Tickmill Review: Is this Broker Regulated?

USP: Regulated by FCA, CySEC, FSA, FSCA | Raw spreads from 0.0 pips | MT4, MT5 & Tickmill Trader

Tickmill Overview & Company Background

Tickmill is a Seychelles-based Forex and CFD broker launched in 2014. From its Eden Island headquarters, the Tickmill Group has expanded globally through regulated entities across Europe, the UK, Asia, and Africa. The broker highlights its industry recognition – each Tickmill entity has won multiple awards for excellence in client service, trading conditions and technology – reflecting a strong market position. In recent years Tickmill has grown rapidly: in 2020 it reported executing 115+ million orders and serving over 75,000 active clients worldwide, underscoring its broad client base. It also continued expanding by launching new regional offices (e.g. Labuan Asia and South Africa in 2020) to strengthen global reach.

- 🏦Headquarters: Eden Plaza, Eden Island, Mahe, Seychelles

- 📅 Founded: 2014

- 📜 Regulation: FCA (UK), CySEC (Cyprus), FSA (Seychelles), FSCA (South Africa)

- 🌐 Supported Countries: Worldwide (excludes US, Iran, India per policies)

- 💻 Platforms: MetaTrader 4, MetaTrader 5, Tickmill Trader (TradingView), WebTrader, Mobile App

- 💵 Min Deposit: $100

Company Overview

Tickmill’s origins center on offering fast execution and low trading costs, and it has steadily built out its infrastructure. Its mission emphasizes client-first service and tight pricing, supported by a suite of trading tools and multi-jurisdictional oversight. Over time Tickmill has launched multiple international branches (UK, Cyprus, Seychelles, South Africa, etc.) to comply with local regulations and cater to global traders. This global expansion has coincided with significant growth – for example, in 2020 Tickmill introduced futures trading on CQG under its UK entity and expanded its product list, while remaining one of the lowest-cost brokers with raw spreads from 0.0 pips. The broker’s focus on client service and reliable execution is evidenced by its many industry awards and its large, growing client base.

Pros & Cons Analysis

- Licensed under FCA (UK), CySEC (Europe), FSA (Seychelles) and FSCA (South Africa) – strong Tier-1/2 regulation.

- Raw spreads from 0.0 pips on the Raw account, offering ultra-low trading costs.

- MT4, MT5 and proprietary Tickmill Trader (TradingView) available – supports advanced charting and multiple devices.

- Segregated client funds plus Lloyd’s insurance and negative-balance protection – high fund safety.

- Competitive commission structure ($3 per lot per side on Raw) and zero commission on Classic accounts.

- No fixed-spread accounts – all spreads are variable, which may not suit traders seeking guaranteed spreads.

- Limited deposit methods for some regions (e.g. no PayPal) and a relatively high $100 minimum, which may be steep for very small traders.

- Restricted access in certain countries (e.g. USA, India, Iran) due to regulations.

Tickmill vs Competitors: Key Differences

- Regulation: Tickmill is multi-regulated globally (FCA, CySEC, etc.), whereas some competitors may only hold offshore or tier-2 licenses.

- Trading Costs: Tickmill’s Raw account offers spreads from 0.0 pips with $3 commission, typically tighter than many rivals.

- Platforms: Unique offering of Tickmill Trader (TradingView integration) alongside MT4/MT5, versus brokers with only MetaTrader or proprietary platforms.

- Funding: Global fund insurance (Lloyd’s) and negative-balance protection at Tickmill give extra safety, a feature not universally available elsewhere.

- Account Types: Tickmill focuses on ECN-style Classic/Raw accounts and has no basic “mini” accounts, unlike some retail brokers.

Is Tickmill Regulated and Safe?

Tickmill is fully regulated in multiple jurisdictions. Its entities include FCA-regulated Tickmill UK, CySEC-regulated Tickmill Europe, FSCA-regulated Tickmill South Africa, and FSA-regulated Tickmill Seychelles. This mix of Tier-1 and Tier-2 regulators implies rigorous oversight, investor protection rules, and periodic audits – all boosting trust. Customer funds are kept in segregated accounts with reputable banks and benefit from additional measures (see below), meaning traders’ money is protected even if the company faces financial trouble. In summary, Tickmill’s broad regulatory coverage and its fund-security policies give it a strong safety profile compared to many brokers.

Regulatory Licenses

- FSA (Seychelles) – License No. SD008

- FCA (UK) – Register No. 717270

- CySEC (Cyprus, Europe) – License No. 278/15

- FSCA (South Africa) – License No. FSP 49464

Safety Measures

- Client Fund Protection: Tickmill holds client deposits in segregated accounts at top-tier banks. It also maintains insurance via Lloyd’s of London (covering losses from $20,000 to $1,000,000) for client funds.

