Alpari Review: Is This Platform Suited for Next-Gen Trading?

USP: 25+ years experience | Tight spreads from 0.0 pips | MT4, MT5 & Proprietary App

Alpari Overview & Company Background

Alpari, founded in 1998, is an offshore forex and CFD broker based in Fomboni, Mohéli, Comoros. It is one of the longest-running online brokers, promoting its 25+ years of market experience and more than 1 million clients worldwide. Serving traders in over 150 countries, Alpari positions itself as a global gateway to financial markets, boasting numerous industry awards (45+ to date). The company highlights its competitive pricing (spreads from 0.0 pips) and broad market access (forex, commodities, indices, stocks, crypto) as key strengths in its long track record.

Headquarters: Bonovo Road, Fomboni, Island of Mohéli (Comoros)

- 📅 Founded: 1998

- 📜 Regulation: Licensed by Mwali International Services Authority (Comoros) – License No. T2023236

- 🌍 Supported Countries: 150+ worldwide

- 💻 Platforms: MetaTrader 4, MetaTrader 5, and the proprietary Alpari Trading App (desktop and mobile)

- 💵 Min Deposit: $30 (Micro account)

Company Overview

Alpari was originally launched as an online trading platform and has grown steadily through technology and market expansion. In 2003 it became the first broker to adopt the MetaTrader platform, which catalyzed its early growth. By 2009 Alpari had opened 100,000 trading accounts, and by 2013 it surpassed 1 million active accounts. Its stated mission is to provide innovative trading tools and global market access. In recent years Alpari has partnered with Exinity (a London-listed fintech) for liquidity and technology, and in 2025 it launched a major update to its mobile app with advanced charts and analysis features. Today, with traders in 150+ countries, Alpari offers a broad range of accounts and instruments under its Comoros regulation which are discussed in Alpari Review, emphasizing competitive pricing and a variety of trading options.

Pros & Cons Analysis

- Established broker (25+ years) with over 1 million clients worldwide

- Trade Forex, Commodities, Metals, Indices, Stocks and Cryptocurrencies

- Raw spreads from 0.0 pips (Pro ECN accounts)

- Commission-free account options (Micro/Standard/ECN have no commission)

- Four account types (Micro, Standard, ECN, Pro ECN) catering to different trader needs

- Supports MetaTrader 4, MetaTrader 5, and its own Alpari Trading app (mobile/desktop) for trading on the go

- Licensed by Comoros (MISA), lacking Tier-1 oversight (no FCA/ASIC etc.)

- Does not serve residents of USA, EU, UK, Canada, Australia, etc

- Offers leverage up to 1:3000, which may be unsuitable or risky for inexperienced traders.

Alpari vs Competitors: Key Differences

-

Ultra-high leverage options (up to 1:3000) which most major regulators (US/EU) prohibit.

-

Offshore (MISA, Comoros) license vs. Tier-1 licenses of many rivals, giving Alpari more flexibility but less regulatory protection.

-

Proprietary mobile/web trading app in addition to MT4/MT5; however, it does not offer cTrader like some other brokers.

-

Diverse account tiers (Micro, Standard, ECN, Pro ECN) vs. simpler account structures at some brokers.

-

Loyalty rewards program (points and VIP tiers) not commonly found at all competitors.

Is Alpari Regulated and Safe?

Alpari is regulated under an offshore license from the Mwali International Services Authority in the Comoros, which is considered a Tier-3 jurisdiction. This means it does not benefit from the strict oversight or investor protections of Tier-1 regulators (FCA, ASIC, CySEC, etc.). Clients should be aware that as a result, Alpari must rely on its own internal safeguards rather than government compensation schemes. On the positive side, Alpari states that it segregates all client funds in top-tier banks and enforces negative-balance protection (ensuring traders cannot lose more than their deposited equity). Overall, its regulatory setup is lighter, so traders should consider this when evaluating Alpari’s safety.

Regulatory Licenses:

- MISA (Comoros) – License No. T2023236

Safety Measures:

- Client Fund Protection: Alpari keeps client funds in segregated accounts at top-tier banks, completely separate from its own operating capital. It emphasizes that it will never use client money for trading or investment, ensuring that client balances are protected.

