Scope Markets : Is It a High-Leverage Global Broker?

USP: FSC (Belize) Regulated | Zero-pip Spreads (Elite) | MT4, MT5 & Fractional Stocks

Scope Markets Overview & Company Background

Scope Markets, launched in 2014, is the online trading arm of the Rostro Group. Based in Belize City, Belize (6160 Park Avenue), it operates globally (serving clients in 200+ countries) and provides access to over 40,000 instruments via powerful platforms (MetaTrader 4/5, CQG, IRESS, Bloomberg). The broker is regulated by the Belize Financial Services Commission (FSC) under RS Global Ltd (license no. 000274/2). Scope Markets has earned multiple industry awards – for example, “Best Broker of the Year 2024 – Global” and “Best Retail CFDs Broker 2024 – Global” – reflecting its growing recognition in the brokerage industry.

📅 Founded: 2014

📜 Regulation: FSC (Belize) – License No. 000274/2

🏦 Supported Countries: 200+ globally

💻 Platforms: MetaTrader 4, MetaTrader 5, CQG, IRESS, Bloomberg

💵 Min Deposit: $10

Company Overview

Scope Markets originated as the retail brokerage brand of the Rostro Group, a diversified multi-asset financial group. Its mission is to empower clients with a personalized trading experience (“Trade like you”) across a vast product range. Since inception, the broker has expanded rapidly: now serving traders in over 200 countries. It leverages Rostro’s global infrastructure to offer tight pricing and broad market access. Scope’s focus on client service and innovation is underscored by regular educational webinars and award-winning trading conditions. Operating under RS Global Ltd with FSC Belize regulation, Scope Markets positions itself as a competitive global FX/CFD broker offering institutional-grade platforms and technology.

Pros & Cons Analysis

- Regulated by FSC (Belize) – provides basic oversight and safeguards (segregated accounts, KYC/AML).

- Extremely competitive pricing – raw spreads from 0.0 pips (Scope Elite account) and low commissions (USD 3.50/side on Elite).

- High maximum leverage (up to 1:1000) on most instruments, allowing aggressive position sizing.

