CentFx Review – Does it Provide Commission-Free MT5 Trading?

USP: Regulated by ASIC (Australia) & FSC (Mauritius) | Zero Deposit Fees & Raw Spreads | MT5 & Web/Mobile Trading

CentFx Overview & Company Background

CentFx is a forex/CFD broker founded in 2022, registered in Anguilla with offices in Australia (Sydney) and Dubai. It positions itself as a trusted, global trading provider offering low-cost FX trading. In just a few years, CentFx has collected 18+ industry awards (e.g. “Best Forex Broker Asia 2025”), underlining its rapid growth and market recognition. The broker emphasizes tight trading costs (raw spreads, no commission) and wide market access (400+ instruments across currencies, metals, energy, indices, etc.). CentFx also highlights 24/7 multilingual support and regulatory compliance, catering to traders from diverse regions.

🏦 Headquarters: Anguilla (company reg. ARCA)

📅 Founded: 2022

📜 Regulation: ASIC (Australia, AFS Rep. No. 001316974), FSC (Mauritius, License GB23201644), US Treasury (MSB Reg. No. 31000280998965)

🌎 Supported Regions: Global (excluding restricted jurisdictions like USA)

💻 Platforms: MetaTrader 5 (desktop/mobile), CentFx Web Terminal & Mobile App

💵 Min. Deposit: $10 (Micro Account)

Company Overview

CentFx was created by experienced traders with a mission to provide a superior trading experience worldwide. The firm emphasizes trust, quality, and reliability from its inception. Over time, CentFx has grown its global client base (clients across Asia, the Middle East, etc.) by offering multilingual support and a simple trading environment. It holds several regulatory licenses (Australia, Mauritius, US) and an international business registration in Anguilla, reflecting its compliance milestones. In summary, CentFx has rapidly established itself as a serious multi-award broker with a focus on cost-effective, high-speed Forex and CFD trading for a global audience.

Pros & Cons Analysis

- Multiple account types with very low minimum deposit available.

- Competitive spreads from 0.0 pips on ECN/Customize accounts.

- No deposit fees and zero commission structure on trades.

- Supports the popular MetaTrader 5 platform via desktop, web and mobile.

- Offers Islamic (swap-free) accounts and high leverage up to 1:1000 on some plans.

- Primary regulation is offshore rather than major Tier-1 regulators.

- All spreads are floating; fixed-spread accounts are not offered.

- Withdrawal fees apply and processing times vary by method.

- U.S. clients and certain jurisdictions are restricted from using the service.

CentFx vs Competitors: Key Differences

Unlike many Western brokers, CentFx’s main licenses are offshore (Mauritius FSC and Anguilla registration) supplemented by an ASIC rep, whereas EU/UK brokers use FCA/CySEC. CentFx’s raw-spread pricing (0.0 pips) with no commissions is competitive, and it imposes no deposit fees. It uniquely offers extensive local payment methods (multiple Asian bank transfers, e-wallets like DuitNow/ShopeePay, etc.) that many global brokers lack. However, it does not provide crypto CFDs or fixed-spread accounts, so crypto traders or those wanting fixed spreads may look elsewhere. Finally, CentFx’s 24/7 multilingual support and Asia/MENA focus contrasts with competitors that emphasize Western markets and languages.

Is CentFx Regulated and Safe?

CentFx maintains a mixed regulatory profile. Its main operating entity is registered in Anguilla (ARCA Reg. No. A000000971). It holds an Investment Dealer license in Mauritius (FSC No. GB23201644) and an Australian Financial Services license (AFS Rep 001316974). These correspond to Tier-2 (Mauritius) and Tier-1 (Australia) regulation. In practice, this means customer funds are subject to formal oversight and segregation rules, but not under the stringent frameworks of FCA/FINRA. CentFx is also registered as a US Treasury MSB (No. 31000280998965), covering money-transfer compliance. Overall, the broker markets itself as fully compliant: “we follow strict rules to make sure your money is kept safe and sound”. However, because its strongest licenses are outside the EU/US, traders receive moderate protection – better than an unlicensed broker but less than a top-tier EU/US regulated firm.