- Compensation Schemes: As an offshore-regulated broker, Alpari does not participate in any formal investor compensation fund (unlike some EU/UK brokers). There is no government-backed safety net; clients rely on Alpari’s financial stability.

- Negative Balance Protection: By policy, Alpari ensures that traders cannot incur losses beyond their account balance. This means client accounts will not go into deficit due to market moves.

- Data Security & Encryption: Alpari uses industry-standard SSL encryption for all client communications and transactions, protecting personal data and account information during transfers. This helps ensure that login credentials and financial data are kept secure.

- Mwali International Services Authority in the Comoros

Trading Conditions & Costs

✅ Instruments: Forex (majors, minors, crosses), Commodities, Metals, Indices, Cryptocurrencies, Stock, CFDs

✅ Spreads: Variable spreads from 0.0 pips (on Pro ECN Accounts

✅ Commission: None on Micro/Standard/ECN accounts; from $2.5 per standard lot on Pro ECN accounts

✅ Leverage: Up to 1:3000 (depending on account type and instrument)

- Instruments: Alpari offers a very broad range of markets. Clients can trade major and minor currency pairs on Alpari Forex, precious metals (gold, silver), energy and commodity CFDs, stock index CFDs, and even cryptocurrencies (on ECN/Pro accounts). Pro ECN accounts also allow trading of stock and ETF CFDs. The low latency execution and deep liquidity mean most liquid instruments have minimal slippage. This wide selection suits traders who want to diversify across forex, crypto, and equities.

