million clients worldwide. The company’s mission is to provide advanced trading tools and broad market access under strict regulatory oversight. Over 20+ years, XTB has expanded to 12 offices on 3 continents, continuously innovating with proprietary tech (like its xStation platform introduced in 2016). Its strong growth is marked by top-tier licenses (FCA, KNF, CySEC, etc.) and a client base in hundreds of countries. XTB has also sponsored global sports stars, reflecting its brand recognition and solid position in the financial industry.

Pros & Cons Analysis

- Licensed by multiple top-tier regulators (FCA UK, KNF Poland, CySEC Cyprus, DFSA UAE) for high client safety.

- Zero commission on stock and ETF trades up to €100,000 monthly

- Very competitive FX spreads (from 0.1 pip on Pro accounts)

- Award-winning xStation 5 platform with robust charting, mobile app and integrated news

- Wide range of 5,800+ instruments (CFDs on FX, indices, commodities, crypto, plus stocks/ETFs)

- No MetaTrader or cTrader support – only the proprietary xStation platform

- Leverage capped at 30:1 for EU/UK retail clients (up to 500:1 only for non-EU).

- Limited fixed-spread or guaranteed-stop options; all pricing is floating.

- Not available to U.S. residents; select withdrawal/card options have fees.

XTB vs Competitors: Key Differences:

-

Platform: XTB relies on its proprietary xStation (award-winning and mobile-friendly) rather than MT4/5, which sets it apart from many brokers. It integrates news feeds and sentiment data directly.

-

Pricing: XTB’s stock/ETF commission policy (0% up to €100k) and low FX spreads are more aggressive than many rivals. On the other hand, leverage limits are tighter in EU due to regulations.

-

Regulation: XTB’s multiple Tier-1 licenses (FCA, KNF) offer stronger oversight than offshore-only brokers. Some competitors may only have Belize or CySEC, while XTB covers global regulator spectrum.

-

Features: Unlike brokers that offer social/copy trading, XTB emphasizes advanced analytics (economic calendar, live news) built into its platform. It also provides investment plans and savings products, which many Forex-only brokers do not.

-

Support: XTB has 24/5 multilingual support with local offices (e.g. Europe, Latin America), giving it broader service than some purely online brokers. Its VIP offering includes dedicated account managers.

Is XTB Broker Review Regulated and Safe?

XTB is overseen by some of the strongest regulators in the industry. It holds Tier-1 licenses (FCA UK #522157, KNF Poland, CySEC #169/12, DFSA UAE), meaning clients benefit from strict oversight, regular audits, and transparent operations. For EU/UK clients, FCA/CySEC rules enforce protections like segregated accounts and compensation schemes. EU/UK retail clients are covered by compensation funds (e.g. up to £85,000 FSCS in the UK), adding a safety layer. Non-EU clients trade under Belize (Tier-3 FSC license), which offers less protection than EU/UK regulators, so risk is higher for those accounts. Overall, XTB’s robust regulatory framework (FCA, KNF, CySEC, etc.) provides strong customer protection and trust.

Regulatory Licenses:

-

FCA (UK) – License No. 522157

-

CySEC (Cyprus) – License No. 169/12

-

KNF (Poland) – License No. DDM-M-4021-57-1/2005

-

FSC (Belize) – License No. 000302/35

Safety Measures:

-

Client Fund Protection: XTB holds all client money in segregated bank accounts, ring-fenced from the company’s own funds. Under FCA/CySEC rules, client deposits cannot be used for operating expenses. In insolvency, clients’ segregated funds are returned in full (not treated as broker assets). This ensures that customer deposits are safer even if XTB faces financial trouble.

-

Compensation Schemes: Eligible clients can claim compensation if XTB fails. UK clients have FSCS protection up to £85,000 per person. EU clients are covered by Cyprus’ ICF (Investor Compensation Fund) up to €20,000. These schemes backstop any losses beyond fund segregation, adding a safety net above 100%.

-

Negative Balance Protection: Retail accounts under FCA/CySEC are safeguarded by guaranteed Negative Balance Protection. This means you cannot lose more than your account balance – XTB will reset any negative balance to zero. (Note: This guarantee applies to EU/UK clients; IFSC/Belize accounts may not have the same protection.)