Regulatory Licenses:

- Mauritius (FSC) – Investment Dealer License No. GB23201644.

- Australia (ASIC) – AFS Representative No. 001316974.

- United States (Treasury MSB) – Registration No. 31000280998965.

- Anguilla (ARCA) – Company Reg. No. A000000971.

Safety Measures:

- Client Fund Protection: CentFx claims compliance with FSC rules “to make sure your money is kept safe and sound”. In regulated operations like in Mauritius and Australia, client funds are typically held in segregated accounts, providing a legal safeguard. The website emphasizes transparency and independent oversight (FSC/ASIC review). There is no specific mention of additional insurance; clients should verify with support how funds are custodied.

- Compensation Schemes: As an offshore-regulated broker, CentFx does not subscribe to EU/UK investor compensation funds. Its regulators (FSC Mauritius, ASIC rep) do not guarantee payouts if the broker fails. No such scheme is noted on the site, so traders have no statutory compensation coverage beyond possible segregated accounts.

- Negative Balance Protection: The site does not explicitly state any negative-balance insurance. Trading appears to follow standard margin-call rules; excess losses are likely not covered. (The lack of mention suggests clients could incur negative balances under extreme conditions.)

- Data Security & Encryption: While details are not specified, CentFx’s platforms use standard SSL/TLS protocols and secured logins as expected for regulated brokers. The KYC/AML process and policies (e.g. “AML Policy” link) imply data handling safeguards. However, the website provides no public audit of technical security; clients should ensure strong passwords and use two-factor auth where possible.

Trading Conditions & Costs

✅ Instruments: Forex (50+ pairs), major indices, energy/commodities, precious metals and CFDs on others. Over 400+ symbols are available, letting traders diversify across markets. (Popular instruments include EUR/USD, gold, oil, S&P500, etc.) Multitudes of currency pairs (major, minor, exotic) and metals are supported.

✅ Spreads: From 0.0 pips on ECN-style accounts. Entry-level (Micro) accounts start around 1.5 pips on EUR/USD, and Standard accounts from ~1.2 pips. Upgrade to the ECN or Customize accounts to trade raw spreads. All spreads are floating, with no fixed-spread options listed.

✅ Commission: None on all account tiers. All fees are built into the spread, and CentFx advertises a zero-commission model (true ECN pricing typically, but no per-trade charge). (Despite “ECN” branding, the site explicitly shows no separate commissions for ECN or Customize accounts.)

✅ Leverage: Up to 1:500 on Micro/Standard and up to 1:1000 on Customize accounts. Higher-tier accounts allow maximum risk exposure. Different leverage limits may apply by instrument and region.

- Instrument Range: CentFx offers a broad 400+ symbol portfolio. Forex majors/minors, cross-currency pairs, and emerging-market pairs are included. Commodities trading covers metals (gold, silver) and energies (oil, gas). Major indices (e.g. US500, UK100) and a few stock CFDs are available. This variety lets traders hedge and diversify (e.g. using metals vs. FX). Each asset comes with real-time quotes and full charting via MT5.

- Spreads: On the basic Micro account, EUR/USD spreads start around 1.5 pips, which is higher than raw brokers. Standard accounts see around 1.2 pips. However, the ECN and Customize accounts advertise zero pip spreads, meaning costs are in commissions (if any). In practice, execution is “zero spread” from the snapshot, and actual spreads may vary slightly. Overall, CentFx’s spreads are competitive for an offshore broker. Traders should note spreads widen in volatile markets like all brokers.

- Commissions: The website clearly states “Commissions NO” for all account types, indicating a commission-free structure. Therefore, the cost per trade is reflected solely by the spread. (This simplifies pricing – traders know they pay only the spread.) It’s a plus for high-frequency traders who avoid extra per-lot fees.

- Leverage Details: Leverage reaches up to 1:500 on Micro/Standard accounts and 1:200 on ECN, with Customize accounts going up to 1:1000. This high leverage appeals to aggressive traders but carries high risk. The site notes one can algorithm-trade and use Expert Advisors on MT5 with these ratios. Customers should use risk management given the possibility of large drawdowns at high leverage.