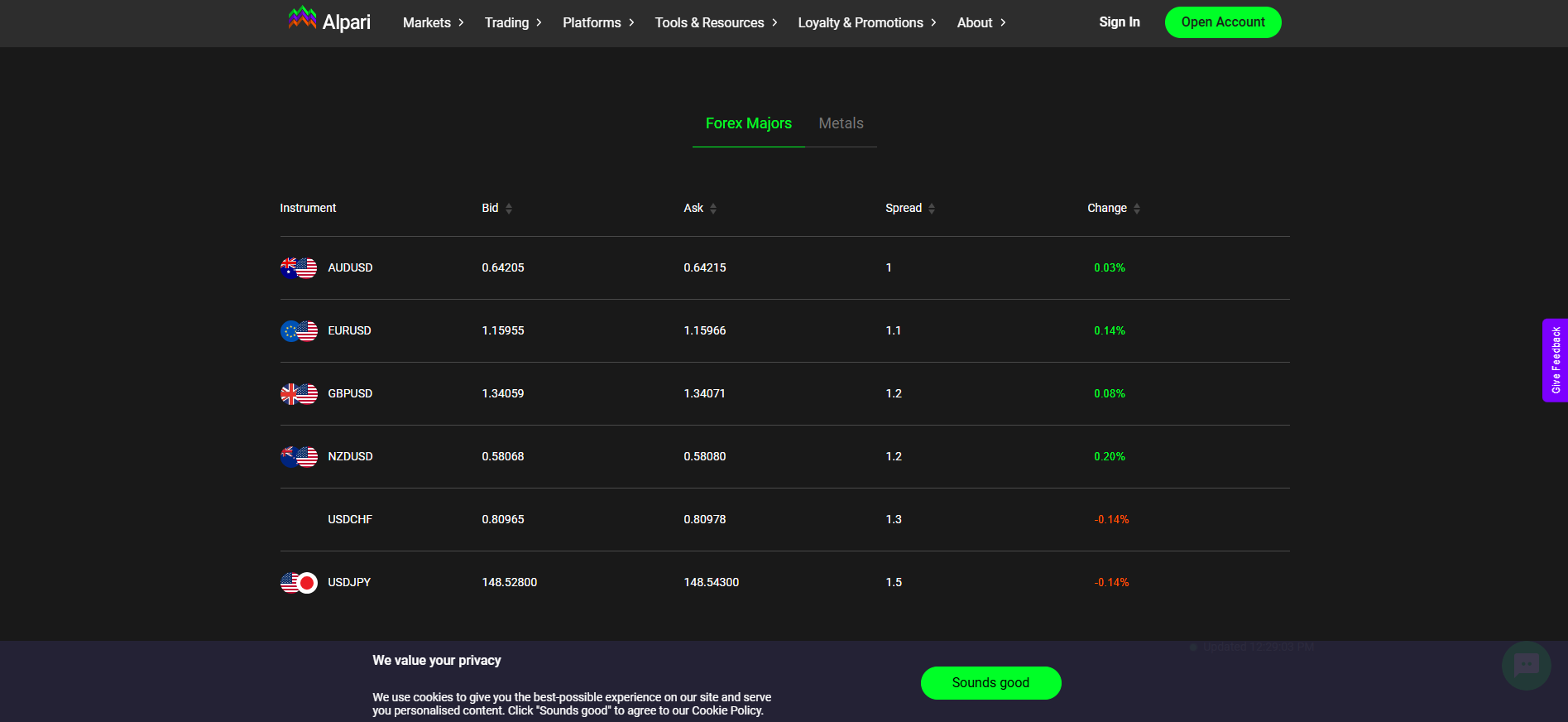

- Spreads: Spreads are variable across accounts. Micro accounts start around 1.5 pips on majors, Standard accounts around 0.3 pips, ECN accounts from 0.1 pips, and Pro ECN from 0.0 pips. All spreads are floating, so costs depend on market conditions. The raw (ECN/Pro) accounts provide very tight spreads when liquidity is high, which benefits scalpers and high-frequency traders. On Standard/Micro accounts, wider spreads are partially offset by no commission fees. The lack of any fixed-spread option means costs may widen during volatile periods.

- Commission: Standard and ECN accounts have no commissions – their revenue is made via spreads. Pro ECN accounts charge explicit commissions on trades: for example, $2.5 per standard lot on forex. This is comparable to other low-spread brokers. In return, Pro ECN spreads start at 0.0 pips on majors. Overall, average trading costs (spread plus commission) on Pro ECN can be very competitive (often under 1 pip round-turn on EUR/USD).

- Leverage: Leverage is very high compared to most brokers. Micro accounts offer up to 1:500, Standard up to 1:1000, and ECN/Pro up to 1:3000 (subject to regulatory and margin rules). This allows substantial buying power for small depositors but significantly increases risk. It is higher than what Tier-1 regulated brokers allow. Traders should use margin responsibly, as higher leverage amplifies both profits and losses.

Alpari Trading Platforms & Tools

Available Platforms:

- Alpari Trading App (Desktop & Mobile): A proprietary app providing intuitive trading on the go. It features multi-asset trading (Forex, commodities, crypto, etc.) via one interface. The app includes integrated dashboards for account management, trade signals, an economic calendar, and charts, making it accessible for beginners and advanced traders alike.

- MetaTrader 4 (MT4): The industry-standard platform known for its stability and extensive features. MT4 allows trading Forex and CFDs with advanced charting, automated Expert Advisors, and 30–80+ built-in technical indicators for analysis. Alpari supports desktop and mobile versions of MT4.

- MetaTrader 5 (MT5): The next-generation platform extending MT4’s capabilities. MT5 supports all instruments offered by Alpari (and adds stock/ETF CFD trading on Pro accounts). It includes even more technical tools and faster execution. Alpari also offers MT5 for desktop and mobile. Both MT4 and MT5 can integrate third-party analytics (e.g. Trading Central, FX Blue) via plug-ins.

Platform Features:

- Economic Calendar & News: Built-in economic calendar and market news feeds are available on the platforms and mobile app, helping traders stay informed about upcoming events that may affect markets.

- Trade Signals: Alpari provides its own daily trade signals and market analysis through the platforms. These signals can highlight trading opportunities and are accessible directly within the trading app and web interfaces.

- Recommended & Trending Instruments: The platforms show curated lists of recommended and trending instruments based on market analysis and customer activity, guiding traders toward popular markets.

