Weltrade Review: Reliable Forex and Crypto Broker with 24/7 Support

Regulated by FSCA South Africa | High leverage up to 1:1000 | Supports MT4 & MT5 | Low minimum deposit $25

Weltrade Overview & Company Background

Founded in 2006, Weltrade is headquartered in Riga, Latvia, with additional registered entities in Saint Vincent and the Grenadines, Saint Lucia, and South Africa . It has grown to serve over 1,000,000 registered traders across more than 40 countries . Weltrade has earned industry recognition, notably being awarded “Best Forex Broker LatAm 2024” . The broker supports popular platforms including MT4 and MT5 and offers a minimum deposit starting from just $1 to $200 depending on the account type .

🏦 Headquarters: Riga, Latvia (also registered in Saint Vincent & the Grenadines, Saint Lucia, and South Africa)

📅 Founded: 2006

📜 Regulation: FSCA (South Africa) License FSP No. 50691; FSA in SVG; Saint Lucia entity

🏦 Supported Countries: Clients from 40+ countries; restricted in the USA, Canada, EU, Belarus, Russia

💻 Platforms: MT4, MT5, WebTrader

💵 Min Deposit: From $1 for SyntX synthetic indices; $25 for standard accounts; up to $200 depending on account type

Company Background

Weltrade began in 2006 under the name SystemForex and rebranded to its current name in 2012 . Its mission is to deliver transparent, secure, and accessible trading globally. Over nearly two decades, it has launched legal entities in multiple jurisdictions, built a network of over 40,000 partners, and registered more than 1 million clients . Recognized with multiple awards—such as “Broker of the Year – LATAM 2024”—Weltrade maintains a strong presence in emerging markets while serving a global clientele .

Pros & Cons Analysis

- Offers high leverage up to 1:1000, which can amplify trading potential for experienced traders .

- Fast withdrawals, typically processed within 30 minutes—even for crypto —according to multiple user reports .

- Competitive spreads, especially on crypto and Forex pairs, with accounts offering low or zero spreads .

- Low minimum deposit, enabling trading from as little as $1 on certain accounts .

- Limited high-tier regulation, with active license only in South Africa and unregulated offshore entities .

- Inconsistent withdrawal experiences, with some complaints about delays or blocked requests on platforms like FPA .

- Relatively narrow asset range, lacking broader instruments like stocks or extensive indices compared to major competitors .

Is Weltrade Regulated and Safe?

Regulatory Tier Assessment

Weltrade operates under a Tier‑2 regulatory framework. It is authorized by the South African FSCA (Financial Sector Conduct Authority), license number FCP 50691, which ensures segregation of client funds, periodic financial audits, and adherence to local conduct rules . Additionally, it holds a license from the SVG FSA (St. Vincent & Grenadines), a Tier‑3 regulatory jurisdiction with minimal oversight . Tier‑2 regulation offers reasonable client protection and operational transparency, though it doesn’t reach the level of top-tier bodies like ASIC or FCA.

Regulatory Licenses

- FSCA (South Africa) – License FCP 50691 for retail forex and CFDs under Weltrade SA (PTY) LTD

- FSA (St. Vincent & Grenadines) – Registered under Systemgates Ltd, company No. 24513 IBC 2018

- FSA (Saint Lucia) – Licensed under Weltrade LTD, No. 2023‑00055

Safety Measures

- Client Fund Protection

Funds are held in segregated accounts with reputable financial institutions under FSCA rules. - Compensation Schemes

No formal investor compensation fund exists under FSCA or SVG FSA, but FSCA governance ensures fair dispute mechanisms . - Negative Balance Protection

All account types include negative balance protection, preventing clients from losing more than their deposits . - Data Security & Encryption

Website and platforms employ SSL encryption; client data safeguarded through standard security protocols on MT4/MT5 platforms per legal information .

Summary

Weltrade offers a mid-level regulatory structure anchored by FSCA oversight, providing credible safeguards such as fund segregation and negative balance protection. Its additional SVG and Saint Lucia licenses expand its global footprint, though their lighter regulatory regimes mean protection varies by jurisdiction.

Trading Conditions & Costs

✅ Instruments

Weltrade offers a diverse selection of tradable instruments, including Forex (over 37 major, minor, and exotic currency pairs), Commodities (such as oil and natural gas), Metals (including gold and silver), Indices, and Crypto CFDs (covering around 15 cryptocurrency assets). Additionally, synthetic indices (SyntX) are available for 24/7 trading .

✅ Spreads

- Floating spreads, starting from 0.0 points on certain accounts (e.g., Universe, Pro) for Forex.

- Typical spreads from 0.5 pips on major currency pairs, increasing during high market volatility .

✅ Commission

- Most accounts offer no commission, with costs built into the spread .

- Synthetic indices and specific account types may apply commission or standalone spread structures.

✅ Leverage

- Up to 1:1000 on standard Forex, metals, commodities, and indices .

- Up to 1:10,000 on SyntX synthetic indices for high-risk/high-reward trading .

