KOT4 Review 2025 – Transparent Crypto & Forex Trading

USP: 24/7 Crypto & Forex Trading | Ultra-Low Spreads | Up to 1:500 Leverage

KOT4 Overview & Company Background

KOT4 (sometimes branded KOT4X) was launched around 2019 by Kot Ltd, which was incorporated in 2018 in St. Vincent & the Grenadines. The broker is headquartered in Kingston, Jamaica. It promotes itself as a “King of Transparency,” offering 24/7 cryptocurrency trading alongside Forex and CFDs. KOT4 has grown to serve thousands of traders worldwide, providing access to over 250 instruments (Forex, metals, indices, 24/7 crypto, etc.). It highlights features like segregated client funds and partnerships with top liquidity providers for maximum protection. To date, KOT4 has positioned itself as a niche low-cost broker in the global market, though it operates without Tier-1 regulatory licenses.

- 🏦 Headquarters: Kingston, Jamaica (registered in SVG)

- 📅 Founded: ~2019 (Kot Ltd, St. Vincent incorporation 2018)

- 📜 Regulation: Unregulated offshore (St. Vincent & the Grenadines)

- 🗺️ Supported Countries: Global (excludes USA)

- 💻 Platforms: TradeLocker (web/desktop/mobile)

- 💵 Min Deposit: $10 (Cryptocurrency funding)

Company Background:

Kot Ltd established KOT4 to offer a “secure ECN trading environment” and highlight transparency. It leveraged its SVG registration to attract global clients, aiming for fast execution and low costs (1:500 leverage, tight spreads). Over time, KOT4 has emphasized privacy and data protection, pledging segregated client funds. While it boasts advanced tech (a proprietary TradeLocker platform powered by TradingView charting), it remains a smaller offshore broker without major regulator oversight. The firm has gradually expanded its client base and product range (including 24/7 crypto), carving out a place among specialized crypto/Forex brokers by focusing on cost-efficiency and anonymity.

Pros & Cons Analysis

- Licensed under SVG offshore entity with broad global reach (though not Tier-1).

- Ultra-low spreads on Forex/crypto markets in raw accounts.

- High leverage (up to 1:500) enabling large exposure.

- Proprietary TradeLocker platform with advanced TradingView charts and quick execution.

- Wide instrument range (Forex majors, metals, indices, 24/7 crypto) totaling 250+ assets.

- Operates as an offshore broker (SVG) with no Tier-1/2 regulation – less customer protection.

- Limited funding options (crypto-focused, no direct bank transfer or local currency deposits).

- No fixed-spread account; variable costs on standard pairs.

- No native MT5/cTrader platform support (uses proprietary platform only).

Is KOT4 Regulated and Safe?

KOT4 is not regulated by any major financial authority. It’s an offshore entity (St. Vincent & Grenadines registration), which places it in Tier-3 status. This implies limited regulatory oversight and no statutory compensation schemes, so traders bear more counterparty risk. On the plus side, KOT4 claims robust safety measures: it stresses data privacy and segregated funds with top-tier liquidity providers. However, its offshore status means customers must trust the broker’s own safeguards. In practice, KOT4’s funded account program even states “we cover all losses” for challenge participants, suggesting internal protections, but this isn’t the same as government-backed insurance.

Regulatory Licenses:

- Kot Ltd (SVG) – Company No. 25045 BC 2018 (registered offshore, no regulatory license).

Safety Measures:

- Client Fund Protection: Client funds are held in segregated accounts with major liquidity partners, keeping trader deposits separate from company capital.

- Compensation Schemes: KOT4X’s own funded accounts offer a fee refund upon success (covering losses up to a point), but there is no official regulator compensation. Traders should not expect FSCS/FDIC protection.

- Negative Balance Protection: For funded-challenge traders, any excess losses are absorbed by KOT4X. Standard retail accounts do not explicitly promise negative-balance guarantees, so losses beyond margin could occur.