- Interactive Charting: All platforms offer advanced charting capabilities as discussed in the Alpari review. The Alpari app features over 100 technical indicators, while MT4/MT5 support 30–80+ indicators. Traders can apply technical studies, draw trend lines, and perform in-depth technical analysis on multi-timeframe charts.

- VPS & Automation: MT4/MT5 traders have access to Virtual Private Server (VPS) hosting for automated trading, which allows robots (EAs) to run 24/7 without interruption.

- Third-Party Research: Traders can install Trading Central, FX Blue and other analytical tools as MT4/MT5 plug-ins, providing expert pattern recognition and performance analysis within the platform.

Research Tools:

- Economic Calendar (Native): A built-in calendar alerts traders to key economic data releases and events.

- Alpari Trade Signals (Native): Free proprietary signals (buy/sell tips and market commentary) integrated into the platform interface.

- Trading Central (Third-party): Advanced technical research and algorithmic signals (available via MT4/MT5 plugin).

- Chart Indicators (Native): A wide array of technical indicators (moving averages, oscillators, etc.) are included with each platform for custom analysis.

- Market News & Analysis: Integrated news headlines and analysis from financial media (platform-native feeds and proprietary analysis).

Alpari Account Types & Minimum Deposit

| Account Type | Min Deposit | Spread | Commission | Platforms |

| Micro | $30 | From 1.5 pips | None | MT4 |

| Standard | $100 | From 0.3 pips | None | MT4, MT5 |

| ECN | $300 | From 0.1 pips | None | MT4 |

| Pro ECN | $500 | From 0.0 pips | From $2.5 per lot (Forex) | MT4, MT5 |

Demo Account: Alpari provides free demo (practice) accounts so traders can test strategies and platforms without risk. All account types are available in “practice” mode.

Islamic (Swap-Free) Accounts: Swap-free accounts are offered for clients who require them (e.g. Islamic finance). These accounts do not incur overnight swap/interest fees (subject to a limited “swap-free allowance” per trade). Traders must request the swap-free status on their account.

VIP / Premium (Loyalty) Program: Alpari runs a tiered loyalty scheme where traders earn points for volume and climb from Bronze to VIP tiers. Higher tiers unlock perks like increased reward point multipliers and exclusive promotions. The “VIP” status here refers to loyalty tiers, not a separate account platform.

Managed (PAMM) Accounts: Alpari supports PAMM managed accounts, where experienced traders (managers) trade pooled investor funds. Investors can allocate money to a PAMM manager’s account and participate in their trading results. This allows passive investment via professional managers.

Deposits & Withdrawals

- Bank Transfer: Global and local bank wires are accepted. Deposits usually clear in 1–2 business days; Alpari charges no fee (though your bank may apply charges). Withdrawals to banks also take 1–3 days, generally without Alpari fees.

- Credit/Debit Cards (Visa/Mastercard): Instant funding in major currencies; no Alpari deposit fees are levied (some card issuers may charge). Withdrawals are refunded to the original card (closed-loop) and typically process quickly (often within hours after request).

- E-Wallets (e.g. Skrill, Neteller): Instant, fee-free deposits and withdrawals via major e-wallets in USD/EUR/GBP (subject to KYC). The broker does not charge for e-wallet transactions, making these methods very convenient for fast funding.

- Cryptocurrencies (BTC, ETH, USDT, etc.): Alpari accepts crypto transfers (e.g. Bitcoin, Ethereum, Tether). Crypto deposits/withdrawals clear in about 1 hour. Alpari does not charge a commission on crypto transactions (only the standard network blockchain fee applies). Minimum crypto deposit/withdrawal is $10, with a $50k max withdrawal per transaction.

Processing Details:

- Processing Time: Deposits are usually instant once payment is confirmed (Alpari says it is an “instant deposit” broker if no extra verification is needed). Withdrawals vary: e-wallets and crypto are typically very fast (minutes to 1 hour), while bank wires and cards may take 1–3 business days.

- Deposit Fees: Alpari does not charge deposit fees on any payment methods. Any fees are due to banks or payment processors (e.g. credit card or crypto network fees).