- Compensation Schemes: UK clients are covered by FSCS up to £85,000, EU clients by CySEC ICF up to €20,000.

- Negative Balance Protection: Ensures clients never lose more than their deposits.

- Data Security & Encryption: Advanced IT security and encryption protect client accounts and data.

Trading Conditions & Costs

✅ Instruments: Forex, Commodities, Indices, Bonds, Crypto, Stocks (62+ FX pairs, gold, oil, indices, BTC, ETH, etc.)

✅ Spreads: From 0.0 pips (Raw), ~1.6 pips on Classic (no commission)

✅ Commission: $3 per side (Raw), $0 on Classic, $3.50 TradingView Raw

✅ Leverage: Up to 1:1000 (offshore), up to 1:30 (EU retail per ESMA rules)

-

Instruments: Forex, Commodities, Indices, Bonds, Crypto, Stocks

Tickmill provides access to a multi-asset range covering over 62+ forex currency pairs (majors, minors, and exotics). Commodity traders can engage in gold, silver, and oil, while global indices like S&P 500, DAX, and FTSE broaden portfolio options. Crypto assets such as Bitcoin (BTC) and Ethereum (ETH) are offered with CFD exposure for high-volatility trading. Bonds and selected stocks complete the mix, making Tickmill suitable for diversified traders across asset classes. -

Spreads: From 0.0 pips (Raw), ~1.6 pips on Classic (no commission)

Tickmill’s Raw account delivers institutional-grade pricing with spreads starting from 0.0 pips on major pairs, especially suited for scalpers and algo traders. Classic account holders benefit from a commission-free model but with slightly wider spreads averaging around 1.6 pips. This dual pricing model ensures both low-spread high-frequency traders and casual traders can find cost structures that align with their style. Tight spreads enhance transparency and minimize trading costs. -

Commission: $3 per side (Raw), $0 on Classic, $3.50 TradingView Raw

The Raw account charges just $3 per side per lot, one of the most competitive commission models in the industry. Classic accounts operate under a spread-only structure with zero commission, making them straightforward for new traders. Tickmill’s TradingView Raw option applies a $3.50 per side fee, balancing platform integration with cost efficiency. Such flexible commission setups allow users to choose between simplicity and institutional-style execution costs. -

Leverage: Up to 1:1000 (offshore), up to 1:30 (EU retail per ESMA rules)

Offshore clients benefit from leverage as high as 1:1000, enabling significant position sizing with smaller capital outlay — though this carries higher risk. For EU and UK retail clients, Tickmill complies with ESMA regulations, capping leverage at 1:30 to enhance investor protection. Professional clients in Europe can apply for higher leverage under specific criteria. The broker’s multi-tiered leverage policy ensures regulatory compliance while still accommodating high-risk traders where permitted.

Tickmill Trading Platforms & Tools

✔ MT4 – Advanced charting, 30+ indicators, EAs, one-click trading

✔ MT5 – More order types, economic calendar, enhanced strategy tester

✔ Tickmill Trader (TradingView) – TradingView integration, thousands of indicators, social features

✔ Mobile App – Full-featured, sync with web/desktop, alerts, portfolio monitoring

