PU Prime: Is This Broker Suitable for Advanced Traders?

USP: Regulated across multiple jurisdictions | Raw-spreads from 0.0 pips | Supports MT4, MT5, WebTrader & proprietary App

PU Prime Overview & Company Background

PU Prime is a global online broker founded in 2015, headquartered in Ebène, Mauritius (via its main entity). It positions itself as a leading multi-asset CFD and forex provider, offering access to over 1,000 instruments across 190+ countries. Notable achievements include multiple industry awards (e.g., “Best Global Online Broker 2022”, “Most Innovative Mobile Trading App 2022”).

-

🏦 Headquarters: Ebène, Mauritius (Suite 201, Level 2, The Catalyst, Cybercity)

-

📅 Founded: 2015

-

📜 Regulation: Multiple entities (e.g., Mauritius FSC License GB23202672; Australia ASIC Licence 410681; Seychelles FSA Licence SD050)

-

🏦 Supported Countries: 190+ countries globally

-

💻 Platforms: MT4, MT5, WebTrader, PU Prime App

-

💵 Minimum Deposit: From approximately USD 50 for Standard accounts.

Company Background

PU Prime began in 2015 and has since evolved into a global fintech broker, offering a wide range of trading instruments (forex, commodities, shares, ETFs, bonds) and multiple trading platforms. The mission centres on accessible, transparent trading: “More Than Trading” is one of their slogans. Over time the firm has grown its client base significantly (marketing materials cite 450,000+ active clients) and achieved regulatory licences in multiple jurisdictions. The group’s structure uses distinct legal entities to serve different regions, enabling local regulation and global reach. Regulatory milestones such as ASIC (Australia) licensing provide stronger trust signals, while other licences like Mauritius and Seychelles widen its reach but may carry lower regulatory strength. Overall, PU Prime now occupies a visible position in the global CFD/forex space, offering low-cost access, high leverage, and multiple platforms to cater from beginners to advanced traders.

Pros & Cons Analysis

- Raw-spreads from 0.0 pips in Prime/ECN accounts.

- High maximum leverage up to 1 : 1000 on many account types.

- Wide instrument coverage (forex, indices, commodities, shares, ETFs, bonds).

- Multiple regulated entities (Australia ASIC, Mauritius FSC, Seychelles FSA) offering segmented regulatory coverage.

- Supports major trading platforms (MT4, MT5, WebTrader, mobile app) plus copy trading and other value-adds.

- For clients under offshore entities (e.g., Seychelles, Mauritius), regulatory protection is weaker relative to Tier-1 jurisdictions.

- Commission-free account types carry wider spreads (starting ~1.3 pips) which may be less ideal for scalpers.

- Some regional restrictions apply: e.g., U.S. residents are not permitted.

PU Prime vs Competitors: Key Differences

-

Offers extremely high leverage (up to 1:1000) which many brokers limit to 1:30 or 1:200 in regulated regions.

-

Raw-spread account (Prime/ECN) with low commission ($3.50 per side) competes favourably with other brokers.

-

Wide global reach and multiple licensing entities allow access from many jurisdictions, though this also means varying regulatory strength.

-

Some competitors may offer fixed spreads, localised deposit/withdrawal options, or stronger Tier-1 only regulation; in those areas PU Prime may lag (for clients in highly regulated markets).

Is PU Prime Regulated and Safe?

Regulatory Assessment

PU Prime operates through multiple legal entities regulated across jurisdictions. Its Australian entity (ASIC Licence 410681) is considered Tier-1 regulation, offering strong investor protection. Other entities such as Mauritius (FSC) and Seychelles (FSA) are considered lower-Tier (Tier-3) regulators in many evaluations, implying comparatively weaker oversight. Therefore, the regulatory strength depends on which entity your account is held with—clients of the ASIC entity benefit from stronger protections. Overall, PU Prime is regulated and legitimate, but traders should confirm local entity coverage, legal rights and safeguards before funding.

Regulatory Licenses

-

ASIC (Australia) – License No. 410681

-

Financial Services Commission (Mauritius) – License No. GB23202672

-

Financial Services Authority (Seychelles) – License No. SD050

-

Financial Sector Conduct Authority (South Africa) – FSP No. 52218

Safety Measures

-

Client Fund Protection: PU Prime states that client funds are segregated from company funds and held with approved banks, and client fund insurance is available via the group brand.

-

Compensation Schemes: In some jurisdictions, regulated entities may benefit from compensation schemes; investors should check local entity coverage before assuming entitlement.