-

Data Security & Encryption: XTB employs industry-standard encryption and security controls for client data.. All personal and trading data is encrypted in transit and at rest. The xStation platform and web portal require secure two-factor authentication (2FA). XTB conducts regular security audits and penetration tests., and mobile apps support biometric or code-based logins. These measures ensure that account access and sensitive information remain protected.

Trading Conditions & Costs

✅ Instruments: Forex, Commodities, Indices, Stocks/ETFs, Crypto.

✅ Spreads: From 0.1 pips (Pro account)

✅ Commission: $0 (Standard, on FX), $3.50 per side (Pro, FX)

✅ Leverage: Up to 1:500 (for non-EU clients); 1:30 for UK/EU retail

-

-

Instruments: XTB offers 5,800+ tradable instruments. Clients can trade CFDs on major and minor forex pairs, precious metals (gold, silver), energy and commodity futures, global stock indices, and over a dozen cryptocurrencies. In addition, XTB provides access to real stocks and ETFs (3,000+ listings) via its Investing account. This wide coverage lets traders diversify across asset classes. All instruments can be traded on margin with market hours matching underlying markets.

-

-

-

Spreads: Spreads are mostly floating and depend on account type. On the Pro account (market spreads), forex majors start around 0.1 pip. Standard (or Basic) accounts have wider spreads (e.g. from ~0.5 pip) but charge no FX commissions. Cryptocurrency CFD spreads are wider than forex but still competitive. XTB publishes real-time spreads in its platform. Because all spreads are floating, costs tighten in high liquidity and widen during volatility. Overall, XTB’s spread costs are on par with major brokers, especially for Pro accounts.

-

-

-

Commission: On Standard/Basic accounts, XTB embeds trading costs in the spreads (no commission on forex/CFDs). Stocks/ETFs commissions are 0% up to €100k monthly turnover (then 0.2%, min €10). Pro accounts operate with raw spreads plus a per-lot commission. For example, forex trades on Pro incur about $3.50 per side (per $100k lot) depending on base currency. This hybrid model suits active traders who prefer razor spreads, trading off a small commission. In any case, XTB clearly shows all fees in its platform for full transparency.

-

Leverage: XTB offers margin trading with up to 500:1 leverage for non-EU clients. However, due to ESMA rules, UK/EU retail clients are limited to 30:1 on forex and 20:1 on major indices. Professional/non-EU accounts can use the higher leverage on all instruments. The high max leverage (500:1) available via XTB International (Belize) is one of the broker’s more aggressive offerings. Traders should use leverage cautiously, understanding that it magnifies both gains and losses.

-

XTB Broker Review Trading Platforms & Tools

Supported Platforms:

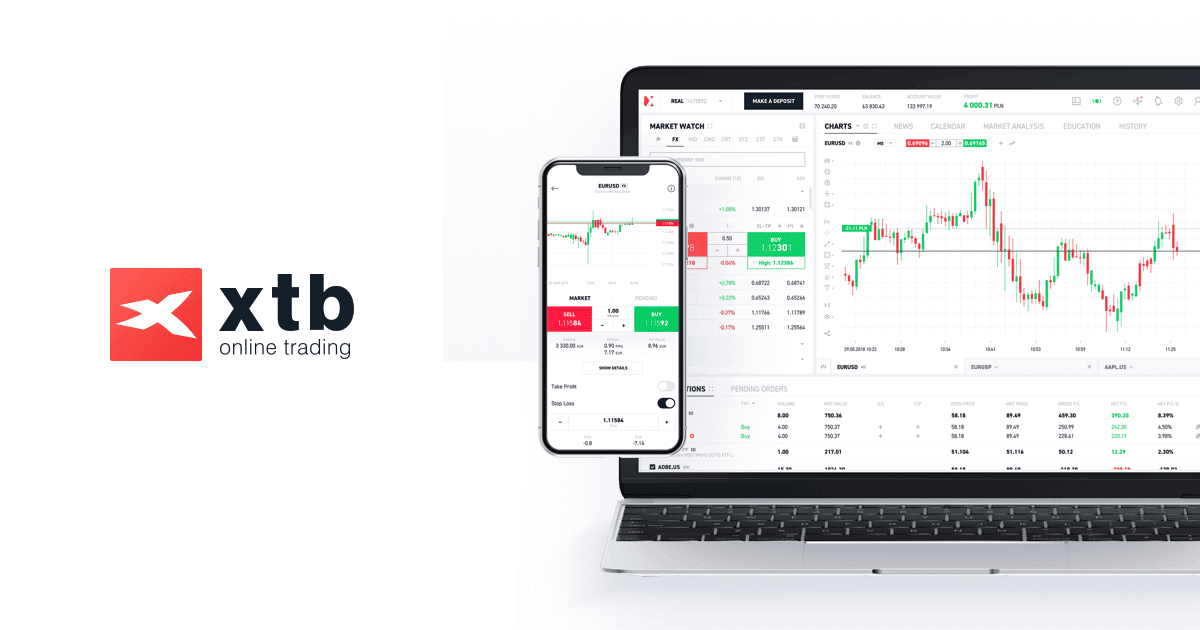

✔ xStation 5 (Desktop/Web): XTB’s own platform with an intuitive, user-friendly interface. It offers live charts, advanced order types (SL, TP, pending orders), an economic calendar, news, and sentiment data all in one place. You can analyze multiple charts, apply indicators and draw objects, and execute trades instantly. It is continuously updated (xStation 5) for speed and reliability.

✔ xStation Mobile (iOS/Android): Full-featured mobile app mirroring the web platform. It supports real-time quotes and charting on the go. Both versions scored 4.7/5 on the App Store. The platform allows account management, funding, and notifications on mobile. XTB does not offer MetaTrader or cTrader; the entire experience is centered on xStation.

Note: MetaTrader 4/5 are not available at XTB – all trading is via xStation 5.

Platform Features:

-

-

Chart Analysis: xStation 5 provides dynamic, interactive charts with multiple timeframes. Traders have access to a wide variety of drawing tools (trendlines, fib retracements, channels) and can open/close trades directly from the chart. The platform’s built-in Investment Calculator shows risk/reward and pip values. Users can view key technical levels and set up custom alerts on price movement.

-

-

-

Technical Indicators: Over 50 pre-built indicators are available (RSI, MACD, Bollinger Bands, etc.). These can be overlaid on charts with adjustable settings. Users can add multiple indicators per chart for technical analysis. There is also a “Market Watch” list where instruments’ bid/ask, change, and custom columns can be added. Overall, the charting package meets the needs of both beginners and experienced traders.

-

-

-

Automated Trading (EAs): While xStation 5 itself does not support EAs, XTB clients have access to Expert Advisors by connecting MetaTrader via its brokerage (Note: MT4/5 not offered, so EAs are limited to the Investing stock/ETF side or third-party tools via API). In practice, algorithmic trading is primarily done on the standard accounts through platform features like trailing stops and order types, since MT4 is not provided.

-

-

-

Mobile Trading Support: The xStation mobile app is fully integrated and offers nearly all desktop features. Traders can execute orders, set alerts, and use charting tools on mobile. Push notifications deliver price alerts and breaking news instantly. Secure login includes biometric (fingerprint/face ID) options. The seamless sync across devices means positions and strategies can be managed anywhere, anytime.

-

Research Tools:

-

-

Economic Calendar & News Feed: xStation 5 includes a real-time economic calendar with impact indicators. Traders can filter by country/impact to track key releases. Additionally, there is a live news stream with breaking financial news, analysis and trading ideas all updated in real time. An audio “Trader’s Talk” feed provides spoken market updates. These integrated features eliminate the need for external news sites.

-

-

-

Market Sentiment & Positioning: XTB provides a proprietary sentiment tool in xStation 5. It shows the percentage of XTB clients who are net-long or net-short on a given instrument (via the Market Watch > Sentiment column). This real-time sentiment indicator helps traders gauge crowd positioning. Combined with CFTC positioning reports (accessible in education), it gives insight into market psychology.