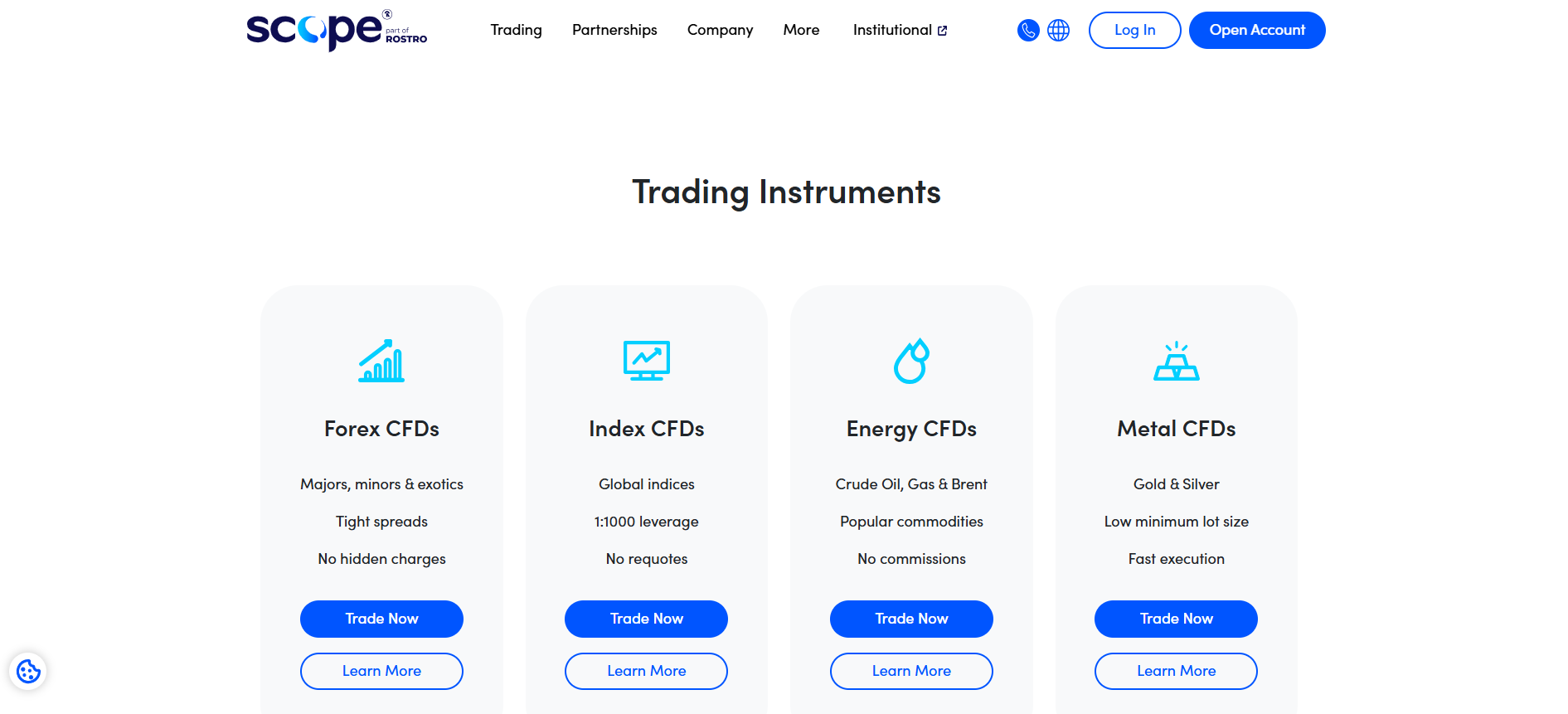

- Wide instrument range – Forex, indices, commodities, energies, metals, CFDs on shares, and even fractional stock trading via the Scope Invest account.

- Multiple robust platforms – full support for MT4 and MT5 (desktop/mobile) with advanced charting and trading tools.

- Not Tier-1 regulated – only licensed in Belize, which means weaker client protections (no EU/UK deposit insurance).

- Restricted jurisdictions – does not accept clients from certain countries (e.g. USA, some EU nations).

- Limited educational/research tools on-site – mostly relies on platform features (MT4/MT5 built-ins) rather than proprietary market analysis.

- High VIP requirements – the Scope Elite account requires a high minimum deposit ($20,000), which may deter smaller traders.

Scope Markets vs Competitors: Key Differences

- Account Structure: Offers a unified “One Account” model (with optional Islamic swap-free variant) and a dedicated Invest (fractional stocks) and Elite account. This simplifies access but differs from brokers with many tiered accounts.

- Instrument Diversity: Unique among forex brokers for its Scope Invest fractional shares service (invest with as little as $50).

- Pricing and Leverage: Allows up to 1:1000 leverage (much higher than regulated brokers), and Elite clients get raw 0.0-pip spreads, comparable to ECN/STP rivals.

- Regulation: Compared to FCA/ASIC-regulated firms, Scope’s Belize FSC license is less stringent. Traders sacrificing some regulatory safety can access its high leverage and global offerings.

- Platforms: Supports only popular platforms (MT4/MT5); unlike some competitors, there is no proprietary or cTrader platform. However, it compensates with extensive analytical tools and a broad partner network (Rostro Group) behind the scenes.

Is Scope Markets Regulated and Safe?

Scope Markets is authorized and regulated by the Belize FSC under RS Global Ltd (registration no. 000274/2). This is considered a Tier-3 (offshore) regulator, which enforces basic standards (like segregated client accounts and KYC) but lacks the stringent investor protections of Tier-1 regulators (FCA, ASIC). There is no formal compensation fund for traders. On the positive side, Scope Markets emphasizes risk management: it uses real-time margin checks to prevent negative account balances. Client funds are kept in segregated accounts with top-tier banks. In summary, Scope is “safe” for trading in that it follows standard broker safeguards (segregation, encryption, etc.), but being Belize-licensed means customers should be aware of the limited recourse if something goes wrong.

Regulatory Licenses:

- FSC (Belize) – License No. 000274/2

Safety Measures:

- Client Fund Protection: All client funds are held in segregated accounts at top-tier banks, keeping customer money separate from Scope Markets’ operating funds.

- Compensation Schemes: Belize regulation does not provide an investor compensation program. Clients have no third-party compensation guarantee if the broker fails.

- Negative Balance Protection: Scope Markets employs automated risk controls – real-time margin protection automatically liquidates positions to prevent accounts from going negative. This protects clients from losing more than their deposit.

- Data Security & Encryption: The broker’s website and platforms use industry-standard encryption and security protocols. According to its privacy policy, Scope Markets implements encryption for data in transit/storage and robust authentication to safeguard customer data. There are no public reports of breaches, and communication is secured via SSL/TLS.