Data Security & Encryption: The broker emphasizes privacy and “protecting your data”. Its TradeLocker platform uses HTTPS and TradingView’s secure charting. While KOT4X doesn’t list encryption specs, all communications occur over encrypted links (SSL), aligning with industry norms.

Trading Conditions & Costs

- ✅ Instruments: 250+ assets including Forex majors/crosses/exotics, Cryptos, Commodities (metals, energies), Global Indices, Stocks, and 24/7 Cryptocurrencies.

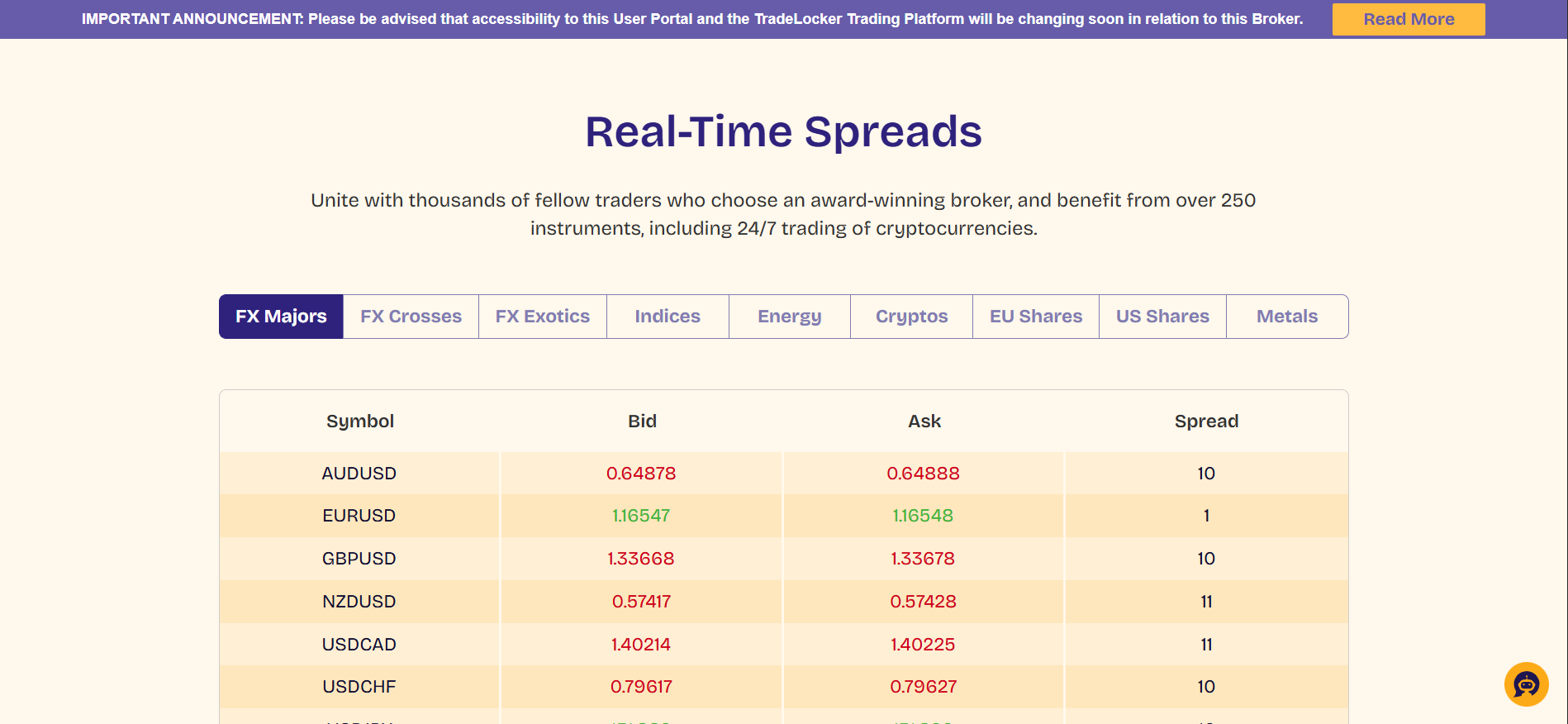

- ✅ Spreads: Ultra-low spreads under ideal conditions. Raw-account spreads on majors can be as low as 0.0 pips; standard account spreads are wider. KOT4X advertises “tight spreads” for highly liquid pairs.