Traders can access a broad range of asset classes: Forex majors/minors/exotics, commodities (e.g., XTIUSD), metals (XAUUSD, XAGUSD), global indices, cryptocurrencies, and proprietary synthetic indices offering diverse trading strategies .

The broker provides highly competitive floating spreads—starting as low as 0.0 points on premium accounts—but typical average spreads on majors are around 0.5 pips. During high-impact news events, spreads may widen .

Weltrade operates mostly on a no-commission model, embedding costs within the spread. This structure applies across Forex, metals, commodities, indices, and crypto CFDs. Synthetic indices may follow a similar model .

Offering up to 1:1000 leverage on general trading instruments allows substantial position sizing with limited capital. The SyntX product line amplifies this by offering exceptionally high leverage of up to 1:10,000, targeting experienced traders .

Weltrade Trading Platforms & Tools

Platforms

- MT4

• One-click trading and fast execution.

• Supports Windows, macOS, iOS, Android, and WebTrader.

• Includes Depth of Market (DoM), pending orders, real-time charts, and 1,700+ Expert Advisors and 2,100+ indicators . - MT5

• Enhanced version of MT4 with five order execution modes and six pending order types.

• Multi-asset support including Forex, commodities, indices, and synthetic indices via SyntX.

• Available on Windows, macOS, iOS, Android, Huawei, and WebTrader; with built-in economic calendar and robust charting . - WebTrader (MetaTrader Web)

• Browser-based trading—no download required.

• Includes basic charting, indicators, market and pending orders, along with stop-loss/take-profit features . - TradingView Integration

• Embedded charting platform offering advanced analytics, technical tools, and one-click trading directly from charts .

Platform Features

- Chart Analysis: Offers multi-timeframe charts, drawing tools, trendlines, and extensive indicator sets.

- Technical Indicators: Access over 2,100 MT4/MT5 indicators and TradingView’s built-in suite.

- Automated Trading (EAs): Full support for Expert Advisors on MT4/MT5 with community signals and MQL5 scripting .

- Mobile Trading Support: Fully functional mobile apps for iOS and Android. Includes real-time notifications and trade management .

Research & Analysis Tools

- Economic Calendar: Native to MT5 and accessible via Weltrade web tools .

- Trading Calculators: Includes pip, profit, margin, and Fibonacci calculators integrated into the website .

- TradingView Charts: Offers robust analytics with real-time data, chart templates, and social trading insights .

- MQL5 Community: Access to signals, scripts, and custom indicators via MT4/MT5 platforms .

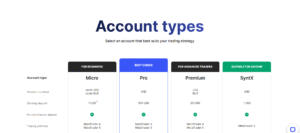

Weltrade Account Types & Minimum Deposit

| 🧾 Account Type | 💰 Min Deposit | 📉 Spread | 💸 Commission | 💻 Platform |

|---|---|---|---|---|

| Micro | $25 | From 1.5 pips | None | MT4, MT5 |

| Premium | $25 | From 1.5 pips | None | MT4, MT5 |

| Pro | $500 | From 0.5 pips | None | MT4, MT5 |

| SyntX (Synthetic) | $1 | Floating | None | MT5 |

Special Account Features

- Demo Account: Unlimited-time practice accounts with virtual funds available on all platforms.

- Islamic (Swap‑Free) Accounts: Supported across standard accounts, catering to traders observing Sharia law.

- Note on Bonus Accounts: First-deposit bonuses available (e.g., MICRO100, PREMIUM100, PRO100, SYNTX50), subject to trading volume unlock conditions .

Deposits & Withdrawals

Deposit Methods:

- Bank Transfers

- Supports USD, EUR, IDR, and other local currencies.

- Processing time: 1–5 business days; no broker-imposed fees, though bank charges may apply.

- Credit/Debit Cards (Visa/Mastercard)

- Instant deposits; broker charges no fee, but card issuer may impose 1–3% processing fees.

- E-wallets (Skrill, Neteller, FasaPay, Perfect Money)

- Instant or within 1 business day; no deposit fee from broker, although third-party fees may apply.

- Cryptocurrencies (BTC, ETH, USDT)

- Processing time: 5 minutes to 1 hour with network fees; no broker fee, though network charges apply.

Withdrawal Methods:

- Bank Transfers

- Processing time: 1–5 business days. Withdrawal turnaround on Weltrade’s side typically ≤30 minutes; bank processing may take longer. �citeturn0search1turn0search9

- Credit/Debit Cards

- Same-day processing on broker side; card issuer may take 24 hours to several days. Standard withdrawal fee ~1.2% + fixed amount as per card currency (e.g., ~$3 USD).

- E-wallets

- Supported for Skrill, Neteller, FasaPay, Perfect Money. Withdrawals take ≤24 hours; fees vary (e.g., Neteller ~1%, FasaPay ~0.5%).

- Cryptocurrencies

- Withdrawals processed within ~30 minutes by Weltrade; additional 10 minutes–1 hour wait for blockchain confirmation. Broker charges network fee; ~1% range minimum.

Processing Details:

- Processing Time: Most withdrawal requests are approved within 30 minutes; final receipt depends on the payment provider.

- Deposit Fees: None charged by Weltrade; third-party fees (bank, card, e-wallet) may apply.