Trading Conditions & Costs

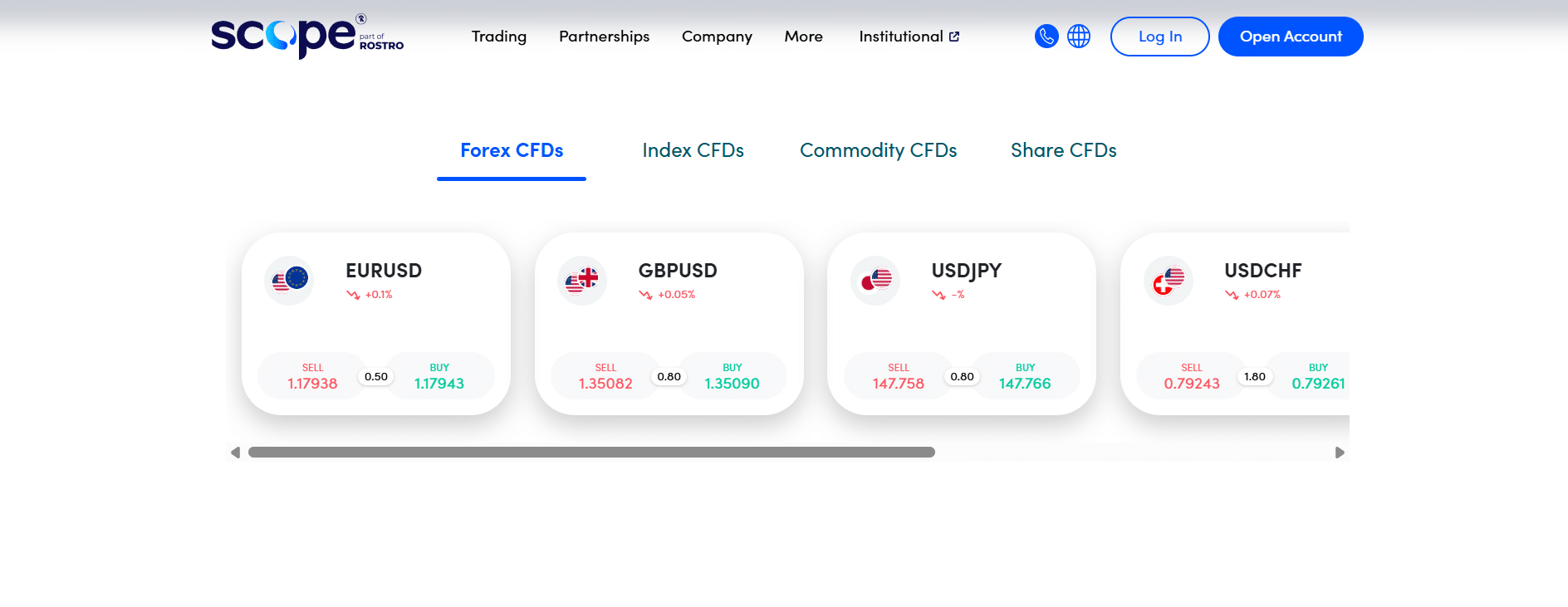

- ✅ Instruments: Forex, CFDs on Commodities, Indices, Energies, Metals, and Shares (plus fractional stocks via Scope Invest). Scope Markets grants access to over 40,000 tradable instruments globally.

- ✅ Spreads: From 0.0 pips on the Elite account (raw pricing), and from 0.9 pips on the standard One Account. Spreads are variable (no fixed-spread option). Scope emphasizes competitive, no-hidden-fee pricing.

- ✅ Commission: $3.50 per lot per side on the Elite account (and $5 per side for futures/commodities on the standard account). Stock CFDs (fractional shares) incur no commission. Non-elite trades have a small $5 commission on certain products; otherwise costs are built into the spread. The broker advertises “no hidden fees”.

- ✅ Leverage: Up to 1:1000 on major FX and other products. (Scope Markets notes leverage varies by instrument and region, but high leverage is available for most tradable assets.)

- Forex & CFDs: Tight variable spreads (from 0.0–0.9 pips) and ECN-style execution appeal to scalpers and intraday traders. Commissions are as low as $3.50/lot on Elite accounts, making total costs very competitive.

- Commodities & Energies: Offered as CFDs on platforms, with similar leverage (up to 1:1000) and low commissions ($5 per contract on standard accounts). Spreads are similarly tight on majors (e.g. gold, oil).

- Indices & Shares: CFD trading on global indices and stocks is available. The Scope Invest account offers fractional stock CFDs (as little as 0.01 lots) with 1:1 leverage and zero commission. Share CFD spreads start from 0.1 pips for Index CFDs on MT5.