✔ Additional Tools – VPS, calculators, MAM/PAMM, Acuity Trading sentiment tools

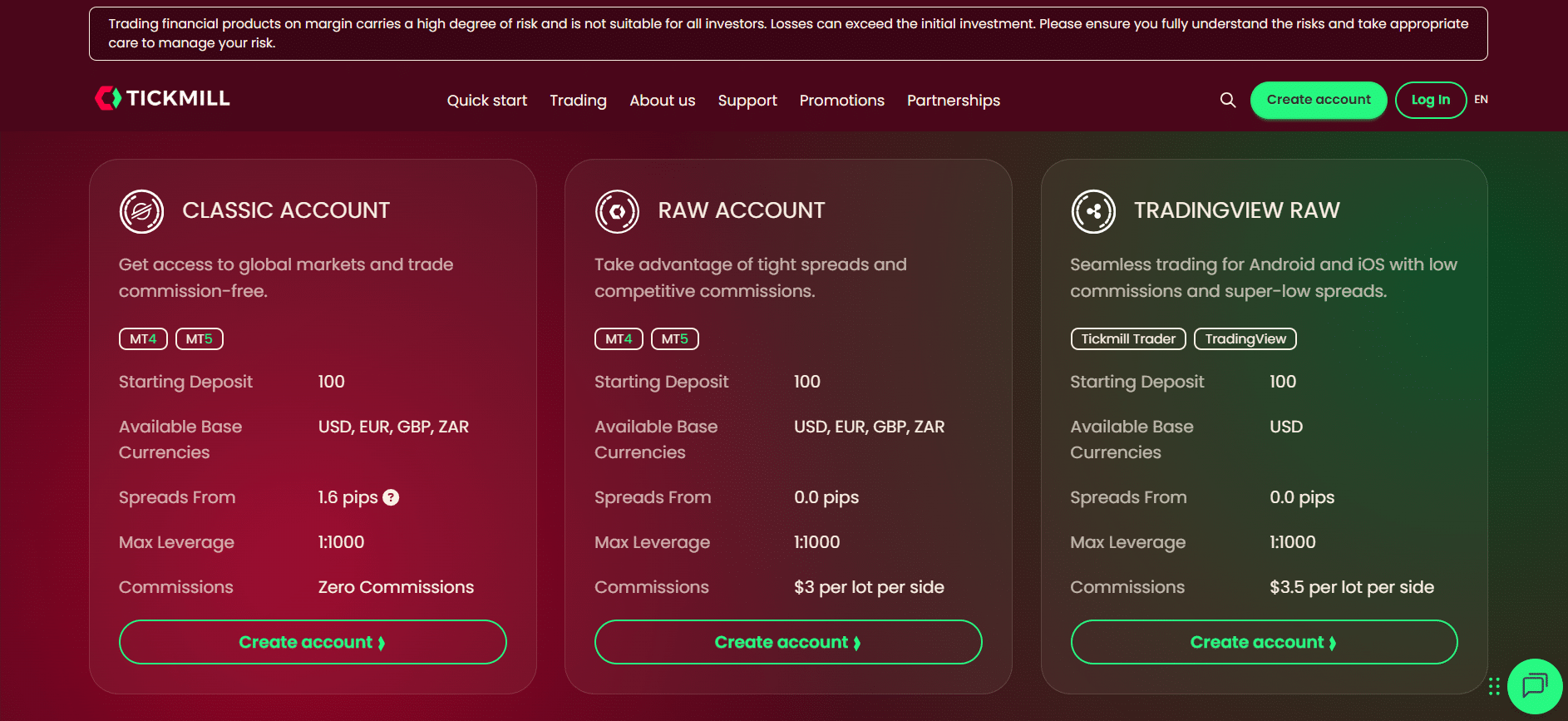

Tickmill Account Types & Minimum Deposit

| Account Types | Min Deposit | Spread | Commission | Platforms |

|---|---|---|---|---|

| Classic Account | $100 | From 1.6 pips | $0 (Zero commission) | MT4, MT5 |

| Raw Account | $100 | From 0.0 pips | $3 per lot per side | MT4, MT5 |

| TradingView Raw | $100 | From 0.0 pips | $3.5 per lot per side | Tickmill Trader (TradingView) |

- Demo Account: Free with $30,000 virtual funds

- Islamic Accounts: Available for both Classic and Raw (swap-free)

- VIP/Premium: Tailored commissions for high-volume traders

- Managed Accounts: MAM/PAMM available

Deposits & Withdrawals

Deposit Methods:

-

Bank Transfer: Supports USD, EUR, GBP, ZAR, etc. Minimum deposit $100; processing typically within 1 working day (no deposit fees). Tickmill will refund up to $100 in transfer fees if needed (for deposits ≥ $5,000).

-

Credit/Debit Cards (Visa/MasterCard): Available for USD/EUR/GBP. Instant funding for deposits* (no card fees), 1-day processing for withdrawals.

-

E-Wallets (Skrill, Neteller): Instant deposits (USD/EUR/GBP), no fees. Withdrawals processed within 1 business day.

-

Cryptocurrencies: Deposit in BTC, ETH, etc. 24/7 instant funding, no deposit fees. Withdrawals to crypto wallets are generally processed within 1 working day.

-

UnionPay: Deposits in CNY or USD/EUR/GBP equivalents. Instant funding (no fee) for deposits; withdrawal processing ~1 working daytickmill.com.

(*“Instant” may be subject to verification or occasional delays.)

Withdrawal Methods: Same channels as deposits – bank wire, cards, Skrill/Neteller, crypto, UnionPay. Tickmill processes withdrawals back to the original source whenever possible. The client portal allows withdrawal requests; for cards it may require a copy of the card (first/last four digits only) for security. All methods have minimum withdrawal $25.