-

Negative Balance Protection: The broker offers negative balance protection, meaning clients will not lose more than their account balance in the event of extreme market moves.

-

Data Security & Encryption: The website and client portal state secure data handling, encryption and adherence to AML/KYC policies, including identity verification documentation upload.

Trading Conditions & Costs

Trading Specs

-

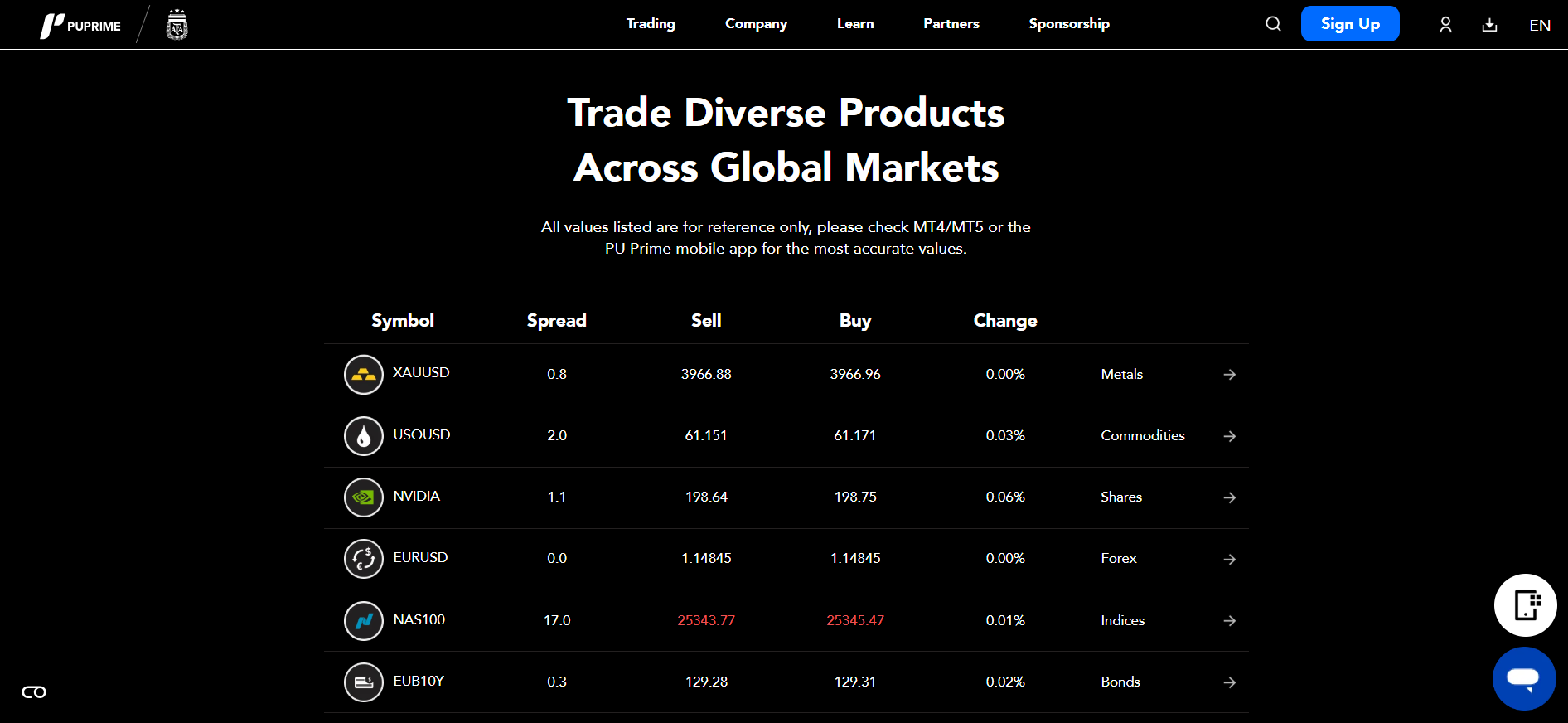

✅ Instruments: Forex, Commodities, Indices, Crypto, Shares, ETFs, Bonds

-

✅ Spreads: From 0.0 pips (Prime/ECN account)

-

✅ Commission: USD 3.50 per side (Prime account)

-

✅ Leverage: Up to 1:500 (Standard), up to 1:1000 (Pro/Prime)

Detailed Explanation

-

Instruments: PU Prime offers a broad range of asset classes—major/minor forex pairs, global indices, commodities like gold/oil, shares of large companies, ETFs and bonds. This gives clients flexibility to diversify across markets.