- ✅ Commission: Raw/Pro pairs incur a small per-side fee (around $3.50–$7 per standard lot). Standard (and .pro) pairs charge ~$7 per round-turn, while .var pairs have no commission. Overall trading fees are considered competitive for ECN-style accounts.

- ✅ Leverage: Up to 1:500 on Forex and selected assets, allowing amplified trading power. (Leverage may be capped lower for crypto or by region.)

- Instruments: KOT4’s portfolio spans major FX pairs, cross-currency pairs, exotic currencies, metals (gold, silver, etc.), energies (Oil, Gas), global indices (S&P500, NASDAQ, DAX, etc.), stocks (US/EU shares), and a broad crypto lineup (BTC, ETH, LTC, XRP, etc. trading 24/7). This ensures traders can diversify across asset classes from one account.

- Spreads: In raw (Pro) accounts, spreads on EUR/USD and other majors often start at 0.0 pips. The funded accounts page highlights “ideal market conditions at ultra-low spreads”. Standard accounts have higher spreads (often 1–2 pips on majors) to offset zero commissions, making raw accounts better for scalpers and high-volume traders.

- Commission: Trading raw pairs costs about $7 per lot (both sides) on FX; the funded challenge advertises similarly. For example, Standard/.pro pairs both incur ~$7 total commission, while .var pairs waive commissions (but use wider spreads). Stock and index trading may carry fixed per-lot fees as well. Overall, KOT4X’s commission levels are on par with other ECN brokers.

- Leverage: KOT4X offers very high leverage (up to 1:500). This means a $1,000 margin could control $500,000 in positions on most FX pairs. High leverage can magnify gains but also risk, so it’s best used cautiously. Note that crypto and other volatile products may have lower max leverage for safety.

KOT4 Trading Platforms & Tools

- ✔ TradeLocker (Desktop/Mobile): KOT4X’s proprietary platform, built on TradingView technology. TradeLocker provides advanced charting, 1-click trading, and a fully web/mobile-compatible interface. It works on Windows, Mac, Android, and iOS. Users get hundreds of technical indicators, drawing tools, and customizable layouts (all native features). TradeLocker also offers integrated one-click order execution and risk management (e.g. stop-loss/ take-profit).

- ✔ Web Trading (Dash): Traders can log in via the KOT4X web portal (dash.) to access account management and open positions. The portal integrates with TradeLocker for charting and trade execution, so there’s no separate Java or install required.

- ✔ Mobile App: The TradeLocker mobile app (Android & iOS) mirrors the desktop platform, providing seamless trading on the go. Users can place/modify orders and monitor accounts from smartphones or tablets, with push notifications.

- Lightning Execution: The platform emphasizes “lightning-fast” execution, minimizing latency from click to fill. This benefits scalpers and high-frequency traders by reducing slippage.

- Advanced Charting & Tools: TradeLocker is powered by TradingView charts, which means traders have access to all of TradingView’s built-in indicators, drawing tools, timeframes, and chart types. Technical analysis is seamless and native to the platform.

- Expert Advisors (EAs): KOT4X supports automated trading. Traders can run MetaTrader 4 EAs by linking through the platform’s integrations. In fact, KOT4X explicitly allows “Expert Advisors” on Forex pairs, appealing to algo traders.

- Flexible Trading: The system permits hedging, multiple positions, and even news-event trading. KOT4X does not restrict trading during market-moving events, and allows strategies like hedging and scalping freely.