- Withdrawal Fees: Alpari generally does not charge withdrawal fees (it supports several methods that allow free withdrawals). However, some banks or card issuers may apply their own fees. Crypto withdrawals carry the usual blockchain fees.

- Minimum/Maximum Limits: Crypto transactions have a $10 minimum (max $600,000 per deposit, $50,000 per withdrawal). Card and e-wallet minimums are typically $10. The minimum deposit of $30 (Micro account) and higher per account type also implicitly set funding thresholds.

How to trade with Alpari? Step-by-Step Guide

- Register: Go to Alpari’s official website and click “Open Account.” Fill in your personal details (name, email, phone) to create a profile which will be later useful for Alpari Login.

- Verify Your Account: Check your email (or phone) for a verification link, then log in and upload KYC documents (proof of identity and address) as prompted. Wait for account approval, which is usually quick.

- Select Account Type: Once verified, choose the trading account type you want (Micro, Standard, ECN, or Pro ECN) and complete the registration. You’ll receive login credentials for that account.

- Deposit Funds: In your Alpari member area, go to “Deposit” and fund your trading account using your preferred method (bank card, e-wallet, bank transfer, or crypto).

- Install a Trading Platform: Download Alpari’s Trading App or MetaTrader 4/5 from the website. Install it on your computer or mobile device and log in using your Alpari account credentials.

- Choose an Instrument: In the trading platform, select the market you want to trade (e.g. EUR/USD, gold, Bitcoin, or stock CFD).

- Analyze the Market: Use the platform’s charts and tools (indicators, trend lines, economic calendar) to research the instrument’s price movement. Apply technical analysis or review Alpari’s trade signals.

- Place a Trade: Open a buy or sell order. Enter your desired volume (lot size) and set your Stop Loss and Take Profit levels to manage risk. Confirm the order.

- Monitor Your Position: Keep an eye on your trade via the chart or terminal. You can adjust or close the trade manually at any time.

- Close & Review: Close the trade when your target is reached or your analysis changes. Review the outcome and plan your next trade.

Summary: Opening and trading an account with Alpari is straightforward. After a simple sign-up and KYC process, you fund your account, log in to MT4/MT5 or the Alpari app, and execute trades with intuitive tools. The available platforms are user-friendly for beginners, yet offer advanced features (indicators, signals) for experienced traders. In short, Alpari makes starting and managing trades relatively easy for all levels of traders.

Customer Support

Support Channels:

Alpari provides multiple support options as discussed in this alpari review. Clients can use the online Help Centre (FAQ and guides) and chatbot for instant answers. There is also a live Telegram support chat (via the “Contact Us” t.me link) and email/contact form on the website. For voice support, Alpari operates a global phone helpline at +44 2045 771 951. Social media channels and an online ticket system are also available.

Support Hours:

Official support is primarily available on weekdays (Monday–Friday), aligning with forex market hours. (Exact hours are not explicitly stated, but Alpari staff are typically reachable during business days.)

Additional Details:

- Multilingual Support: Alpari’s support is offered in multiple languages, ensuring help is available in your preferred language.

- 24/7 Chatbot: An AI-powered chatbot can answer common queries at any time, providing quick assistance even outside of live hours.

- Loyalty Tiers: The tiered loyalty program (Bronze → VIP) effectively functions as enhanced support/benefits for active traders. Higher-tier traders unlock priority perks (higher point multipliers, etc.), although dedicated personal account managers are not explicitly mentioned on the site.

- Response Quality: Alpari emphasizes prompt, “world-class” customer service, although no specific response-time guarantees are published. Most inquiries on live chat or email are reportedly answered within minutes to hours on trading days.

Alpari Final Verdict

“Ideal for global forex/CFD traders seeking high leverage, competitive pricing, and multiple account options.”

Avoid If: You require strict Tier-1 regulation or are based in a restricted country. Alpari Broker operates under an offshore (Comoros) license and explicitly excludes residents of the USA, EU, UK, and several other regions. It only offers variable spreads (no fixed-spread accounts) and does not support the cTrader platform. Traders needing local deposit methods or guaranteed lowest spreads (fixed) may also find Alpari unsuitable.