-

Spreads: The broker’s promotional figures show raw spreads from 0.0 pips on competitive account types (Prime/ECN) which is attractive for cost-sensitive traders. On commission-free accounts, spreads start higher (e.g., ~1.3 pips).

-

Commission: For lower spread accounts (Prime, ECN), commissions apply — for example USD 3.50 per side per lot on the Prime account.

-

Leverage: The default leverage is up to 1:500 for many account types, with up to 1:1000 on “Pro” selections or selected instruments. This offers high exposure potential but elevates risk.

PU Prime Trading Platforms & Tools

Available Platforms

-

✔ MetaTrader 4 (MT4): Classic industry standard, ideal for forex and CFD trading, supports EAs, charting, custom indicators. PU Prime supports MT4, offering strong third-party ecosystem.

-

✔ MetaTrader 5 (MT5): Upgraded version with more asset classes, improved charting, hedging, more order types. PU Prime offers MT5 to give access to shares/ETFs and broader coverage.

-

✔ WebTrader & PU Prime Mobile App: Browser-based WebTrader allows trading without download; the mobile app supports trading on-the-go, depositing/withdrawing and copy trading.

Platform Features

-

Platform Feature 1: Expert Adviser (EA) compatibility for algorithmic trading via MT4/MT5.

-

Platform Feature 2: Copy Trading / Social Trading functionality embedded in the mobile app—beginners can copy professional traders.

-

Platform Feature 3: Multi-device sync – trade from desktop, browser or mobile seamlessly, with account settings and dashboards unified.

-

Platform Feature 4: Integrated market insights, webinars, trading academy and analysis tools embedded into the brokerage platform, enabling education and decision support.

Research Tools

-

Market Insights: PU Prime publishes in-house market analysis and webinars (platform-native).

-

Economic Calendar, Trading Calculators & Market Scanner: Available via platform or broker website to assist with strategy (platform-native).

-

Copy-Trading Tools: Integrated into the app to allow mirror trading, performance analytics and selection of strategy providers (proprietary).

PU Prime Account Types & Minimum Deposit

AccountTable

| Account Types | Min Deposit | Spread | Commission | Platforms |

|---|---|---|---|---|

| Standard | USD 50* | From ~1.3 pips | None | MT4/MT5, WebTrader, App |

| Prime | USD 1,000 | From 0.0 pips | USD 3.50 per side/lot | MT4/MT5, WebTrader, App |

| ECN | USD 10,000 | From 0.0 pips | USD 1 per side/lot |

* Minimum deposit figures vary by region and currency.

SpecialFeatures

-

Demo Account: Allows traders to test strategies and platforms risk-free before committing real funds—offered by PU Prime.

-

Islamic (Swap-Free) Accounts: PU Prime offers swap-free (Sharia compliant) accounts on request, for eligible clients.

-

VIP / Premium Accounts: Higher-tier clients or those meeting minimum criteria (usually larger deposits) may receive enhanced service, tighter pricing or rebates (not always standardised).

-

Managed Accounts: Although not heavily promoted, the copy-trading and social/trader-follower model can function akin to managed account services (user following professionals).

Deposits & Withdrawals

DepositMethods

-

International Bank Transfer: Clients can fund via bank wire; not always instant.

-

Credit/Debit Cards & E-Wallets: Various local/international e-wallets and card options are supported via the client portal or app.

WithdrawalMethods

-

Bank Transfer: Withdrawals via client portal; first international bank transfer withdrawal each month may be reimbursed.

-

E-Wallets/Cards: Withdrawal via same route where deposit was made (subject to verification/KYC).

ProcessingDetails

-

Processing Time: Varies by method and jurisdiction (broker notes some deposits may not be immediately reflected).

-

Deposit Fees: PU Prime states no handling fee for deposits via most methods, though some international wire or e-wallet charges may still occur via provider.

-

Withdrawal Fees: No internal fee for first international bank transfer each month; subsequent transfers can incur ~USD 20 (or equivalent) bank handling fee.

-

Minimum / Maximum Limits: Example: Minimum withdrawal ~40 account currency units (HKD/JPY equivalent of USD 40) for some accounts.

How to trade with PU Prime? Step-by-Step Guide

-

Visit PU Prime’s official website.

-

Click on “Register” / “Open Live Account” and fill in personal details (name, email, residence country).

-

Verify your email and phone number.