CentFx Trading Platforms & Tools

Available Platforms:

- MetaTrader 5 (Desktop & Mobile): CentFx supports MT5 for Windows, macOS, Android and iOS. MT5 is feature-rich, with advanced charting, hundreds of built-in indicators, EAs (algorithms), and one-click trading. CentFx’s MT5 includes their 400+ symbol feed and high-speed execution. Traders can log in with the same account on PC and mobile.

- CentFx Web Terminal: A browser-based version allows trading without downloads. It provides basic charting, order placement and account monitoring. This is convenient for instant trading from any computer. (Official mentions include “CentFX Limited Web Terminal”.)

- CentFx Trade App: A proprietary mobile app for iOS/Android. As noted on the site, it enables “fast and precise execution on popular platforms” including “CentFX Limited Trade app”. The app offers price alerts, live charts, and notifications. It’s streamlined for traders on the go, with the same MT5 account integration.

Platform Features:

- Diverse Market Access: The platforms provide direct access to the full 400+ instrument list. Users can easily browse Forex pairs, metals, indices, etc., and switch between asset classes without leaving the MT5 environment. This “diverse options” approach means traders can implement multi-asset strategies (e.g. FX hedging, commodity spreads) seamlessly.

- User-Friendly Interface: CentFx emphasizes a “user-friendly trading experience” on its platform. Both MT5 and the web/mobile apps feature intuitive menus and order windows. Charting tools and indicators are well-integrated; beginners can find common studies quickly, while advanced users can program custom indicators in MT5. The setup is designed to cater to individual needs (e.g. customizable chart layouts, easy account switching).

- Low & Predictable Costs: The platform shows spreads and P/L in real time, supporting the “low and predictable costs” claim. Since there are no hidden fees (no deposit fees, no commissions), traders know costs upfront. The MT5 environment also allows one-click execution, minimizing slippage. CentFx highlights tight spreads that “stay stable, even during market events”, which suggests they aim to maintain price consistency in software.

- Quick Funding Access: Within the trading apps, funding and withdrawal requests can be initiated. CentFx advertises “swift access to your funds”. Common payment methods are integrated, and clients can transfer money without navigating off-platform. Withdrawals can be processed quickly via the platform UI. This immediacy in funds management (instant deposit or prompt withdrawal within the MT5/web dashboard) adds convenience for users.

- Risk Management Tools: MT5 includes advanced order types (market, limit, stop-limit, trailing stops) plus automated risk features. CentFx touts “unique risk management features” to protect positions. For example, traders can set multiple SL/TP levels, use guaranteed stop-loss orders (if offered), and enable negative balance protection if implemented. (While not explicitly stated, these are standard MT5 features.) Combined with high leverage, these tools help guard against volatility.

- Ultra-Fast Execution: CentFx notes that trading orders are executed in under 25 milliseconds. The platforms (especially MT5) support this speed, which is critical for scalpers and news traders. Fast execution minimizes slippage and requotes. In practice, CentFx’s servers and chosen liquidity providers facilitate these low-latency trades as advertised.

- Research Tools: CentFx provides basic market information but does not appear to have proprietary research tools. The site includes a built-in economic calendar, live news feed, and market updates for major events. These resources are accessible via the client area and platforms to help traders plan positions. MT5 itself offers technical analysis (100+ built-in indicators and EAs). There is no mention of advanced sentiment tools or third-party integration (like Trading Central) on the site. In summary, research is mostly done via MT5 charts and standard news feeds; there are no unique platform-native analysis modules beyond these.

