Fortrade Review – Is it Safe and Regulated?

USP: Regulated by FCA & CySEC | No-Commission Trading (spread-only) | Fortrader Platform & MT4 Compatibility

Fortrade Overview & Company Background

Fortrade Ltd. is a UK-based online forex and CFD broker founded in 2013. It has grown into a global trading provider with offices and licenses in Europe, Australia, Canada and Mauritius. Fortrade positions itself as “one of the premier providers of products, services and platforms for online CFD trading”. Its mission is to make trading accessible through user-friendly, technologically advanced platforms.

- 🏦 Headquarters: London, United Kingdom

- 📅 Founded: 2013

- 📜 Regulation: FCA (UK), CySEC (Cyprus), FSC (Mauritius), ASIC/AFSL (Australia), CIRO (Canada)

- 🏦 Supported Countries: Global (serving clients worldwide; services are not offered in the USA, Belgium and some other restricted jurisdictions)

- 💻 Platforms: Fortrader (proprietary Web/Desktop/Mobile), MetaTrader 4 (Desktop/Web/Mobile)

- 💵 Min Deposit: ~$100 (varies by currency)

Company Background

Fortrade began in London and quickly expanded internationally, establishing licensed entities in Cyprus, Australia, Canada and Mauritius. It emphasizes strict compliance and client protection (e.g. fully segregated client funds) to build trust. Today Fortrade offers trading on 50+ currency-pair CFDs, 300+ stock CFDs, plus indices, commodities, ETFs and digital currencies. Its proprietary Fortrader platform (web, desktop and mobile) synchronizes accounts across devices for “anytime, anywhere” trading. Over time, Fortrade has maintained tight spreads and no-commission pricing to stay competitive.

Pros & Cons Analysis

- FCA and CySEC regulated (Tier-1 regulation).

- Commission-free, spread-only pricing (no added trade fees).

- Intuitive proprietary trading platform (“Fortrader”) with synchronized mobile and desktop access.

- Wide instrument range: 50+ forex, 300+ stocks, plus indices, commodities and crypto CFDs.

- Strong client protections (segregated funds, CIPF coverage, negative balance protection).

- No services for US or Belgian residents.

- Single account model (no ultra-low-commission RAW/ECN account on standard pricing) – all trading is spread-based.

- Inactivity fee applies ($10/month) after ~6 months of dormancy.

- Limited research/tools onboard (reliance on built-in charts; no MetaTrader 5 or cTrader).

Fortrade vs Competitors: Key Differences:

-

Proprietary Fortrader platform (Desktop/Web/Mobile) vs. competitors often only offering MT4/MT5.

-

Multi-jurisdictional regulation (FCA, CySEC, ASIC, CIRO) vs. some brokers licensed offshore only.

-

Commission-free model (mark-up in spread) vs. many brokers offering raw spreads with per-trade commission.

-

Focus on CFD trading across global markets (incl. crypto CFDs) vs. others that may offer direct stock trading or fixed spreads.

-

Limited product range compared to some (no fixed-rate bonds, options, etc.) and no US market access.

Is Fortrade Regulated and Safe?

Is Fortrade Regulated and Safe?

Regulatory Assessment: Fortrade is strongly regulated across multiple jurisdictions. Its UK entity is authorized by the FCA (Tier-1 regulator) and its Cyprus entity by CySEC (Tier-1 EU regulator). It also holds licenses under ASIC (Australia), FSC (Mauritius) and is registered with CIRO in Canada. This broad oversight implies stringent client protection standards: client funds are kept in segregated accounts and the broker adheres to strict risk controls. Retail clients benefit from negative balance protection (they cannot lose more than their deposited balance). Overall, Tier-1 regulation by FCA/CySEC means investors can trust in compliance with EU/UK rules, while additional Tier-2/3 jurisdictions extend global coverage.

Regulatory Licenses:

-

FCA (UK) – License No. 609970

-

CySEC (Cyprus) – CIF License No. 385/20

-

ASIC (Australia) – ABN 33 614 683 831, AFSL No. 493520

-

FSC (Mauritius) – License No. SEC-2.1B (GB21026472)

-

CIRO (Canada) – Regulated by CIRO (formerly IIROC) (Canadian Investor Protection Fund (CIPF) member – CRN BC1148613).