-

-

-

Technical & Fundamental Research: In addition to platform tools, XTB offers a Market Analysis section (articles, videos) and daily webinars. The Knowledge Base and charting tools support technical analysis. However, research coverage focuses more on broader macro and technical themes rather than in-depth equity analysis, reflecting XTB’s CFD trading focus.

-

XTB Broker Review Account Types & Minimum Deposit

| Account Types | Min Deposit | Spread (from) | Commission | Platforms |

|---|---|---|---|---|

| Standard (Basic) | None | From 0.5 pips | $0 (FX/CFDs) | xStation 5 (Desktop/Mobile) |

| Pro | None | From 0.1 pips | From $3.50/side (FX) | xStation 5 (Desktop/Mobile) |

| Islamic (Swap-Free) | None | From 0.5 pips | $0 (FX/CFDs) | xStation 5 (Desktop/Mobile) |

XTB offers three main live account types: Standard (Basic), Pro, and Islamic (Swap-Free). All accounts can be opened with no minimum deposit – traders can start with any funding amount. The Standard account has wider spreads (from about 0.5 pips on majors) but no trading commissions on forex/CFDs. The Pro account uses raw spreads (from 0.1 pips) plus a commission (around $3.50 per side on EUR/USD). The Islamic account is identical to Standard but without overnight swaps (for qualifying clients). All accounts use the xStation 5 platform (no MT4/5). Stock & ETF investing is available via Standard/Pro with 0% commission up to €100k turnover. Spreads and commissions are competitive across all account types.

Special Features:

-

Demo Account: XTB offers a free unlimited demo with $100k in virtual funds. It mirrors live conditions (all instruments, xStation 5) so traders can practice risk-free. Demo account signup is fast – no funding or ID needed – and is recommended for beginners to test the platform.

-

Islamic (Swap-Free) Accounts: Swap-free (Islamic) versions of Standard/Pro accounts are available for eligible clients (Muslim traders). They have the same spreads and commissions but no overnight finance charges. This ensures compliance with Sharia law for those who qualify.

-

VIP / Premium Accounts: XTB provides VIP services for high-volume investors (e.g. large fund deposits, institutional clients). These accounts may have customised spreads, one-on-one support, and tailored solutions like dedicated account managers. Details are provided upon request.

-

Managed Accounts: While XTB primarily offers self-trading, it also has options for portfolio management and investment plans (passive ETF investing). Customers seeking managed services can use “Investment Plans” – auto-investing into ETFs – effectively having XTB automate their trading strategy. This is unique compared to many CFD brokers.

Deposits & Withdrawals

-

Credit/Debit Cards: XTB accepts Visa/Mastercard debit and credit cards (USD/EUR/GBP). Deposits in GBP/EUR are instant and free of charge. Cards in other currencies may incur small fees from the processor. Withdrawals to cards are possible for some clients (with a 1.5% fee) and typically arrive within 1–3 business days.

-

Bank Transfers: Free domestic and international bank transfers are supported. UK/EU clients see funds in 1 business day (often same day), while transfers from other countries may take 2–5 business days. Withdrawals by wire are returned to your registered bank account (no broker fee for withdrawals above £50/€50/$50). Withdrawal processing: UK accounts same day (if before 1pm GMT); EU accounts by next business day; International accounts typically 1 business day.

-

E-wallets: PayPal, Neteller and Skrill are available for funding. EU clients enjoy free deposits via PayPal/Skrill. Non-EU clients using Neteller/Skrill pay a small fee (1–2%). (Withdrawals can only be made via bank transfer or card, not back to e-wallets.)

-

Crypto Deposits: Not supported. XTB does not offer direct cryptocurrency deposits; clients must deposit fiat currency. (Cryptocurrencies can only be traded as CFDs within the trading account.)

Processing Details:

-

Processing Time: Card/E-wallet deposits are instant. Bank deposits clear in 1–5 days as above. Withdrawals are processed on the day requested (if before cutoff) or next day, usually hitting your bank within 1–3 days.

-

Deposit Fees: XTB itself charges no fees on deposits by bank transfer or card. E-wallet deposits are free for EU (0% for PayPal/Skrill) but carry 1–2% fees for others.