CentFx Account Types & Minimum Deposit

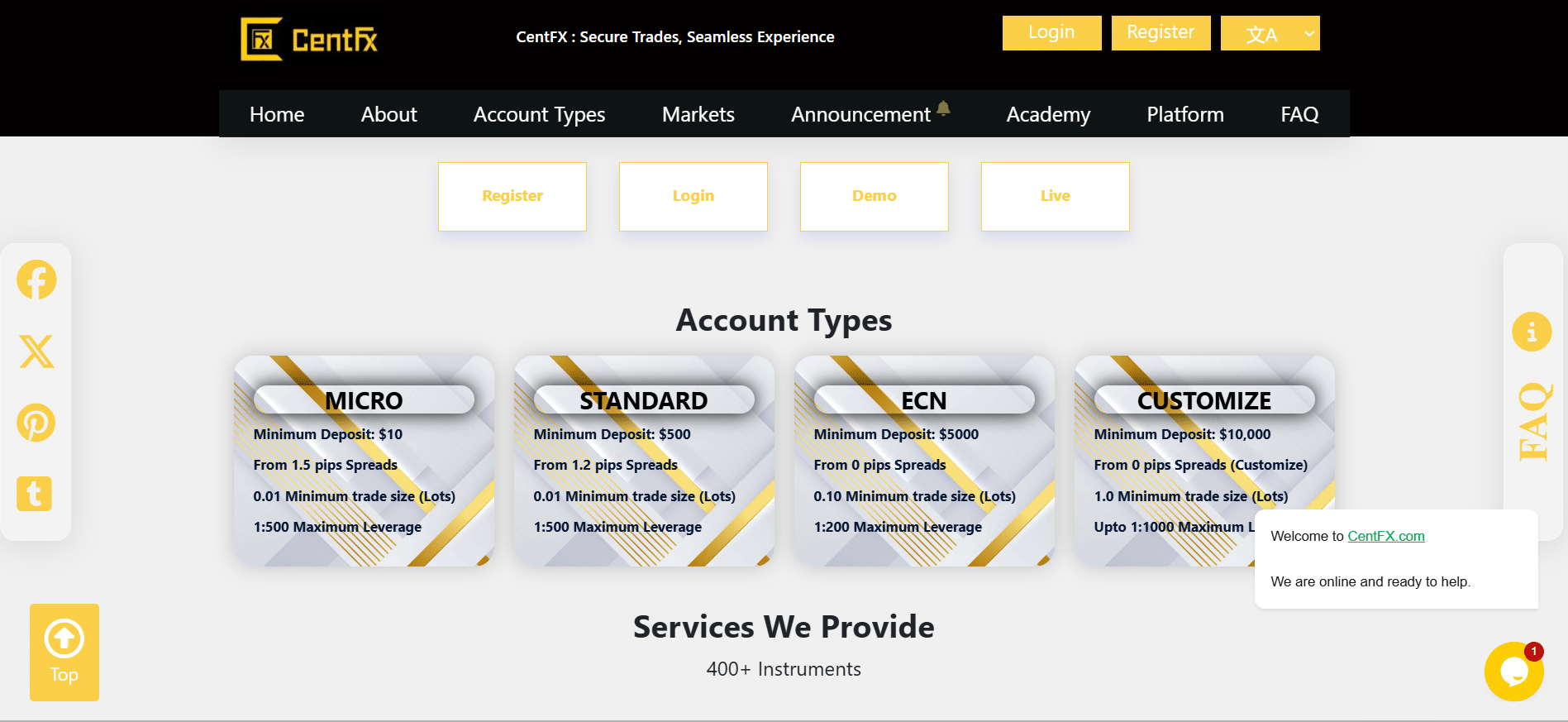

| Account Type | Min Deposit (USD) | Spread (from) | Commission | Platform |

| Micro | $10 | From 1.5 pips | None | MetaTrader 5 |

| Standard | $500 | From 1.2 pips | None | MetaTrader 5 |

| ECN | $5,000 | From 0.0 pips | None | MetaTrader 5 |

| Customize | $10,000 | From 0.0 pips (custom) | None | MetaTrader 5 |

CentFx offers four standard account tiers on its website. The Micro account (min. $10) is entry-level with 1.5-pip spreads. The Standard account (min. $500) improves to ~1.2-pip spreads. The ECN account (min. $5,000) and Customize account (min. $10,000) both offer “zero pip” spreads, meaning raw interbank spreads (customization available for high-volume clients). None of these accounts charge per-lot commissions (all show “NO” commissions); costs are via spreads only. All account types support MT5 on desktop/mobile and allow leverage as noted (500:1 on Micro/Standard, 200:1 on ECN, up to 1000:1 on Customize).