-

Processing Time: Bank wire, card and e-wallet withdrawals typically take 1-3 business days. Crypto withdrawals are usually released within 24h. Card and account withdrawals are processed during business hours on weekdays only.

-

Deposit Fees: Tickmill does not charge any deposit fees on its listed funding methods. Clients should only use payment methods in their own name (no third-party funding).

-

Withdrawal Fees: No additional fees by Tickmill on withdrawals. Some intermediary banks may impose fees (particularly on wire transfers), but Tickmill will reimburse up to $100 on qualified large deposits as noted above.

-

Minimum/Maximum Limits: Minimum deposit is $100 for all account types. Minimum withdrawal is $25. There is no stated maximum, but each method or currency may have its own limits (e.g. UnionPay requires ≥ CNY700).

How to trade with Tickmill? Step-by-Step Guide

- Visit Tickmill website → click “Register”

- Fill in personal details

- Verify email/phone

- Submit KYC documents

- Fund account

- Choose platform (MT4/MT5/Tickmill Trader)

- Select trading instrument

- Analyze market (technical/fundamental)

- Place a trade (set SL/TP)

- Monitor & close position

Customer Support

- Email: support@ (24/5)

- Live Chat: Website (Mon–Fri)

- Phone: +852 5808 7849 (regional availability)

- Languages: English, Chinese, Arabic, Spanish, Russian + 10+ others

- Extra: WhatsApp lines, VIP managers, FAQs, social channels

Tickmill Final Verdict

“Ideal for traders seeking ultra-low costs, fast ECN-style execution, and multi-jurisdictional regulation.”

Avoid if: You need fixed spreads or local funding options – Tickmill only offers variable spreads, and its deposit methods may not cover all local currencies. Also avoid if you are in a restricted country (e.g. USA, India, Singapore) where Tickmill is not licensed. Beginners who need a large suite of educational tools might find Tickmill less tailored to their needs compared to brokers focused on novice training.

Bottom Line: Tickmill delivers on its value proposition as a low-cost, institutional-grade broker. It stands out with genuine 0.0-pip raw spreads

tickmill.com

, transparent $3 commission, and a robust regulatory framework

tickmill.com

. Execution is fast across its MT4/MT5 platforms and innovative Tickmill Trader. The broker’s safety measures (segregated funds, insurance, negative balance protection) add confidence for serious traders. We recommend Tickmill especially for scalpers and active traders who prioritize tight spreads and execution quality. Its straightforward account types and competitive pricing make it a strong choice for cost-conscious forex traders.

Frequently Asked Questions

What is the minimum deposit required by Tickmill?

tickmill.com

. This applies to Classic, Raw, and TradingView accounts alike. There are no lower-tier “mini” accounts – all accounts start at $100.

Which trading instruments are available at Tickmill?

tickmill.com

. All instruments trade 24/5, and Tickmill adds new instruments over time.

Does Tickmill offer swap-free (Islamic) accounts?

tickmill.com

.

What deposit and withdrawal methods does Tickmill support?

tickmill.com

tickmill.com

. The minimum deposit is $100 and there are no funding fees from Tickmill on any method

tickmill.com

.

Is Tickmill regulated?

tickmill.com

, the Cyprus entity by CySEC (License 278/15)

tickmill.com

, the Seychelles office by FSA (SD008)

tickmill.com

, and the South Africa branch by FSCA (FSP 49464)

tickmill.com

. This multi-jurisdictional regulatory status (Tier-1 and Tier-2 licenses) provides robust oversight and client fund protections.

About Author

Robert J. Williams

Robert J. Williams, an MBA graduate from the University of Southern California with a significant background in finance. Extensive professional experience with top investment firms such as Balt Investment and Globe Investments, enhancing venture capital portfolios and developing sophisticated investment strategies. Contributing expert at PipPenguin, where he simplifies complex financial topics and online brokers for a broad audience, empowering them with the knowledge to succeed in trading.User Reviews

Be the first to review “Tickmill Review: Is this Broker Regulated?” Cancel reply

- Tickmill Overview & Company Background

- Pros & Cons Analysis

- Tickmill vs Competitors: Key Differences

- Is Tickmill Regulated and Safe?

- Trading Conditions & Costs

- Tickmill Trading Platforms & Tools

- Tickmill Account Types & Minimum Deposit

- Deposits & Withdrawals

- How to trade with Tickmill? Step-by-Step Guide

- Customer Support

- Tickmill Final Verdict

- Frequently Asked Questions

- About Author

There are no reviews yet.