-

Withdrawal Fees: Most withdrawals are also free. XTB imposes no withdrawal fee as long as the amount is above the local threshold (£/€/$50). Below these minima, a small fee may apply (check latest terms). Credit card withdrawals incur a 1.5% fee for certain clients. Beneficiary and intermediary bank fees (if any) are paid by the client’s bank, not XTB.

-

Limits: There is no hard maximum limit per transaction, aside from standard banking limits. Minimum withdrawal is £50/€50/$50 to avoid fees. The account can be funded/redeemed in any multiples above the min margin requirement.

How to trade with XTB Broker Review? Step-by-Step Guide

-

Visit XTB’s official website and click “Create Account” to begin registration.

-

Register your details: Fill in the online form with your name, email, phone number and country.

-

Verify your contact: You’ll receive a verification code by email and SMS – enter these to confirm your account.

-

Complete KYC: Upload scanned ID (passport/ID card) and proof of address (utility bill or bank statement). XTB reviews these documents (usually within 1 business day).

-

Fund your account: Once approved, log in and go to “Deposit Funds.” Choose a funding method (card, bank, PayPal) and send money. Funds arrive instantly for cards/e-wallets or within 1–5 days for transfers.

-

Log in to the trading platform: Use xStation 5 via browser, desktop app or mobile app. Enter your account credentials on the chosen platform (web/mobile).

-

Choose an instrument: In the Market Watch, select an asset you want to trade (Forex pair, commodity, index, stock CFD, etc.).

-

Analyze the market: Open a chart for the instrument. Apply technical indicators or analyze fundamentals (view the economic calendar/news feed) to decide entry/exit levels.

-

Place your trade: Click Buy or Sell. Enter trade size (volume), set Stop-Loss (SL) and Take-Profit (TP) if desired, and confirm the order. The position opens immediately at market price.

-

Monitor and close: Track the trade in the Positions window. You can modify or close the trade anytime. Closing is as simple as clicking “Close” on the position. Profits/losses will reflect in your account balance instantly.

XTB’s account opening and funding process is fast and largely automated. Beginners will find the on-screen guidance and demo account useful to practice without risk. Overall, the trading process is straightforward – log in to xStation, pick an instrument, and execute with a few clicks. The intuitive layout and integrated news ensure that even new users can get started quickly.

Customer Support

Support Channels: XTB provides 24/5 live chat (Sunday PM to Friday). Clients can also contact support via email (e.g. support@) and by phone with dedicated numbers per region (Europe, Latin America, Middle East, etc.). Each national branch has local phone lines and email addresses for account opening and assistance. XTB also maintains active social media and offers support tickets through the client portal.

Support Hours: Customer support is available 24 hours a day during weekdays (typically 24/5). For example, live chat operates from Sunday 16:00 GMT through Friday 24:00 GMT. Phone and email support match these hours. Weekends have limited/no coverage. Note: support hours can vary slightly by branch (e.g. UK/EU).

Additional Details:

-

Multilingual support: XTB staff speak many languages (English, Spanish, Polish, French, etc.) to serve its global client base.

-

Dedicated VIP managers: High-volume or VIP clients can be assigned a personal account manager for tailored service.

-

Fast response: Live chat typically replies instantly. Emails are usually answered within 24 hours. The broker aims for high service levels, reflecting its large employee base (1000+ staff) and emphasis on client experience.

-

Education & Help: The support team also provides guidance via educational articles and webinars. XTB’s Help Center and FAQ cover technical questions thoroughly.

XTB Broker Review Final Verdict

“Ideal for traders seeking a globally regulated broker with low trading costs and an intuitive proprietary platform.”

XTB is best suited for traders who prioritize security and professional-grade tools. Its multiple Tier-1 licenses and segregated funds build confidence, while the commission-free stock/ETF offering and low FX spreads keep trading costs minimal. The user-friendly xStation platform (desktop/mobile) has advanced features like real-time news, a calendar, and sentiment data, which benefit both novices and experienced traders. We recommend XTB to global investors who want transparent fees and strong oversight; it’s especially appealing to long-term investors (investing plans) and active CFD traders.