Bottom Line: Alpari is a veteran broker with a broad global footprint, known for its flexible account choices, tight trading costs (spreads from 0.0 pips), and high leverage. Its proprietary app and popular Alpari MT4/MT5 platforms cater to both new and experienced traders. The main trade-offs are its offshore (MISA) regulation and country restrictions, which limit oversight and accessibility. We recommend Alpari for traders who value wide market access, high leverage, and low trading costs; however, those seeking top-tier regulatory protection or fixed spreads should consider other brokers.

Frequently Asked Questions

Alpari is licensed by the Mwali International Services Authority (Comoros). This is an offshore (Tier-3) license, so regulatory oversight is lighter than in the EU/US. However, Alpari segregates client funds and provides negative-balance protection. There is no government compensation scheme. Overall, the broker has standard safeguards, but customers should note the limited regulatory framework. As discussed in the Alpari Review, Alpari offers four main account types: Micro, Standard, ECN, and Pro ECN. The Micro account requires a $30 minimum deposit, Standard $100, ECN $300, and Pro ECN $500. Micro accounts have spreads from ~1.5 pips (no commission), while Pro ECN accounts have spreads from 0.0 pips but charge commissions (from $2.5/lot on forex). Standard and ECN accounts combine relatively low spreads (from 0.3–0.1 pips) with no commissions. Each account supports MetaTrader trading; Standard and Pro accounts also allow MT5. You can trade a wide range of instruments with Alpari: major/ minor Forex pairs, precious metals, energy and commodity CFDs, stock index CFDs, and cryptocurrencies. On Pro ECN accounts, you can also trade stock and ETF CFDs. Essentially, Alpari covers all major asset classes, giving traders access to FX, metals (gold/silver), indices (like US500, DAX), commodities (oil, natural gas), crypto (Bitcoin, Ethereum), and more. Alpari supports MetaTrader 4 and MetaTrader 5, the industry-standard platforms (desktop, web, and mobile). It also offers its own proprietary Alpari Trading App for desktop and mobile, which integrates trading, analysis tools, and account management. All platforms have advanced charting tools. MT4/5 support automated trading (EAs), 30–80+ indicators, and third-party plugins (Trading Central, FX Blue), while the Alpari app provides an intuitive interface with integrated news, signals, and economic calendar. Alpari accepts deposits/withdrawals via bank wire transfers, credit/debit cards, e-wallets (like Skrill, Neteller), and cryptocurrencies. Deposits typically arrive instantly (except bank transfers, which take ~1–2 days). There are no broker fees on deposits, though banks/cards may charge. Withdrawals to e-wallets and crypto are usually processed within 1 hour; bank transfers/cards take ~1–3 business days. Alpari does not charge withdrawal fees for most methods. Crypto withdrawals have a $10 minimum (up to $50k).Is Alpari regulated and safe?

What account types does Alpari offer?

What instruments can I trade with Alpari?

Which trading platforms does Alpari support?

How can I deposit and withdraw funds from Alpari?

About Author

Robert J. Williams

Robert J. Williams, an MBA graduate from the University of Southern California with a significant background in finance. Extensive professional experience with top investment firms such as Balt Investment and Globe Investments, enhancing venture capital portfolios and developing sophisticated investment strategies. Contributing expert at PipPenguin, where he simplifies complex financial topics and online brokers for a broad audience, empowering them with the knowledge to succeed in trading.User Reviews

Be the first to review “Alpari Review: Is This Platform Suited for Next-Gen Trading?” Cancel reply

- Alpari Overview & Company Background

- Pros & Cons Analysis

- Is Alpari Regulated and Safe?

- Trading Conditions & Costs

- Alpari Trading Platforms & Tools

- Alpari Account Types & Minimum Deposit

- Deposits & Withdrawals

- How to trade with Alpari? Step-by-Step Guide

- Customer Support

- Alpari Final Verdict

- Frequently Asked Questions

- About Author

There are no reviews yet.