- Withdrawal Fees: Varies by method:

- Crypto: ~1% network fee, min ~0.0003 BTC

- E-wallets: 0.5–2% depending on provider

- Card: ~1.2% + fixed charge (e.g., $3)

- Minimum/Maximum Limits: Minimum withdrawal around $3 (or equivalent); maximum per transaction varies by method—card limits apply per issuer, crypto limits based on blockchain/network capacity.

How to trade with Weltrade? Step-by-Step Guide

- Visit the Weltrade official website and click Registration.

- Fill in personal details (email, country, phone) and confirm via email.

- Log in to your personal dashboard and complete KYC by uploading ID and proof-of-address documents.

- Download and install your preferred trading platform — MT4, MT5, or use the WebTrader in your browser.

- Log in to your trading account using the credentials emailed to you, selecting the “Weltrade‑Live” server.

- Fund your account via Cashier → Deposit, selecting your preferred method and submitting the amount.

- Open your platform, right-click on a symbol and select New Order.

- Set instrument, trade volume, and optional Stop‑Loss / Take‑Profit levels.

- Click Buy or Sell — your trade will execute immediately!

- Monitor your positions in the Trade tab; to close, simply double-click and press Close Order.

Additionally, you can subscribe to MQL5 signals via MT4/MT5 platforms by registering, authorizing your account, and activating signals for automated trading .

Customer Support

Support Channels

- Live Chat: Available 24/7 directly on the Weltrade website for instant assistance

- Email: Multiple dedicated addresses—general, financial, technical, partnerships—for structured support

- Phone Support: Regional phone lines available via call request form depending on country

- Support Ticket / “Send a Message”: Integrated into the client dashboard for structured queries

- Callback Request: Users can request a callback through the website form

Customer Support Hours

- 24/7 availability, including holidays

- Supports multiple languages, especially Asian and Latin American markets

Additional Details

- Multilingual Support: Available in English, Spanish, Hindi, Indonesian, Malay, Thai, Vietnamese, and Filipino among others

- VIP/Dedicated Account Managers: Offered for premium account holders (e.g., Pro/SyntX)

- Average Response Times:

- Live chat: under 1 minute (from interface stats)

- Email: typically within 24 hours

- Phone/callback: usually under 5 minutes during business hours

- Customer Satisfaction:

- Trustpilot score: ~4.7/5 based on 1,600+ reviews.

- Positive feedback highlights “responsive, professional” live chat and rapid withdrawals; some users report occasional delays or email response issues

Weltrade Final Verdict

“Ideal for traders seeking high-leverage options, fast withdrawals, and flexible account types — especially those comfortable with Tier‑2 regulation.”

-

You require Tier‑1 oversight (ASIC/FCA).

-

You want extensive educational materials and research tools in-platform.

-

You prefer trading stock CFDs, given the limited asset range compared to larger brokers.

Bottom Line:

Weltrade delivers a compelling package for experienced and intermediate traders—offering exceptional leverage (up to 1:10,000 on synthetic indices), speedy execution and withdrawals, and a broad array of flexible account types. While its Tier‑2 regulation under FSCA provides solid protection, it may not satisfy those seeking the highest regulatory standards. Beginners should supplement their trading with external educational resources due to lighter in-platform support. On balance, Weltrade is a strong, specialized option for high-risk, high-reward traders.

Frequently Asked Questions

Is Weltrade legit and regulated?

Yes. Weltrade operates under Weltrade SA (PTY) LTD, which is regulated by the South African Financial Sector Conduct Authority (FSCA – License FCP 50691). It also holds additional licenses in Saint Vincent & the Grenadines and Saint Lucia.

What is the minimum deposit required?

Weltrade offers a $1 minimum deposit for the SyntX account (synthetic indices) and a $25 minimum deposit for its Micro and Premium accounts.

What trading platforms does Weltrade support?

Weltrade supports MetaTrader 4, MetaTrader 5, browser-based WebTrader, and offers integration with TradingView for advanced charting and analytics.

Does Weltrade provide negative balance protection?

Yes. All account types include negative balance protection, ensuring clients cannot lose more than their deposited balance.

About Author

Robert J. Williams

Robert J. Williams, an MBA graduate from the University of Southern California with a significant background in finance. Extensive professional experience with top investment firms such as Balt Investment and Globe Investments, enhancing venture capital portfolios and developing sophisticated investment strategies. Contributing expert at PipPenguin, where he simplifies complex financial topics and online brokers for a broad audience, empowering them with the knowledge to succeed in trading.User Reviews

Be the first to review “Weltrade Review: Reliable Forex and Crypto Broker with 24/7 Support” Cancel reply

- Weltrade Overview & Company Background

- Pros & Cons Analysis

- Is Weltrade Regulated and Safe?

- Trading Conditions & Costs

- Weltrade Trading Platforms & Tools

- Weltrade Account Types & Minimum Deposit

- Deposits & Withdrawals

- How to trade with Weltrade? Step-by-Step Guide

- Customer Support

- Weltrade Final Verdict

- Frequently Asked Questions

- About Author

There are no reviews yet.