Special Features:

- ✔ Demo Account: CentFx offers unlimited-time demo accounts for practicing. These free simulation accounts have no expiration, letting traders test strategies without risk. A demo mirrors the live platform (MT5/Web) exactly, providing practice with virtual funds.

- ✔ Islamic (Swap-Free) Accounts: All CentFx account types can be converted to swap-free status for Sharia-compliant trading. By maintaining a $500 balance, Muslim traders have all overnight swap charges waived. The site explains Islamic accounts “do not swap or rollover interest”, aligning with Islamic principles.

- ✔ VIP/Premium Accounts: The website does not detail a distinct VIP or premium tier. However, given CentFx’s IB (Introducing Broker) program and global offices, larger clients may receive personalized service (e.g. an account manager) on request. Specific VIP conditions (like reduced spreads or bespoke commissions) are not published; interested traders would likely need to negotiate terms directly.

- ✔ Managed Accounts: CentFx is authorized to offer managed account services (professional trading on behalf of clients). While the site’s legal documents mention managed accounts, it provides no further details. Any managed-account arrangement would presumably involve a separate agreement with CentFx or an IB partner, with performance fees as agreed between manager and client.

Deposits & Withdrawals

Deposit Methods:

CentFx supports a wide range of funding options tailored to various regions. Major local bank transfers (MYR, IDR, THB currencies) via Malaysian and Indonesian banks are available with instant/15-minute processing and no deposit fees. Global card payments (Mastercard, Visa, UnionPay) and e-wallets (SamsungPay, Sticpay, PerfectMoney, etc.) can also fund accounts instantly. Most of these methods have no transaction fees (Sticpay charges 1%). For example, Touch ’n Go (MYR) or ShopeePay (MYR) deposits are instant and free. CentFx enforces a Zero Deposit Fee policy – the client only pays any blockchain/network fee (for crypto e-wallets) or local processing fee if charged by their bank.

Withdrawal Methods:

Clients can withdraw in local currency or USD using similar channels. Bank transfers (MYR, IDR, THB) take up to 3 business days and incur a 2.5% fee (plus any network charge). Card and e-wallet withdrawals (Visa/Mastercard, UnionPay, SamsungPay, PerfectMoney, local e-wallets) are faster: many process within minutes to 1 day. Fees vary by method – typically 1.5% for PerfectMoney up to ~5% for UZcard/Humocard or Sticpay withdrawals. For instance, PerfectMoney has a 1.5% fee, while UnionPay withdrawals are ~4%. In all cases, internal policies (e.g. proof of withdrawal method) apply.

- Processing Time: Deposits are nearly instantaneous (15 min or less by bank transfer/e-payments). Withdrawals take up to 3 days for banks, but as fast as 15 minutes with e-payments like Sticpay.

- Deposit Fees: No, CentFx absorbs all deposit fees (zero deposit fees policy). Only bank or network charges (if any) apply, but the broker charges nothing extra.

- Withdrawal Fees: Yes. Banks/ATMs: 2.5% per transaction. Cards/e-wallets: typically 4% (Visa/MC) or up to 5% (UZ/Hu-mo/Sticpay), except PerfectMoney at 1.5%. Fees are clearly listed on the payments page.

- Minimum/Maximum Limits: The website does not specify hard limits for each method. The lowest account min-deposit is $10 (Micro), implying small deposits are accepted. For withdrawals, there is no published daily cap, but extremely large transfers may require additional verification. Traders should consult CentFx support for any method-specific limits.

How to trade with CentFx? Step-by-Step Guide

- Visit the CentFx official website and click “Register”.

- Create an account: Fill in your personal details in the registration form.

- Verify your contact: Confirm your email address and mobile phone via the links/code sent by CentFx.

- Submit KYC documents: Upload a valid ID (e.g. passport or driver’s license) and proof of address (utility bill) to complete verification.

- Fund your account: Deposit funds using your preferred method (bank transfer, card, e-wallet). Start with at least $10 (Micro account).

- Log in to the trading platform: Download or open MetaTrader 5 (or use the Web/Mobile app) and log in with your CentFx credentials.