Safety Measures:

-

Client Fund Protection: All client deposits are held in segregated accounts (top banks) and treated as customer funds, ensuring protection if the broker faces issues

-

Compensation Schemes: As a CIRO member, Canadian clients are covered by CIPF (up to C$1 million per client). UK clients benefit from FCA rules (up to £85,000 via the FSCS, although FSCS membership isn’t explicitly stated on-site, FCA authorization generally provides this coverage).

-

Negative Balance Protection: Fortrade explicitly states retail traders “can lose all, but not more than the balance of [their] trading account”, guaranteeing no debt obligation if markets go extreme.

-

Data Security & Encryption: Fortrade’s websites and platforms use industry-standard SSL encryption and secure data protocols to protect client information. (All data transmissions are encrypted; verification and KYC processes follow regulatory AML standards.)

Trading Conditions & Costs

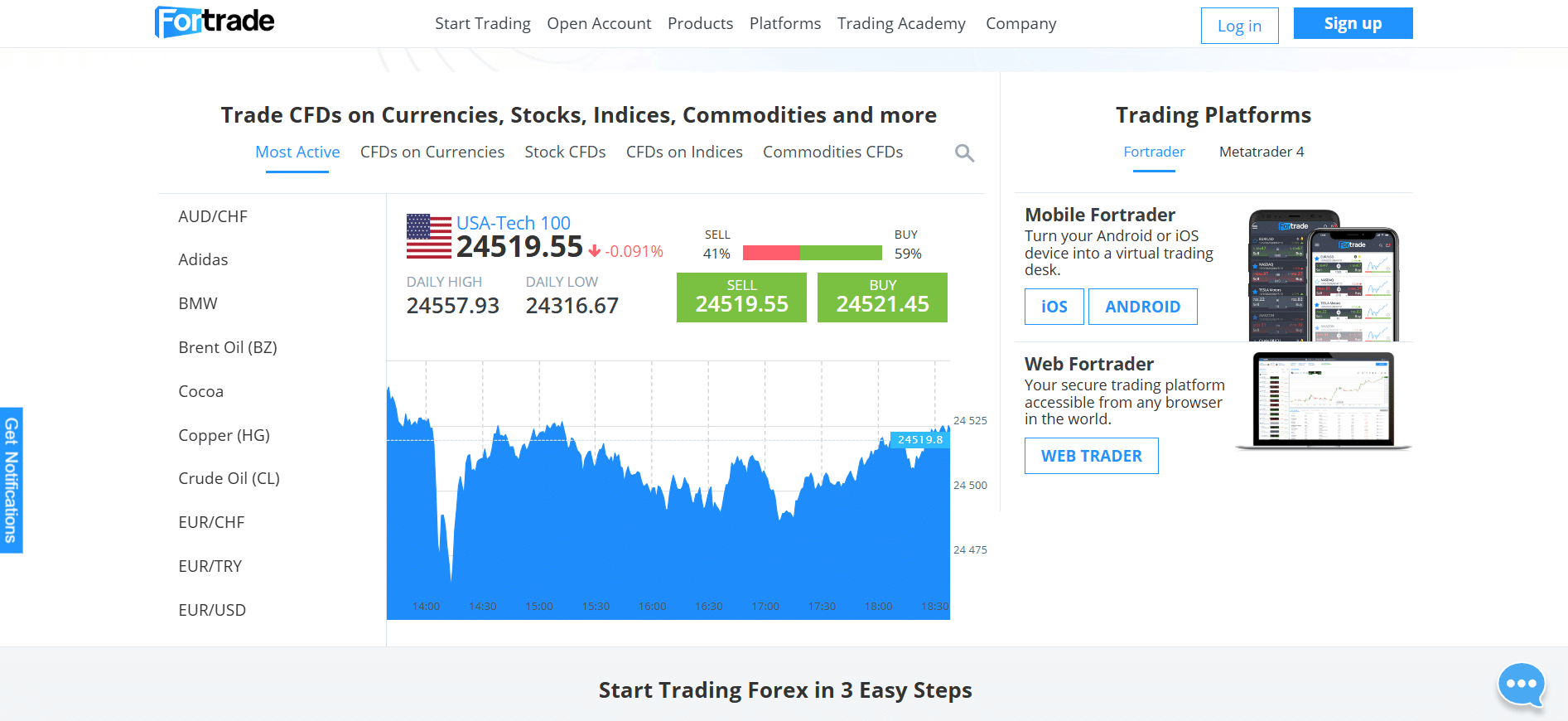

- ✅ Instruments: CFDs on Forex (50+ pairs), Stocks (300+), Indices, Commodities (metals, energy, agriculture), ETFs and Cryptocurrencies.

- ✅ Spreads: Competitive variable spreads – from ~1.0 pip on major FX pairs (EUR/USD). Spreads widen in volatile markets.

- ✅ Commission: None on standard accounts. (Fortrade’s model embeds costs in the spread; no per-trade fees for retail accounts.)

- ✅ Leverage: Up to 1:30 for retail clients (per ESMA limits); higher leverage (up to 1:500) available for professional or offshore accounts.

Each of these specifications is subject to change by market or regional rules.

- Instruments (Detail): Fortrade offers an extensive range of CFD products. You can trade 50+ currency pairs, 300+ equity CFDs, global indices, commodities (oil, gold, etc.), ETFs and major crypto CFDs like Bitcoin. This breadth allows diversified trading strategies across asset classes.

- Spreads (Detail): Spreads on major forex pairs are relatively tight (often around 1.0 pip on EUR/USD in calm markets). All spreads are floating. For example, a EUR/USD spread might range from ~1.0 up to ~2.0 pips. There is no commission on standard accounts, so all costs come via the spread markup. Note: Fortrade also mentions “tight spreads” in marketing.