- Research Tools: KOT4X relies on platform-native tools for analysis. Its TradeLocker charts (TradingView) offer extensive technical indicators (RSI, MACD, etc.) and drawing objects. While the broker doesn’t list proprietary news or sentiment features, the TradingView engine typically provides integrated market news and alerts. No dedicated sentiment or market scanner is given on site – traders may use external feeds or TradingView widgets. The key built-in tool is the advanced charting mentioned above; fundamental news would come from third-party financial news sites.

KOT4 Account Types & Minimum Deposit

| Account Type | Min Deposit | Spread | Commission | Platforms |

| Standard | $10 | From ~1.0 pips (medium) | $7 per lot (round-turn) | TradeLocker, MT4 (via bridge) |

| Pro | $10 | From ~0.4 pips (low) | $7 per lot (round-turn) | TradeLocker, MT4 |

| Variable | $10 | Variable (wider spreads) | $0 (commission-free) | TradeLocker, MT4 |

| Mini | $10 | From ~1.0 pips | $1 per lot ($7 on indexes) | TradeLocker, MT4 |

Special Features:

- Demo Account: KOT4X offers a free demo with virtual funds and up to 1:500 leverage for practice. Traders can test strategies and the TradeLocker platform risk-free.

- Islamic (Swap-Free) Accounts: Not available at present. KOT4X explicitly states it does not offer swap-free Islamic accounts as of 2024, though it plans to consider them later.

- VIP/Premium Accounts: No separate VIP/premium tiers are listed. All retail clients trade under the same account conditions, aside from funded-challenge offerings.

- Managed/MAM Accounts: KOT4X does not provide MAM/PAMM managed-account solutions. Traders must use their accounts directly or join the funded program if seeking capital allocations.

Deposits & Withdrawals

- Deposit Methods: KOT4X is a crypto-focused broker. It accepts deposits in cryptocurrencies only. Bitcoin is the primary funding method – the site touts Bitcoin for “fast transfers, secure transactions, and minimal fees”. Other supported coins include stablecoins and alts: USDT (Tether), USDC (USD Coin, TRC20), Litecoin, Ripple (XRP), and Dogecoin. Traders can also use a credit/debit card indirectly: KOT4X partners with third-party crypto payment providers that let you buy crypto (e.g. BTC or USDT) via card, which is then deposited into the account. All crypto deposits typically clear quickly (often within 3 hours).

- Withdrawal Methods: Withdrawals are primarily via Bitcoin (or tether USDT) back to the user’s crypto wallet. Alternatively, KOT4X offers a payout to your original funding source: for example, if you funded by card, you can withdraw (refund) to that card. The key point: withdrawal options mirror funding methods – mainly crypto or the original fiat channel. Processing times are fairly fast; KOT4X aims to approve withdrawal requests within 24 hours, after which crypto arrives in your wallet in 1–3 hours.

- Processing Details: KOT4X states that withdrawals are typically processed within one business day. Once approved, funds (BTC/USDT) appear in your crypto wallet usually within 1–3 hours. There are no broker-imposed deposit fees beyond the normal blockchain/network fees – deposits in crypto incur only miner costs (no KOT4X charge). Similarly, KOT4X does not levy withdrawal fees; clients pay standard network (blockchain) fees when sending crypto out. The minimum withdrawal amount is $100; there is no maximum limit on withdrawals.

How to trade with KOT4? Step-by-Step Guide

- Visit the official KOT4 website (https://kot4x.com) and click Sign Up/Register to open a live trading account.

-

Complete the registration form with your personal details (name, address, contact info) as prompted.

-

Verify your email (and phone, if required) by entering the code sent to you – this activates your account.

-

Submit KYC documents for account verification (photo ID and proof of address) so you can trade with real funds.

-

Fund your account via your preferred method: e.g. deposit Bitcoin or other supported crypto (instructions are provided in your dashboard).

-

Log in to the TradeLocker trading platform (via the web portal or downloaded app) using your account credentials.

-

Choose a trading instrument (Forex pair, crypto, etc.) from the list of 250+ assets.