- Crypto (CFDs): Though not explicitly detailed on the site, Scope Markets typically offers major crypto CFDs on MT5 (Bitcoin, Ethereum, etc.) in line with its other offerings. These likely have wider spreads and lower leverage.

Overall, Scope Markets delivers professional-grade conditions: market-derived spreads (no markups), low commissions, and extremely high leverage. The trading environment is suited to active traders who demand low trading costs and flexible sizing, at the expense of minimal regulatory protection.

Scope Markets Trading Platforms & Tools

Scope Markets provides the industry-standard trading platforms MetaTrader 4 (MT4) and MetaTrader 5 (MT5) for all accounts. It also offers institutional-grade platforms via the Rostro Group network (e.g. CQG, IRESS) and Bloomberg terminals for certain clients.

✔ MetaTrader 4 – A popular multi-asset platform (desktop, web, mobile) known for its reliability. Scope’s MT4 supports advanced charting and analysis: it includes 30+ built-in indicators (e.g. moving averages, oscillators), one-click order execution, and automated trading via Expert Advisors (custom EAs in MQL4). The MT4 app (iOS/Android) allows trading on-the-go with real-time quotes and strategy backtesting.

✔ MetaTrader 5 – The newer multi-asset platform with enhanced features. MT5 is optimized for both retail and institutional use, covering Forex, stocks, futures and more. It offers an expanded toolkit: more chart timeframes, additional pending order types, and an integrated economic calendar. MT5 also supports hedging and netting. Scope’s MT5 is available on desktop/web/mobile; the mobile app has an upgraded interface and extra order types compared to MT4.

✔ CQG Trader / CQG Web: (Advanced futures and equities platform) – Offered for professional traders. CQG provides direct market access and sophisticated analytics for futures and commodity trading. It includes advanced charting, order routing to multiple exchanges, and real-time data streams. (Details not specified on the website.)

✔ IRESS Trading Platform: (Mainly for stocks and multi-asset trading) – An institutional-grade platform with rich market data and order management tools. IRESS supports algorithmic trading and multi-market execution. (Scope Markets brand may provide access via the Rostro Group; specifics are not detailed online.)

✔ Bloomberg Terminal (Data Feed): Scope’s clients (especially institutional) can access Bloomberg’s data terminals and APIs for real-time news, analytics, and fundamental data. This gives sophisticated traders professional research tools and market insight. (Not directly a trading platform, but part of Scope’s tech ecosystem.)

Platform Features:

- Cross-Device Access: MT4 and MT5 run on Windows/Mac desktops, web browsers, and iOS/Android mobile apps. Accounts sync across devices, so trades and charts are updated in real-time everywhere. This lets traders monitor and execute from anywhere.

- Advanced Charting & Analysis: Both platforms include dozens of technical indicators and drawing tools. Scope’s MT4 offers 30+ built-in indicators even on mobile. Traders can import custom indicators or scripts. The charting engines support multiple timeframes (MT5 adds more than MT4) and real-time data feeds. News and alerts can be viewed in-platform (MT4’s streaming news is available on desktop).

- Automated Trading & Backtesting: Both MT4 and MT5 support algorithmic trading. Traders can develop Expert Advisors (EAs) using MQL4/5 and run them 24/7. Built-in strategy testers allow backtesting of EAs using historical data, which helps refine automated strategies before going live.

- Fast Execution & Order Types: Scope’s MT4/5 offer one-click trading (see the MT4 interface). MT5 in particular provides advanced order types (market, limit, stop, trailing stop, etc.) and partial fill options. Depth-of-Market (Level II) is available on MT5 for seeing true bid/ask sizes. Traders can hedge positions or use netting mode depending on strategy.

- Multilingual Interface & Alerts: The platforms support multiple languages and allow custom price alerts and internal messaging. Mobile apps (MT4/MT5) keep traders notified via push alerts. These features help Scope’s global clientele manage trades across time zones.

Research Tools:

- Economic Calendar (Scope website): Scope Markets offers a built-in economic calendar showing upcoming macro events and news (e.g. interest rate decisions, GDP releases). Traders can track event dates and estimated impacts directly on the broker’s site to plan trades.

- Trading Calculators: The website provides pip, margin, swap, and profit calculators to help plan trades. For example, the pip/margin calculator computes position sizes and required margin given chosen leverage.