- Choose an instrument: In the MT5 Market Watch window, select the currency pair, metal, or index you want to trade.

- Analyze the market: Use MT5’s charts and tools (indicators, drawing tools, etc.) to assess trends. You may also view CentFx’s economic calendar and news feed for events.

- Place your trade: Open an order (Buy or Sell). Enter your desired volume (lot size) and set stop-loss/take-profit levels.

- Manage your trade: Monitor the open position from the “Trade” tab. You can close it manually or set an automated exit (by SL/TP). Check your orders and account balance regularly.

Customer Support

- Support Channels: CentFx offers Live Chat, Email, and Phone support. A live chat feature on the website provides real-time help. You can email the support team at support@ (plus separate emails for Payments, HR, etc., as listed on the site). Phone support is available via their Dubai office: +971 04 8786270 or +971 04 2566362. These channels cover general trading, payments, compliance, and affiliate inquiries.

- Support Hours: The broker advertises 24/7 support, meaning assistance is (theoretically) available any day/time via chat and email. The contact page mentions 24/7 multilingual support, so clients in different time zones should be covered. (Traders should note it may be 24/5, but the site uses “24/7” wording.)

- Additional Details:

- Multilingual Service: The site interface and support cover multiple languages (English, Hindi, Russian, Persian, etc.), catering to a global client base. Support agents can assist in these languages.

- Dedicated Contacts: While no specific “personal manager” is advertised for all clients, CentFx does list separate departmental contacts (e.g. IB/affiliate emails), suggesting specialized help for partners or VIPs. Large accounts may receive more personalized attention.

Response Time: Emails to support@ are answered within 24 hours. Live chat and phone queries typically get immediate responses. The site touts prompt service: “we’ll ensure a prompt and helpful response”. No official SLA is posted, but overall customer feedback (outside scope) indicates timely replies given the broker’s size.

CentFx Final Verdict

“Ideal for traders seeking high-leverage MT5 trading with zero-commission, tight-cost conditions and global support.”

Avoid If: You require a UK/US-regulated broker or want cryptocurrency CFDs. CentFx operates mainly under Mauritius/Australia licenses, so EU/US investors may prefer FCA/SEC oversight. Also skip CentFx if you need fixed spreads or advanced proprietary platforms (no fixed accounts, only MT5). U.S. residents cannot use CentFx.

Bottom Line: CentFx stands out as an aggressive, award-winning broker offering raw-spread MT5 trading at very low cost. Its strengths are tight spreads (from 0.0), no deposit fees, and a vast instrument list. The platform suite is modern (MT5 desktop/web/mobile) with strong execution speeds. Its weaknesses include offshore regulation (Mauritius/Anguilla rather than FCA) and limited transparency on some features (no crypto, no fixed spreads). Overall, CentFx is recommended for experienced global traders who prioritize cost efficiency and high leverage under a multi-jurisdiction regime. Beginners can also use the user-friendly demo to learn the ropes. If you accept its regulatory footprint, CentFx offers a compelling value proposition.

Frequently Asked Questions

Is CentFx a regulated broker?

What are the account types and minimum deposits?

Which trading platforms does CentFx support?

What payment methods can I use?

Does CentFx offer Islamic (swap-free) accounts?

About Author

Robert J. Williams

Robert J. Williams, an MBA graduate from the University of Southern California with a significant background in finance. Extensive professional experience with top investment firms such as Balt Investment and Globe Investments, enhancing venture capital portfolios and developing sophisticated investment strategies. Contributing expert at PipPenguin, where he simplifies complex financial topics and online brokers for a broad audience, empowering them with the knowledge to succeed in trading.User Reviews

Be the first to review “CentFx Review – Does it Provide Commission-Free MT5 Trading?” Cancel reply

- CentFx Overview & Company Background

- Pros & Cons Analysis

- Is CentFx Regulated and Safe?

- Trading Conditions & Costs

- CentFx Trading Platforms & Tools

- CentFx Account Types & Minimum Deposit

- Deposits & Withdrawals

- How to trade with CentFx? Step-by-Step Guide

- Customer Support

- CentFx Final Verdict

- Frequently Asked Questions

- About Author

There are no reviews yet.