-

Analyze the instrument’s chart (using the platform’s built-in indicators and tools) and decide on entry.

-

Place a trade (Buy or Sell) through the platform; set your stop-loss and take-profit levels to manage risk.

-

Monitor your open positions on the TradeLocker interface; close trades manually or let SL/TP trigger automatically.

Trading with KOT4 is straightforward: after account setup and funding (via crypto), you trade on the TradeLocker platform which offers familiar charting and order functions. The process – from deposit to execution – is streamlined for both beginners and pros. Its interface is user-friendly and mobile-ready, so even first-time traders can navigate orders, apply indicators, and manage risk easily. Overall, KOT4’s onboarding and trading flow is designed for efficiency, although beginners should exercise caution given the high leverage and lack of regulatory protections.

Customer Support

- Support Channels: KOT4X provides 24/7 customer support. You can submit queries via email or the website contact form (support@), or use the live chat feature on the platform. There is also a Discord server for community discussions (invite linked on site) and social media channels (e.g. Instagram). Note: No phone number is listed; support is mainly through digital channels.

- Support Hours: Support is 24 hours a day, 7 days a week, every day. According to the site, KOT4X “has your back 24/7” via chat/email.

- Additional Details:

- Multilingual support: The broker’s site and support articles are in English; local language support is not highlighted, so English is the primary channel.

- Dedicated Account Manager: No official VIP/account-manager service is mentioned – support appears uniform for all traders.

- Response Time: With 24/7 live chat, response is typically quick, though actual times depend on workload. KOT4X advertises round-the-clock care to ensure prompt answers.

KOT4 Final Verdict

“Ideal for experienced traders seeking low-cost, high-leverage access to crypto and forex markets with advanced charting tools.”

Avoid if:you need strong regulatory oversight or traditional banking options. KOT4 does not offer fixed spreads or local deposit/withdrawal in many fiat currencies, so it’s ill-suited for traders who require Tier-1 regulation, FCA/CFTC oversight, or local payment methods. If you want guaranteed negative-balance protection or FSCS-like compensation, look elsewhere. KOT4 is best for **tech-savvy, cost-conscious** traders comfortable with an offshore broker and crypto funding.

Bottom Line: KOT4 delivers exceptional trading conditions (tight spreads, 1:500 leverage, and 24/7 crypto access) for active traders who prioritize cost and flexibility. Its proprietary TradeLocker platform provides professional-grade charting and swift execution. However, the lack of major regulation and limited deposit options mean it carries higher risk and inconvenience for beginners or those needing robust investor protections. In summary, KOT4 is a recommended choice for advanced traders focusing on crypto/Forex and low fees, but it’s not the right fit if you prefer a regulated broker with traditional banking.

Frequently Asked Questions

Is KOT4 regulated by any major authority?

What account/pair types does KOT4 offer?

How can I deposit and withdraw money?

Which trading platforms does KOT4 support?

Does KOT4 offer swap-free (Islamic) accounts?

About Author

Robert J. Williams

Robert J. Williams, an MBA graduate from the University of Southern California with a significant background in finance. Extensive professional experience with top investment firms such as Balt Investment and Globe Investments, enhancing venture capital portfolios and developing sophisticated investment strategies. Contributing expert at PipPenguin, where he simplifies complex financial topics and online brokers for a broad audience, empowering them with the knowledge to succeed in trading.User Reviews

Be the first to review “KOT4 Review 2025 – Transparent Crypto & Forex Trading” Cancel reply

- KOT4 Overview & Company Background

- Pros & Cons Analysis

- Is KOT4 Regulated and Safe?

- Trading Conditions & Costs

- KOT4 Trading Platforms & Tools

- KOT4 Account Types & Minimum Deposit

- Deposits & Withdrawals

- How to trade with KOT4? Step-by-Step Guide

- Customer Support

- KOT4 Final Verdict

- Frequently Asked Questions

- About Author

There are no reviews yet.