- Platform-Native Tools: Research is primarily done via the trading platforms. Both MT4 and MT5 have integrated news feeds (when enabled) and charting tools. Scope Markets itself does not appear to offer proprietary analysis tools or sentiment indicators; clients rely on platform features or external research.

- Third-party News & Analysis: While not embedded, traders can use Bloomberg, Reuters, or financial news sources alongside Scope’s platforms for fundamental research. Scope’s affiliation with Bloomberg (as a data provider) suggests professional clients can access Bloomberg news on-demand.

Scope Markets Account Types & Minimum Deposit

Scope Markets offers four live account types: One Account (Standard), Islamic Account (Swap-Free), Scope Invest, and Scope Elite (VIP). These appear on the official site with the following conditions:

| Account Type | Min Deposit | Spreads | Commission | Platforms |

| One Account (Standard) | USD 10 | From ~0.9 pips (FX majors) | $5 per side on futures/commodities (spot FX has no extra commission) | MT4, MT5 |

| Islamic Account* | USD 10 | From ~0.9 pips (FX majors) | $5 per side on futures/commodities | MT4, MT5 |

| Scope Invest (Stocks) | USD 10 | From 0.1 pips (stock CFDs) | 0% commission (stocks CFDs) | MT5 only |

| Scope Elite (VIP) | USD 20,000 | From 0.0 pips (raw spreads) | $3.50 per side (FX pairs) | MT4, MT5 |

*Islamic Account T&Cs apply (swap-free FX/Commodities).

- Min Deposit: The minimum to open a live trading account is as low as $10 for the One, Islamic, and Invest accounts. (The Scope Elite VIP account requires a much higher USD 20,000 deposit.)

- Special Accounts: A swap-free (Islamic) variant of the One Account is available for traders who require it. The Scope Invest account is a MT5-only account tailored for fractional stock trading (available for as little as $50). Elite accounts include extra perks (rebates, premium support) but have high entry thresholds.

- Demo Account: Scope Markets offers a free demo for practice (register on the site to access a virtual trading account).

- Managed Accounts/VIP: The site mentions dedicated account managers and VIP events. Eligible high-volume clients get personal support and possible rebates (up to $8 per million) on the Elite account.

Deposits & Withdrawals

Scope Markets provides a variety of funding methods to suit global traders. Available deposit options (shown on the site) include: bank wire transfer, credit/debit cards (Visa/Mastercard), e-wallets (Neteller, Skrill), and local payment systems such as VietQR, ZaloPay, UnionPay, Alipay, FPX, Mobile Money (e.g. M-Pesa). Withdrawal methods generally mirror the deposit options: bank transfers and e-wallets. (Credit cards usually only allow refunds up to the deposited amount.)

Deposit Methods:

- Bank Transfer (Wire): International bank wires are accepted. Funds arrive in ~1–3 business days.

- Credit/Debit Card (Visa/Mastercard): Instant funding from most countries. No Scope Markets fees (card issuer may charge).

- E-Wallets (Skrill, Neteller): Quick deposits (near-instant). Popular for rapid funding; Scope charges no fees for these.

- Local Services: Depending on region, Scope Markets supports systems like UnionPay/Alipay (China), VietQR/ZaloPay (Vietnam), FPX (Malaysia), and M-Pesa/Mobile Money (Africa). These allow deposits in local currency via regional payment apps.

Withdrawal Methods:

- Bank Transfer (Wire): Withdrawals to the client’s bank account (takes ~1–5 business days). Broker usually does not charge withdrawal fees, but the receiving bank’s fees may apply.

- E-Wallets (Skrill, Neteller): Funds return to the same e-wallet. Processing is typically same-day or 1 business day (depending on volume and checks).

- Cards & Others: Credit card withdrawals are limited to the deposited amount and processed like refunds. Other local methods follow similar rules.

- Processing & Limits: Scope Markets states that deposits are processed immediately or within the same day (depending on method), while withdrawals are handled promptly but may take 1–3 days or longer for wire transfers. The broker charges no deposit or withdrawal fees itself; any fees come from banks/payment providers. The minimum deposit/withdrawal is effectively $10 (per transaction) for most methods (as the trading account minimum). No public maximum limits are listed, but very large transfers should be arranged via bank wire.

How to trade with Scope Markets? Step-by-Step Guide

- Register an Account: Go to the Scope Markets website and click “Open Account”. Complete the signup form with your email and personal details.

- Verify Your Identity: Submit required KYC documents (ID and proof of address) as prompted. Scope Markets will verify your documents via email.