- Commission (Detail): Fortrade does not charge trading commissions on its standard account. This means you pay only the visible spread. (Raw or ECN-style accounts with separate commissions are not advertised in the standard offering.)

- Leverage (Detail): Leverage is set by regulation and account type. UK/EU retail accounts are capped at 1:30. However, professional or Australian/Mauritian clients can access higher leverage (up to 1:500), subject to eligibility. High leverage increases both potential gains and risks.

Fortrade Trading Platforms & Tools

Fortrade provides multiple trading platforms designed for different preferences, all offering sophisticated features and integration with its back end.

- ✔ Fortrader (Web/Desktop/Mobile): Fortrade’s proprietary Fortrader platform is available as a web application, downloadable desktop client (PC/Mac), and mobile app (iOS/Android). It features real-time price feeds, interactive charting, and one-click trading. Positions and settings synchronize instantly across devices, letting you trade from anywhere. (Fortrader also includes tutorials and a “Guide Me” feature to walk new users through trading.)

- ✔ MetaTrader 4 (Desktop & Web): Industry-standard MT4 is supported. Traders who prefer MT4 can download it for desktop or use the web trader. MT4 on Fortrade provides live quotes, customizable charts, automated trading (Expert Advisors), multiple timeframes and a deep indicator library. This appeals to advanced traders who rely on EA automation and MT4’s robust feature set.

- ✔ MetaTrader 4 (Mobile): MT4’s mobile app is also supported. Android and iOS apps let you trade any account on the go with MT4’s interface, including viewing full charts and executing trades.

Platform Features:

- Real-Time Charts & Indicators: All platforms offer live-streaming quotes and advanced charting with numerous built-in technical indicators (moving averages, RSI, MACD, etc.) for market analysis.

- One-Click Trading: Instant order execution is available directly from charts or quote panels, enabling fast entries/exits. Pending orders and both market and limit orders are supported.

- Cross-Device Synchronization: The Fortrader platforms keep mobile, desktop and web sessions in sync. You can place a trade on your phone and see it immediately on your computer. Account balances and open positions are shared across devices.