-

Upload KYC documents: Valid ID (passport or driver’s licence) + Proof of Address (utility bill/bank statement) as per broker’s requirement.

-

Fund your account via your preferred deposit method and select account type and currency.

-

Log in to the trading platform of your choice (MT4/MT5/WebTrader/App).

-

Choose your trading instrument (e.g., forex pair, commodity, index) from the product list.

-

Analyse the chart using indicators/tools available in the platform; apply risk management settings (stop-loss/take-profit).

-

Place your trade (Buy/Sell) and monitor; set stop-loss (SL) and take-profit (TP) levels as per your strategy.

-

Close the trade manually or let it close automatically when it hits SL/TP; withdraw profits when ready.

Summary

The trading process with PU Prime is streamlined and beginner-friendly: account opening is relatively quick, choice of deposit methods is broad, platforms familiar, and trading instruments wide. Beginners can benefit from demo mode, while advanced traders can leverage fast execution, low costs and high leverage.

Customer Support

SupportChannels

-

Live Chat accessible via website/app.

-

Email support (e.g., info@puprime.com)

-

Telephone support (e.g., +248 4373 105)

SupportHours

24/7 support is advertised, covering all week with live chat and email options.

AdditionalDetails

-

Multilingual support: The website and app support multiple languages (English, Arabic, Thai, Vietnamese, etc.).

-

Dedicated account manager for VIPs: Higher-tier clients may get personalised service (implied in VIP/premium account offerings).

-

Response time: While exact metrics are not published, the broker emphasises fast, around-the-clock support.

PU Prime Final Verdict

“Ideal for global traders seeking tight costs, professional-grade tools, and top-tier regulation.”

Avoid if you’re looking for a broker with purely Tier-1 regulation in all respects (some entities are offshore), or if you require local Indian rupee deposits/withdrawals and Indian regulation—India is specifically excluded from the operating jurisdictions.

BottomLine

PU Prime offers a compelling combination of low-cost trading (raw spreads, low commission), high leverage (up to 1:1000), broad platform support, and global coverage. The multiple regulatory licences add legitimacy, though strength of protection depends on the entity under which you sign up. For traders comfortable with global brokers and the risks of high-leverage CFD trading, PU Prime is a strong contender recommended for many use-cases.

Frequently Asked Questions

Is PU Prime regulated and legitimate?

Yes — PU Prime operates under multiple regulated entities including Australia’s Australian Securities & Investments Commission (ASIC) Licence 410681, Mauritius’s Financial Services Commission (Mauritius) Licence GB23202672 and Seychelles’s Financial Services Authority (Seychelles) Licence SD050.

What is the minimum deposit required to open an account?

The minimum deposit varies by account type: for Standard accounts it is around USD 50; for Prime accounts it is typically USD 1,000; and for ECN accounts it can be USD 10,000.

What payment methods are available for deposit and withdrawal?

Clients can deposit via credit/debit cards, e-wallets and bank transfers; many methods are instant and carry 0% commission. Withdrawals use the same or similar methods, subject to verification.

What leverage and instruments does PU Prime offer?

PU Prime offers a wide range of instruments including forex, commodities, indices, shares, ETFs and more. Leverage can be up to 1:500 or higher depending on account type and jurisdiction.

How do I open an account and start trading?

You begin by registering on the website, verifying your email and phone number, uploading KYC documents (ID and proof of address), funding the account, selecting your platform (e.g., MT4/MT5), choosing an instrument, analysing the chart and placing a trade with SL/TP settings. The process is designed to be straightforward for both beginners and experienced traders.

About Author

Robert J. Williams

Robert J. Williams, an MBA graduate from the University of Southern California with a significant background in finance. Extensive professional experience with top investment firms such as Balt Investment and Globe Investments, enhancing venture capital portfolios and developing sophisticated investment strategies. Contributing expert at PipPenguin, where he simplifies complex financial topics and online brokers for a broad audience, empowering them with the knowledge to succeed in trading.User Reviews

Be the first to review “PU Prime: Is This Broker Suitable for Advanced Traders?” Cancel reply

- PU Prime Overview & Company Background

- Pros & Cons Analysis

- Is PU Prime Regulated and Safe?

- Trading Conditions & Costs

- PU Prime Trading Platforms & Tools

- PU Prime Account Types & Minimum Deposit

- Deposits & Withdrawals

- How to trade with PU Prime? Step-by-Step Guide

- Customer Support

- PU Prime Final Verdict

- Frequently Asked Questions

- About Author

There are no reviews yet.