- Fund Your Account: After approval, log in to the client portal and deposit funds using your preferred method (card, bank, e-wallet, etc.). The minimum deposit is $10.

- Choose a Trading Platform: Download and install MetaTrader 4 or 5 (from ) on your desktop or mobile. Log in with the account credentials provided.

- Select an Instrument: In the platform’s market watch, pick a currency pair, stock CFD, commodity or index you want to trade.

- Analyze the Market: Use built-in charts and indicators (or apply your own analysis). Traders can set indicators, draw trendlines, or use Scope’s economic calendar to time their trades.

- Place the Trade: Enter a new order in MT4/MT5. Specify Buy or Sell, trade size (lots), and optionally set Stop Loss (SL) and Take Profit (TP) levels. For example, to buy EUR/USD, click “Buy” and enter your lot size. Then set a Stop at a level below the current price.

- Manage Your Position: Monitor the trade on the chart. You can adjust SL/TP or close manually at any time. MT4/MT5 also allow trailing stops or one-click closing. The Elite account offers very tight execution and slippage control.

“Scope Markets’ onboarding process is straightforward for beginners. After a quick registration and KYC (via the portal), you can deposit funds and immediately start trading on familiar MT4/MT5 platforms. The steps are simple enough for new traders, and the broker provides educational resources (videos, e-books) to help them analyze charts and execute trades. Overall the trading process is smooth and user-friendly.”

Customer Support

Scope Markets provides support primarily via email and phone. Contact options include:

- Email: support@ (24/5 support).

- Phone: +44 20 3051 6959 (Mon–Fri 24 hours).

- Live Chat/Form: An online contact form is available on the website (submit message on the Contact page). No live chat widget is listed on the site.

- Social Media: Scope is active on social platforms (Facebook, Instagram, Telegram, LinkedIn, YouTube). Traders can reach out via Telegram or official social accounts for updates and general queries.

Support Hours: Customer service is generally available on weekdays (24/5). Exact hours are not specified, but email queries typically receive responses within 1 business day.

Additional Details:

- Multilingual support – The website and support materials are offered in multiple languages (English, Spanish, etc.), catering to international clients.

- Dedicated account managers – VIP and high-volume clients receive personalized service (Scope Elite customers get a dedicated account manager with expedited handling).

- Education and Webinars – Scope Markets runs weekly trading webinars and provides e-books for clients, reflecting its commitment to trader education. However, no formal satisfaction metrics are published.

Scope Markets Final Verdict

“Ideal for active forex and CFD traders seeking wide market access, tight execution and high leverage.”

Avoid if: You require Tier-1 regulation (Scope is only Belize-licensed) or fixed spreads. Residents of restricted countries (e.g. USA, Canada, EU) cannot open accounts. Also, traders needing local deposit options or extensive in-house research tools may find it limiting.

Bottom Line: Scope Markets is a robust offshore broker offering extremely competitive trading conditions. Its strengths are low trading costs (raw spreads and low commissions) and advanced platforms (MT4/MT5 with full mobile support). The unified account structure, fractional stock trading, and affiliation with Rostro Group set it apart. However, its Belize regulation means less investor protection than a top-tier broker. We recommend Scope Markets for experienced global traders who prioritize market variety, high leverage (up to 1:1000), and cost efficiency. Cautious traders or those in restricted regions should consider whether a more strongly regulated broker better meets their needs.

Frequently Asked Questions

Is Scope Markets regulated and safe?

What account types and minimum deposit does Scope Markets offer?

Which trading platforms are supported?

How can I deposit or withdraw funds?

About Author

Robert J. Williams

Robert J. Williams, an MBA graduate from the University of Southern California with a significant background in finance. Extensive professional experience with top investment firms such as Balt Investment and Globe Investments, enhancing venture capital portfolios and developing sophisticated investment strategies. Contributing expert at PipPenguin, where he simplifies complex financial topics and online brokers for a broad audience, empowering them with the knowledge to succeed in trading.User Reviews

Be the first to review “Scope Markets : Is It a High-Leverage Global Broker?” Cancel reply

- Scope Markets Overview & Company Background

- Pros & Cons Analysis

- Is Scope Markets Regulated and Safe?

- Trading Conditions & Costs

- Scope Markets Trading Platforms & Tools

- Scope Markets Account Types & Minimum Deposit

- Deposits & Withdrawals

- How to trade with Scope Markets? Step-by-Step Guide

- Customer Support

- Scope Markets Final Verdict

- Frequently Asked Questions

- About Author

There are no reviews yet.