- Built-in Guidance: The Fortrader platform includes a guided tutorial (“Guide Me”) for new users, explaining how to open/close orders and use features. Educational resources are also linked (see Research Tools below).

- Custom Alerts & Tools: Traders can set price alerts and use trading calculators (pip value, margin) directly in the platform. Advanced order types (stop orders, OCO, etc.) are supported.

Research Tools:

- Economic Calendar & News: Built-in calendar shows major economic events and news releases. A market news feed provides real-time headlines (global indices, FX news, etc.) to inform trading decisions.

- Trading Central Analysis: Fortrade integrates Trading Central (a third-party research provider) to offer market commentary and technical analysis signals on many instruments.

- Educational Resources: The platform links to Fortrade’s Online Academy, including webinars, trading guides and tutorial videos. New traders benefit from built-in tutorials on the Fortrader platform.

- Calculator Tools: Fortrade provides handy utilities like a pip value calculator, currency converter, margin calculator and swap rate calculator directly on its site/toolbox to help plan trades.

Fortrade Account Types & Minimum Deposit

| Account Type | Min Deposit | Spread | Commission |

Platforms |

| Standard Account |

$100 |

From ~1.0 pip (EUR/USD) | None | Fortrader (Web/Desktop/Mobile), MetaTrader 4 |

Fortrade’s standard trading account is simple: all clients have the same account type with variable spreads (no fixed spreads or tiered raw accounts advertised). The minimum funding is about $100 (recommended $500). Trading costs are spread-only; no per-trade commissions are charged on the Standard Account. Platforms available for Standard accounts include Fortrade’s own Fortrader platform and MetaTrader 4 (desktop, web and mobile).

Special Features:

- Demo Account: Free unlimited demo (practice) accounts can be opened instantly. You get virtual funds (usually $10,000) to practice in real market conditions without risk. The Fortrader platform will walk you through trades before switching to live mode.

- Islamic (Swap-Free) Accounts: Fortrade offers Sharia-compliant swap-free accounts upon request. Islamic account holders don’t incur overnight swap charges on positions held, provided certain conditions are met (e.g. standard commission usually applies instead of swaps). This is suitable for Muslim traders needing swap exemption.

- VIP / Premium Accounts: While not publicly detailed, Fortrade indicates premium terms (e.g. dedicated support or tailored pricing) are available for high-volume traders. Larger deposits may qualify for a VIP account manager and tighter spread conditions.

- Managed Accounts: Fortrade permits managed-account relationships. Professional money managers can trade on behalf of clients via specific segregated or PAMM accounts under Fortrade’s infrastructure, giving investors hands-off exposure (subject to manager qualifications and company approval).

Deposits & Withdrawals

Deposit Methods:

- Credit/Debit Cards (Visa/MasterCard): Instant funding. No fees charged by Fortrade (any processing fees by the card issuer are separate). This is the quickest method.

- Bank Wire Transfer: Electronic bank transfers (SWIFT) to Fortrade’s bank. No Fortrade fee, though your bank’s wire fees apply. Transfers typically post within 1–2 business days.

- E-Wallets (Neteller, Skrill, PayPal, etc.): Instant deposits via major e-wallets. No Fortrade fee (payment provider fees may apply). These are convenient for quick funding without bank wires. (For Canadian clients, Interac e-Transfer is also supported via a local option.)

Withdrawal Methods:

- Bank Wire Transfer: Standard method for large withdrawals. Processing at Fortrade’s end takes up to ~2 business days, then 3–5 days to reach your bank account. Fortrade does not charge a withdrawal fee (sender’s bank wire fee usually ~$30–40 is passed to client).

- Credit/Debit Card Refund: Withdrawals up to the amount originally deposited on that card (per AML rules). Card refunds can take up to 15 business days to appear on your statement. No Fortrade fee, but limited to the total you funded by card.

- E-Wallets (Neteller, Skrill): Fast withdrawals (typically same-day or within 24h). No fee from Fortrade. Simply specify your wallet ID and amount, and funds are usually received quickly.