Avoid if: You require MetaTrader or cTrader (XTB does not support them), or you need very high leverage under FCA rules (EU/UK leverage is limited to 30:1). Also, if you seek fixed spreads or guaranteed stops, XTB’s purely floating spreads may not suit you. U.S. residents cannot use XTB. Beginners who rely heavily on copy/social trading features might also find XTB’s offering less suited to them.

Bottom Line: XTB stands out as a safe, well-regulated broker with a broad asset selection and one of the industry’s better trading platforms. Its strengths are cost-effective trading and high-quality support, backed by millions of investors worldwide. While not the cheapest or most exotic, XTB delivers excellent value for traders who value stability and technology.

Frequently Asked Questions

Is XTB a regulated broker?

Yes. XTB is regulated by multiple top-tier authorities: FCA in the UK (FRN 522157), CySEC in Cyprus (No. 169/12), KNF in Poland (license DDM-M-4021-57-1/2005) and others. It maintains segregated client accounts and participates in compensation schemes (e.g. FSCS £85k in the UK). Overall, XTB’s regulatory structure is very strong and provides high safety for traders.

What is the minimum deposit at XTB?

XTB does not enforce a fixed minimum initial deposit. You can open and fund an account with any amount above the margin requirement. In practice, clients often start with around $100–$250, but technically you can begin with as little as a few dollars. There are no minimum funding limits on card or transfer deposits.

What trading platform does XTB offer?

XTB offers its own proprietary platform, xStation 5, which is available as a desktop/web application and a mobile app. This award-winning platform includes real-time charts, news, and order execution. XTB does not support MetaTrader 4/5 or cTrader, so all trading is done on xStation. The platform is known for its ease of use and powerful features for analysis.

What assets can I trade with XTB?

You can trade thousands of instruments at XTB. This includes Forex (majors/minors), Commodities (oil, gold, etc.), Indices (e.g. S&P 500, DAX), Stocks & ETFs (over 3,000 real stocks/ETFs with 0% commission up to €100k turnover), and Cryptocurrencies (as CFDs: Bitcoin, Ethereum, Ripple, etc.). In total XTB offers around 5,800 CFDs plus the stock/ETF investing productir., covering all major markets worldwide.

How do I withdraw funds from XTB?

Withdrawals must be made back to your own bank account or eligible card. For UK and EU accounts, withdrawals are processed within the same or next business day. There is no withdrawal fee as long as you withdraw at least £50/€50/$50. Smaller amounts incur a small fee. XTB covers its own bank fees; only intermediary bank charges (if any) are passed on. Simply initiate a withdrawal via xStation or Client Office – funds typically reach your bank in 1–3 days after processing.

Does XTB provide negative balance protection?

Yes. For retail clients under the FCA and CySEC (UK/EU), XTB offers Guaranteed Negative Balance Protection. This means you cannot lose more than your account equity; the broker will reset your balance to zero if a trade goes into large deficit. This protection safeguards against extreme market moves. (Note: Accounts under Belize regulation do not have this guarantee.)

About Author

Robert J. Williams

Robert J. Williams, an MBA graduate from the University of Southern California with a significant background in finance. Extensive professional experience with top investment firms such as Balt Investment and Globe Investments, enhancing venture capital portfolios and developing sophisticated investment strategies. Contributing expert at PipPenguin, where he simplifies complex financial topics and online brokers for a broad audience, empowering them with the knowledge to succeed in trading.User Reviews

Be the first to review “XTB Broker Review: Comprehensive Insights into Services and Features” Cancel reply

- XTB Broker Review Overview & Company Background

- Pros & Cons Analysis

- Is XTB Broker Review Regulated and Safe?

- Trading Conditions & Costs

- XTB Broker Review Trading Platforms & Tools

- XTB Broker Review Account Types & Minimum Deposit

- Deposits & Withdrawals

- How to trade with XTB Broker Review? Step-by-Step Guide

- Customer Support

- XTB Broker Review Final Verdict

- Frequently Asked Questions

- About Author

There are no reviews yet.