- Other (if applicable): PayPal withdrawals are not commonly supported; if needed, use bank wire or e-wallet alternatives.

Processing Details:

- Processing Time: Withdrawal requests are processed by Fortrade within ~2 business days of submission. Additional time depends on the method (card, wire, etc.).

- Deposit Fees: No fees from Fortrade on deposits. (Your payment provider or bank may impose its own fee.)

- Withdrawal Fees: Fortrade itself does not charge withdrawal fees. International wire fees (~$40) and card issuer restrictions apply (see below).

Minimum/Maximum Limits: Minimum deposit is ~$100 (or equivalent). There is no specified maximum deposit/withdrawal, but very large transactions may be subject to additional verification. The only enforced limit is that card withdrawals cannot exceed the original deposit amount.

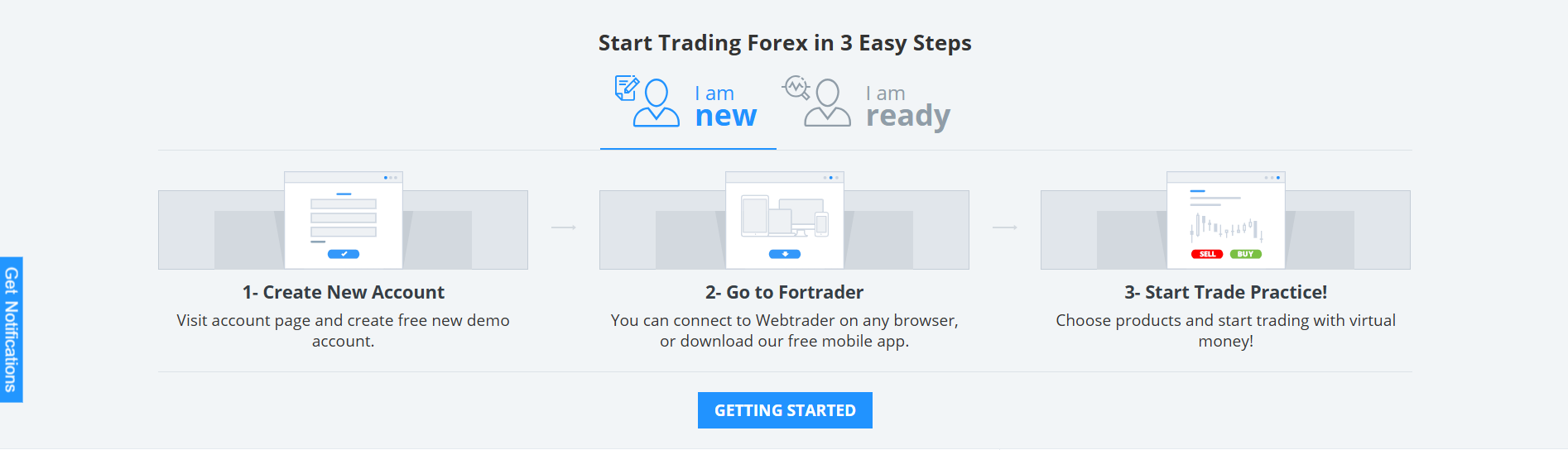

How to trade with Fortrade? Step-by-Step Guide

- Open an Account: Visit the official Fortrade website and click “Register” or “Open Account.” Fill in your personal details (name, email, contact).

- Verify Your Identity: Check your email/phone for verification links or codes. Log into your new account on the Fortrade site or Fortrader platform.

- Submit Documents: Complete the KYC process by uploading ID (passport/ID card) and proof of address (utility bill) as requested in your account portal.

- Fund Your Account: Choose a deposit method (card, bank wire, e-wallet) and deposit funds (min ~$100). Wait for the funds to reflect in your trading account.

- Download & Log In to Platform: Download the Fortrader desktop app or mobile app, or log into WebTrader. Enter your account credentials to access the platform.

- Select a Trading Instrument: Browse Fortrade’s market list (Forex, stocks, indices, commodities, crypto). Click on an instrument to load its live chart.

- Analyze the Market: Use the built-in charts and indicators to analyze price action. Apply technical indicators or check the Economic Calendar for upcoming news.

- Place a Trade: Decide to Buy (Long) or Sell (Short). Enter trade size, and set stop-loss (SL) and take-profit (TP) levels as desired. Click to execute the order.

- Monitor the Trade: Track your position in the platform’s trade panel. You can modify SL/TP or close the trade manually at any time.

- Close & Review: When your trade hits your profit target or stop, or when you choose to exit, close the position. Review your trade in the history report.

Summary: Fortrade’s trading process is straightforward. The account setup is quick (especially for the demo mode) and the Fortrader platform is intuitive for both beginners and experienced traders. Switching between demo/practice and live trading is done with one click. Overall, placing a trade involves choosing an instrument, setting parameters, and confirming execution – all steps are guided and user-friendly.

Customer Support

- Channels: Support is available via 24/5 Live Chat, Email ([email protected]), and phone lines (e.g. UK: +44 203 966 4506, +44 204 571 7564; Canada: +1 778 658 0363; Australia: +61 2 8324 6571; Cyprus: +357 25 262083). A comprehensive FAQ/Help Center and Q&A section are also provided on the website.

- Support Hours: Operating hours are 24/5 (Monday–Friday) around the clock. (Note: support is generally offline on weekends and major holidays.)

- Additional Details: Support is multilingual (the website and agents cover many languages including English, Spanish, French, etc.). VIP or high-volume clients may receive a dedicated account manager (by request). Response times are typically very fast via live chat (instant) and within one business day via email. Fortrade also offers educational materials (videos, webinars, eBooks) to supplement support.

Fortrade Final Verdict

“Ideal for regulated CFD traders wanting straightforward, low-cost trading on a proprietary platform.”

Avoid If: You are in the USA or Belgium (Fortrade does not serve these countries). Also avoid if you specifically need fixed spreads (Fortrade only offers floating spreads) or access to MetaTrader 5/cTrader (only MT4 is supported). Traders requiring local currency banking in all regions may find limited deposit/withdrawal options.

Bottom Line: Fortrade is a solid multi-regulated CFD broker with no-commission, spread-based trading and a modern trading platform. Its strengths lie in regulatory security (FCA/CySEC oversight), a user-friendly proprietary Fortrader platform (syncing across devices), and a wide range of tradable CFDs. Costs are competitive for retail traders (all-in spreads, no hidden fees). On the downside, it lacks multiple account tiers and advanced third-party tools, which may be a drawback for high-frequency or algorithmic traders. Overall, we recommend Fortrade for traders seeking a reliable, well-regulated broker with intuitive platforms and straightforward pricing.

Frequently Asked Questions

Is Fortrade regulated?

What is the minimum deposit?

Does Fortrade charge commissions?

What platforms are available?

How can I withdraw money from Fortrade?

About Author

Sikirty Chatterjee

Sikrity Chatterjee holds a Master’s in English from Loreto College, Calcutta University, with four years in content strategy, generative AI, and in‑depth forex, crypto, and trading analysis. She also writes insightful fintech articles, bridging complex financial technologies and market trends. She authored “Anticipating the Impact: RWA in the Crypto Ecosystem,” dissecting tokenization frameworks, valuation models, and compliance. At BrokerInspect, she leads financial education and cross‑asset intelligence, and designs our AI‑powered Broker Evaluation Process—assessing execution, custody, compliance, stress tests, and transparency for rigorous, tech‑enhanced broker reviews.User Reviews

Be the first to review “Fortrade Review – Is it Safe and Regulated?” Cancel reply

- Fortrade Overview & Company Background

- Pros & Cons Analysis

- Is Fortrade Regulated and Safe?

- Is Fortrade Regulated and Safe?

- Trading Conditions & Costs

- Fortrade Trading Platforms & Tools

- Fortrade Account Types & Minimum Deposit

- Deposits & Withdrawals

- How to trade with Fortrade? Step-by-Step Guide

- Customer Support

- Fortrade Final Verdict

- Frequently Asked Questions

- About Author

There are no reviews yet.